Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need answer with this question

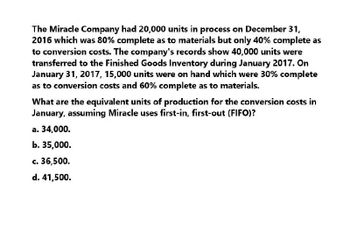

Transcribed Image Text:The Miracle Company had 20,000 units in process on December 31,

2016 which was 80% complete as to materials but only 40% complete as

to conversion costs. The company's records show 40,000 units were

transferred to the Finished Goods Inventory during January 2017. On

January 31, 2017, 15,000 units were on hand which were 30% complete

as to conversion costs and 60% complete as to materials.

What are the equivalent units of production for the conversion costs in

January, assuming Miracle uses first-in, first-out (FIFO)?

a. 34,000.

b. 35,000.

c. 36,500.

d. 41,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardArdt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardNarwhal Swimwear has a beginning work in process inventory of 13,500 units and transferred in 130,000 units before ending the month with 14,000 units that were 100% complete with regard to materials and 30% complete with regard to conversion costs. The cost per unit of material is $5.80 and the cost per unit for conversion is $8.20 per unit. Using the weighted-average method, what is the amount of material and conversion costs assigned to the department for the month?arrow_forward

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardMazomanie Farm completed 20,000 units during the quarter and has 2,500 units still in process. The units are 100% complete with regard to materials and 55% complete with regard to conversion costs. What are the equivalent units for materials and conversion?arrow_forwardA production department within a company received materials of $7,000 and conversion costs of $5,000 from the prior department. It added material of $78400 and conversion costs of $47000. The equivalent units are 5,000 for material and 4,000 for conversion. What is the unit cost for materials and conversion?arrow_forward

- There were 1,700 units in beginning inventory that were 40% complete with regard to conversion. During the month, 8,550 units were started and 9,000 were transferred to finished goods. The ending work in process was 60% complete with regard to conversion costs, and materials are added at the beginning of the process. What is the total amount of equivalent units for materials and conversion at the end of the month using the weighted-average method?arrow_forwardThe Morning Star Company had 25,000 units in process on December 31, 2019 which was 80% complete as to materials but only 40% complete as to conversion costs. The company's records show 45,000 units were transferred to the Finished Goods Inventory during January 2020. On January 31, 2017, 17,000 units were on hand which were 30% complete as to conversion costs and 60% complete as to materials. What are the equivalent units of production for the conversion costs in January, assuming Morning Star uses first-in, first-out (FIFO)?arrow_forwardThe GH company uses a cost accounting system by process and presents the following information for the month of July 2017: Its products are electronic components, manufactured in series for which its Elaboration is paid for by work cards. 37,000 units were started, the Material requisitions were $ 83,000, conversion costs were $ 98,000 and 33,000 units were completed. Starting inventory as of July 1 was 8,500 units with a cost of $ 31,000 of raw material and $ 39,000 conversion costs (100% material advance premium and 80% conversion costs). The ending inventory is 12,500 units, which have 100% raw material and the 40% conversion costs. Based on previous information: a) Evaluate with the three inventory valuation methods (FIFO, LIFO and CPP) and determine the unit cost of productionarrow_forward

- The Sanding Department of Quik Furniture Company has the following production and manufacturing cost data for March 2017, the first month of operation.Production: 9,940 units started which is comprised of 6,940 units finished and transferred out and 3,000 units started that are 100% complete as to materials and 20% complete as to conversion costs.Manufacturing costs: Materials $38,965; labor $20,500; overhead $43,288.Prepare a production cost report. (Round unit costs to 2 decimal places, e.g. 2.25.) QUIK FURNITURE COMPANYSanding DepartmentProduction Cost ReportFor the Month Ended March 31, 2017 Equivalent Units Quantities PhysicalUnits Materials ConversionCosts Units to be accounted for Work in process, March 1 enter the number of units Started into production enter the number of units Total units enter a total of the two previous numbers of units…arrow_forwardThe production data for Department 1 for August 2015 are as follows:Actual UnitsWIP, August 1 (1/4 done as to conversion costs) 100,000Started in August 740,000Transferred out during August 610,000Spoiled units 80,000Cost of Beginning work-in process:Materials 1,250,000Conversion Costs 150,000Current Costs:Materials 7,400,000Conversion Costs 4,710,000Unit costs:Materials ?Conversion Costs 6Materials are added at the start of the process.Conversion costs are added evenly during the process.The company uses the FIFO method of costing.Inspection occurs, when production is 100% complete.Normal spoilage is 11% of good units transferred out during August.Req: What is the cost allocated to next department, work-in-process end in Department 1, and period cost?arrow_forwardSunland Company has the following production data for March 2027: no beginning work in process, units started and completed 28,200, and ending work in process 4,700 units that are 100% complete for materials and 40% complete for conversion costs. Sunland uses the FIFO method to compute equivalent units. If unit materials cost is $7 and unit conversion cost is $11, determine the costs to be assigned to the units completed and transferred out and the units in ending work in process. The total costs to be assigned are $561,180. Completed and transferred out Ending work in process $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning