FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

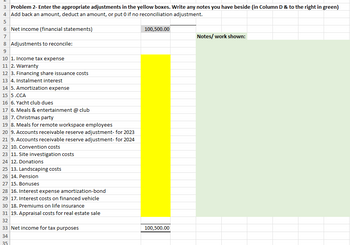

Transcribed Image Text:3 Problem 2- Enter the appropriate adjustments in the yellow boxes. Write any notes you have beside (in Column D & to the right in green)

4 Add back an amount, deduct an amount, or put 0 if no reconciliation adjustment.

5

6 Net income (financial statements)

7

8 Adjustments to reconcile:

9

10 1. Income tax expense

11 2. Warranty

12 3. Financing share issuance costs

13 4. Instalment interest

14 5. Amortization expense

15 5.CCA

16 6. Yacht club dues

17 6. Meals & entertainment @ club

18 7. Christmas party

19 8. Meals for remote workspace employees

20 9. Accounts receivable reserve adjustment- for 2023

21 9. Accounts receivable reserve adjustment- for 2024

22 10. Convention costs

23 11. Site investigation costs

24 12. Donations

25 13. Landscaping costs

26 14. Pension

27 15. Bonuses

28 16. Interest expense amortization-bond

29 17. Interest costs on financed vehicle

30 18. Premiums on life insurance

31 19. Appraisal costs for real estate sale

32

33 Net income for tax purposes

34

35

100,500.00

100,500.00

Notes/work shown:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2Aarrow_forward6 - Which of the following is the account and amount that should appear in the dotted places in the journal article above? a) 191 VAT Deductible 5.400 TL B) 391 VAT to be calculated Hs. 5.400 TL NS) 391 Calculated VAT Hs. 6.300 TL D) 360 Taxes and Funds Payable Hs. 5.400 TL TO) 191 VAT Deductible 5,000 TLarrow_forwardPlease help me. Thankyou.arrow_forward

- D10.arrow_forwardok D Int = Print Compute the annual dollar changes and percent changes for each of the following accounts. (Decreases should be indicated with a minus sign. Round percent change to one decimal place.) 0 ferences # Short-term investments Accounts receivable Notes payable Percent Change = Short-term investments Accounts receivable Notes payable Type here to search Esc fo F1 1 X F2 $ Current Year $ 378,252 100,583 @ 2 0 Horizontal Analysis - Calculation of Percent Change Numerator: 1 Current Year F3 20 #m Prior Year $ 236,897 104,503 91,702 3 378,252 $ 100,583 F4 0 S4 Prior Year $ 236,897 104,503 91,702 F5 $ % 5 Denominator: Dollar Change F6 111,355 (3,920) (91,702) DELL F7 A Percent Change 29.4 % (26.7) % (100.0) % 6 F8 & 7 0 F9 * a 8 F10 9arrow_forward← A Excel II Assignment_Data_1-1 B C D E F G Borrower's Loan Interest Payment 1 Name Amount rate years 2 James $22,500 8% 5 3 Mike $25,000 6% 5 4 John $31,000 8% 5 5 Elison $30,000 7% 5 6 Anna $35,000 8% 5 7 8 9 10 11 12 13 14 15 16 17 18 19 Monthly Paymentarrow_forward

- VOLTE If the difference between current assets and current liabilities is 67.2, bill payable 147.7, creditors 30, prepaid expenses 10, then what is the total current assets? Select one: Oa. All the given choices are not correct Ob. 187.70 Oc. 244.90 Od. 97.20 Oe. 254,90 Next page O O D 个arrow_forwardGeneral Computers Inc. purchased a computer server for $65,500. It paid 25.00% of the value as a down payment and received a loan for the balance at 6.50% compounded semi-annually. It made payments of $2,400.41 at the end of every quarter to settle the loan. a. How many payments are required to settle the loan? o payments Round up to the next payment b. Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places. Payment Number 0 11 Payment $0.00 $0.00 Interest Portion Principal Portion 50.00 50,00 SUBMIT QUESTION $0.00 50.00 Principal Balance $49.125.00 $0.00 $0.00arrow_forwardRequired information ©lmage Source, all rights reserved. Knowledge Check 01 The times interest earned ratio is computed as: O interest expense times income before interest expense and income taxes. income before interest expense and income taxes divided by interest expense. income before interest expense divided by interest expense. O income before income taxes divided by income taxes. > F5 F4 F8 94 F7 F10 6- LL %23 2$ % 5. 9. 6. Rarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education