Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

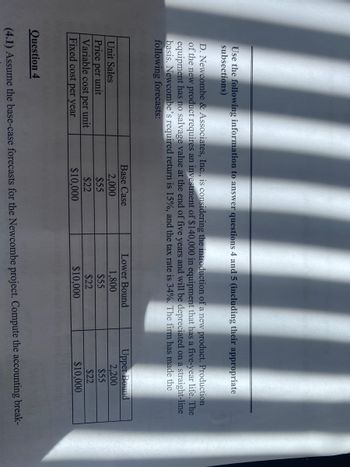

Transcribed Image Text:Use the following information to answer questions 4 and 5 (including their appropriate

subsections)

D. Newcombe & Associates, Inc., is considering the introduction of a new product. Production

of the new product requires an investment of $140,000 in equipment that has a five-year life. The

equipment has no salvage value at the end of five years and will be depreciated on a straight-line

basis. Newcombe's required return is 15%, and the tax rate is 34%. The firm has made the

following forecasts:

Unit Sales

Price per unit

Variable cost per unit

Fixed cost per year

Base Case

2,000

$55

$22

$10,000

Lower Bound

1,800

$55

$22

$10,000

Upper Bound

2,200

$55

$22

$10,000

Question 4

(4.1) Assume the base-case forecasts for the Newcombe project. Compute the accounting break-

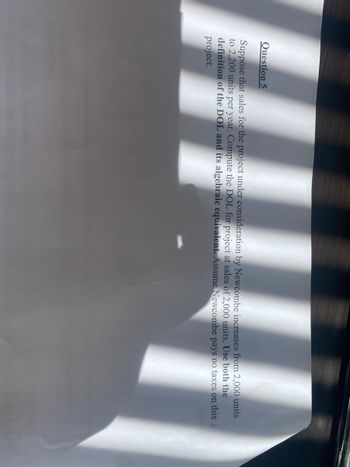

Transcribed Image Text:Question 5

Suppose that sales for the project under consideration by Newcombe increases from 2,000 units

to 2,200 units per year. Compute the DOL for project at sales of 2,000 units. Use both the

definition of the DOL and its algebraic equivalent. Assume Newcombe pays no taxes on this

project.

6 Sarbino

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Sun Brite has a new pair of sunglasses it is evaluating. The company expects to sell 5, 700 pairs of sunglasses at a price of $ 152 each and a variable cost of $104 each. The equipment necessary for the project will cost $300,000 and will be depreciated on a straight-line basis over the 9-year life of the project. Fixed costs are $180,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 increase in variable costs per pairs of sunglasses? Multiple Choice -$4,117 -S3, 335 -$4, 503 S3, 705 $3,335arrow_forwardYou are considering a new product launch. The project will cost $900,000, have a 4-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 560 units per year; price per unit will be $19,200, variable cost per unit will be $15,900, and fixed costs will be $950,000 per year. The required return on the project is 12 percent, and the relevant tax rate is 23 percent. a. The unit sales, variable cost, and fixed cost projections given above are probably accurate to within ±10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your NPV answers to 2 decimal places, e.g., 32.16.) Scenario Unit sales Variable cost per unit Fixed costs Scenario Base-case Best-case Worst-case Upper bound NPV Lower bound unitsarrow_forwardWe are evaluating a project that costs $844,200, has a nine-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 80,000 units per year. Price per unit is $54, variable cost per unit is $38, and fixed costs are $760,000 per year. The tax rate is 23 percent, and we require a return of 10 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±15 percent. Saved Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case Worst-case NPVarrow_forward

- Tasty Bakery Co. is considering a new product line. In order to manufacture the new product, the company must purchase $3 million in capital assets with expected economic life of 6 years and no salvage value. Annual pre-tax cash flows are expected to equal to $800,000 and Tasty Bakery's discount rate is 10%. Income tax rate is 30% Should this project be undertaken? Why or why not?arrow_forwardYou are considering a new product launch. The project will cost $1,750,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 220 units per year; price per unit will be $20,000, variable cost per unit will be $13,000, and fixed costs will be $500,000 per year. The required return on the project is 15 percent, and the relevant tax rate is 22 percent. a-1.The unit sales, variable cost, and fixed cost projections given above are probably accurate to within ±10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.)a-2.What is the base-case NPV? What are the best-case and worst-case scenarios? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g.,…arrow_forwardWe are evaluating a project that costs $788,400, has a nine-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 75,000 units per year. Price per unit is $52, variable cost per unit is $36, and fixed costs are $750,000 per year. The tax rate is 21 percent, and we require a return of 12 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±15 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case Worst-casearrow_forward

- A company is considering the purchase of new testing equipment that is expected to produce 8000 profit during the first year of operation. The amount will decrease by 500 per year for each additional year of ownership. The equipment cost 20000 and will have a salvage value of 3000 after 8 years of use. The minimum attractive rate of return is 18%. You are required to adivice the company whether they will go ahead with the purchasearrow_forwardThe management of Origami Company, a wholesale distributor of beachwear products, is considering purchasing a $30,000 machine that would reduce operating costs in its warehouse by $5,000 per year. At the end of the machine's eight-year useful life, it will have no scrap value. The company's required rate of return is 11%. (Ignore income taxes.) Required: 1. Determine the net present value of the investment in the machine. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negative amount should be indicated by a minus sign.) Net present value 2. What is the difference between the total undiscounted cash inflows and cash outflows over the entire life of the machine? Net cash flowarrow_forwardTidal Wave is considering purchasing a water park in Fort Worth, Texas, for $2,100,000. The new facility will generate annual net cash inflows of $495,000 for ten years. Engineers estimate that the facility will remain useful for ten years and have no residual value. The company uses straight-line depreciation. Its owners want payback in less than five years and an ARR of 12% or more. Management uses a 10% hurdle rate on investments of this nature. (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) Read the requirements. (Click the icon to view the present value table.) (Click the icon to view the future value table.) Requirement 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.) (Round the payback period to one decimal place.) The payback period (in years) is (Round the…arrow_forward

- We are evaluating a project that costs $976,000, has a life of ten years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 144,000 units per year. Price per unit is $36, variable cost per unit is $25, and fixed costs are $984,784 per year. The tax rate is 23 percent, and we require a return of 13 percent on this project. The projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/- 17 percent. a. Calculate the best-case NPV. Best case b. Calculate the worst-case NPV. Worst casearrow_forwardWendy and Wayne are evaluating a project that requires an initial investment of $795,000 in fixed assets. The project will last for eight years, and the assets have no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 143,000 units per year. Price per unit is $36, variable cost per unit is $28, and fixed costs are $798,975 per year. The tax rate is 30 percent, and the required annual return on this project is 21 percent. The projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/- 14 percent. Required: (a)Calculate the best-case NPV. (Do not round your intermediate calculations.) (Click to select) # (b)Calculate the worst-case NPV. (Do not round your intermediate calculations.) (Click to select) +arrow_forwardRaas Hardware is adding a new product line that will require an investment of $1,454,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $310,000 the first year, $290,000 the second year, and $240,000 each year thereafter for eight years. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. Select the formula, then enter the amounts to calculate the ARR (accounting rate of return) for the new product line. (Round ARR to the nearest hundredth percent [two decimal places], X.XX%.) (1) ÷ (2) = ARR ÷ = % (1) Amount invested Average amount invested Average annual operating income Present value of net cash inflows (2) Amount invested Average amount invested Average annual operating income Present value of net cash inflowsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education