FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

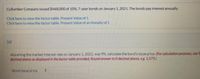

Transcribed Image Text:Cullumber Company issued $468,000 of 10%, 7-year bonds on January 1, 2021 The bonds pay interest annually.

Click here to view the factor table. Present Value of 1

Click here to view the factor table. Present Value of an Annuity of 1

(a)

Assuming the market interest rate on January 1, 2021, was 9%, calculate the bond's issue price. (For calculation purposes, use 5

decimal places as displayed in the factor table provided. Round answer to O decimal places, eg. 1,575)

Bond issue price

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments.arrow_forwardOn January 1, 2024, Christmas Anytime issues $850,000 of 6% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Assume that the market interest rate is 5% and the bonds issue at a premium. 3a. Calculate the issue price of a bond.3b. Complete the first three rows of an amortization schedule. (FV of $1, PV of $1, FVA of $1, and PVA of $1)arrow_forwardOn December 31, 2024, when the market interest rate is 14%, McMann Realty issues $800,000 of 11.25%, 10-year bonds payable. The bonds pay interest semiannually. Determine the present value of the bonds at issuance. (Round all currency amounts to the nearest whole dollar.) (Click the icon to view Present Value of Ordinary Annuity (Click the icon to view Present Value of $1 table.) of $1 table.) (Click the icon to view Future Value of $1 table.) of $1 table.) The present value of the bonds at issuance amounts to (Click the icon to view Future Value of Ordinary Annuityarrow_forward

- Problem Tower Inc. issues $40,000, 10%, 10-year bonds at January 1, 2020. Interest is paid semi- annually on June 30 and December 31. On the date of issuance, the bonds sold for 113.5 when the market rate was 8%. 1.) Compute the price of the bonds on their issue date. Round to the whole dollars.arrow_forwardOn September 30, 2023, when the market interest rate is 9 percent, Score Ltd. issues $8,000,000 of 11-percent, 20-year bonds for $9,472,126. The bonds pay 30. Score Ltd, amortizes bond premium by the effective-interest method. Required 1. Prepare an amortization table for the first four semi-annual interest periods. Score amortizes a bond premium by the effective-interest method. 2. Record the issuance of the bonds on September 30, 2023, the accrual of interest on December 31, 2023, and the semi-annual interest payment on March 3 Requirement 1. Prepare an amortization table for the first four semi-annual interest periods. (Round your answers to the nearest whole dollar.) B: Interest Expense (4.5% of Preceding Bond Carrying Amount) A: Interest Payment Semi-annual Interest (5.5% of Maturity Period Values) Issue date. March 31, 2024 September 30, 2024 March 31, 2025 September 30, 2025 440,000 440,000 440,000 440,000 426,245 C: Premium Amortization (A-B) 13,755 D: Unamortized Premium…arrow_forwardAt January 1, 2020, Konerko Corp. issued $40,000,000 of 6%, 12-year bonds that paid interest semiannually on June 30 and December 31. The bonds were issued at $36,788,326 to earn 7%. How much interest expense should Konerko report for these bonds on its income statement for the full year ended December 31, 2020? Please round your answer to the nearest dollar.arrow_forward

- 3. On July 1, 2018, Volunteer Inc. issued bonds with a $500,000 face value at 108.0 and the 5-year bonds have a 10% interest rate in a market with a rate of 8%. Interest is payable semi-annually and the effective-interest method is used for amortization. Prepare journal entries for the following transactions. Premium on Bonds Payable Interest Income Discount on Bonds Payable Interest Expense Cash Bonds Payable PLEASE NOTE: For each of the following journal entries there is one account's treatment (DR or CR), that depends on whether it is a bond issued at a premium or a discount. You are to identify if it is a DR or a CR. You must enter the account names exactly as written above and all dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345). July 1, 2018: to record issuing the bonds DR DR/CR ? CR Dec. 31, 2018: to record the amortization & payment of interest to bondholders: DR…arrow_forwardOn January 1, 2018, Parker Company issued bonds with a face value of $63,000, a stated rate of interest of 12 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 14 percent at the time the bonds were issued. The bonds sold for $58,674. Parker used the effective interest rate method to amortize the bond discount cash payment interest expense discount amortization carrying value jan 1 2018 58764 dec 31 2018 7560 8214 654 59329 dec 31 2019 dec 31 2020 dec 31 2021 dec 31 2022 totals 37800 42126 4326arrow_forwardOn January 1, 2019, $40 million face amount of 5%, 20-year bonds were issued. The bonds pay interest on a semiannual basis on June 30 and December 31 each year. The market interest rates were slightly higher than 5% when the bonds were sold. Were these bonds issued at a premium or discount? Will the semiannual interest expense on these bonds be more than or less than the amount of interest paid on each payment date? Multiple Choice The bonds were issued at a discount, and the semiannual interest expense will be more than the amount of interest paid on each payment date. The bonds were issued at a discount, and the semiannual interest expense will be less than the amount of interest paid on each payment date. The bonds were issued at a premium, and the semiannual interest expense will be more than the amount of interest paid on each payment date. The bonds were issued at a premium, and the semiannual interest expense will be less than the amount of interest paid on each payment date.arrow_forward

- On January 1, 2020, Joe Construction issued $350,000, 3-year bonds for $320,000. The stated rateof interest was 7% and interest is paid annually on December 31.1. Calculate the amount of discount that will be amortized each period. Discount/period:2. Calculate the amount of interest expense for each period.Interest/period:3. Complete the amortization table below for Joe Constructions bonds. Joe ConstructionAmortization for BondsPeriod Cash Payment (credit)Interest Expense(debit)Discount onBondsPayable(Credit)Discount onBondsPayableBalance Book ValueAt issue $ - $ - $ - $ 320,00012/31/202012/31/202112/31/2022arrow_forwardplease use P*R*T fomular as well. Thanksarrow_forwardThe following section is taken from Crane's balance sheet at December 31, 2024. Current liabilities Interest payable Long-term liabilities Bonds payable (9%, due January 1, 2028) (a) (b) $41,000 Interest is payable annually on January 1. The bonds are callable on any annual interest date. (c) 510,000 Journalize the payment of the bond interest on January 1, 2025. Assume that on January 1, 2025, after paying interest, Crane calls bonds having a face value of $105,000. The call price is 105. Record the redemption of the bonds. Prepare the adjusting entry on December 31, 2025, to accrue the interest on the remaining bonds.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education