Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Answer

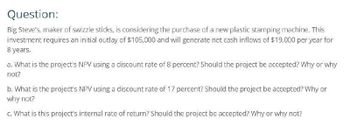

Transcribed Image Text:Question:

Big Steve's, maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This

investment requires an initial outlay of $105,000 and will generate net cash inflows of $19,000 per year for

8 years.

a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why

not?

b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or

why not?

c. What is this project's internal rate of return? Should the project be accepted? Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardJasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardThe Ham and Egg Restaurant is considering an investment in a new oven that has a cost of $60,000, with annual net cash flows of $9,950 for 8 years. The required rate of return is 6%. Compute the net present value of this investment to determine whether or not you would recommend that Ham and Egg invest in this oven.arrow_forward

- Question: Big Steve's, maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $19,000 per year for 8 years. a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not?arrow_forwardNeed a little help with this onearrow_forwardBig Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $95,000 and will generate net cash inflows of $21,000 per year for 9 years. a. What is the project's NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? Question content area bottom Part 1 a. If the discount rate is 11 percent, then the project's NPV is $enter your response here.arrow_forward

- (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $95,000 and will generate net cash inflows of $19,000 per year for 11 years. a. What is the project's NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 13 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 11 percent, then the project's NPV is $ (Round to the nearest dollar.).arrow_forwardBig Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $110,000 and will generate net cash inflows of $17,000 per year for 8 years. a.What is the project's NPV using a discount rate of 8%? Should the project be accepted? Why or why not? b.What is the project's NPV using a discount rate of 17%? Should the project be accepted? Why or why not?arrow_forwardBig Steve’s, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $17,000 per year for 9 years. A. What is the project’s NPV using a discount rate of 9 percent? Should the project accepted? Why or why not? B. What is the project’s NPV using a discount rate of 16 percent? Should the project be accepted? Why or why not ? C. What is the project’s internal rate of return? Should the project be accepted? Why or why not? If the discount rate is 9 percent, then the NPV is Round to the nearest dollararrow_forward

- ← (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine This investment requires an initial outlay of $105,000 and will generate net cash inflows of $17,000 per year for 9 years a. What is the project's NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 16 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not?arrow_forward(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $16,000 per year for 9 years. a. What is the project's NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? ed c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 11 percent, then the project's NPV is $ (Round to the nearest dollar.) tion stion stion rse (Busin Use Priv Enter your answer in the answer box and then click Check Answer. Check Answer 6 parts remaining Clear All 99+arrow_forward(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $90,000 and will generate net cash inflows of $19,000 per year for 8 years. a. What is the project's NPV using a discount rate of 9 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 9 percent, then the project's NPV is $nothing. (Round to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT