Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

On December 31, 2018, when the market interest rate is 16%, McMann Realty issues $300,000 of 14.25%, 10-year bonds payable. The bonds pay interest semiannually. Determine the

Transcribed Image Text:S14A-14 (similar to)

Question Help

On December 31, 2018, when the market interest rate is 16%, McMann Realty issues $300,000 of 14.25%, 10-year

bonds payable. The bonds pay interest semiannually. Determine the present value of the bonds at issuance. (Round all

currency amounts to the nearest whole dollar.)

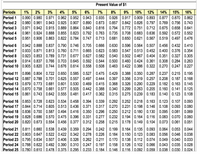

(Click the icon to view Present Value of $1 table.)

(Click the icon to view Present Value of Ordinary

Annuity of $1 table.)

(Click the icon to view Future Value of $1 table.)

(Click the icon to view Future Value of Ordinary Annuity

of $1 table.)

The present value of the bonds at issuance amounts to

Transcribed Image Text:Present Value of $1

Periods

Period 1

Period 2

Period 3

Period 4

Period 5

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

12%

14%

15%

16%

0.990 0.980 0.971 0.962 0.952 | 0.943

0.980 0.961 0.943 0.925 0.907

0.971 0.942 0.915 0.889 0.864 0.840 | 0.816

0.961 0.924 0.888 0.855 0.823 | 0.792

0.951 0.906 0.863 0.822 0.784

0.917 0.909

0.842 0.826

0.772 0.751

0.708 0.683

0.650 0.621

0.870 0.862

0.769 0.756 0.743

0.712 0.675 0.658 | 0.641

0.636 0.5920.572 | 0.552

0.567 0.519 0.497 0.476

0.935

0.926

0.893

0.877

0.890

0.873

0.857

0.797

0.794

0.763

0.735

0.747 0.713

0.681

Period 6

Period 7

Period 8

Period 9

Period 10 0.905 0.820 0.744 0.676 | 0.614 0.558

0.942 0.888 0.837 0.790 0.746 | 0.705

0.933 0.871

0.923 0.853 0.789 0.731 0.677 0.627

0.914 0.837 0.766 0.703 0.645| 0.592

0.596 0.564

0.547 0.513

0.502 0.467

0.460 0.424

0.422 0.386

0.456 0.432 0.410

0.452 0.400 0.376 | 0.354

0.327 0.305

0.308 0.284 0.263

0.270 0.247 || 0.227

0.666

0.630

0.507

0.813 0.760 0.711

0.665 0.623

0.583

0.582

0.540

0.404

0.351

0.544

0.500

0.361

0.508

0.463

0.322

Period 11 0.896 0.804 | 0.722 0.650 0.585 0.527

Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444

Period 13 0.879 0.773 0.681 0.601 | 0.530 | 0.469

Period 14 0.870 0.758 | 0.661 | 0.577 0.505 0.442 | 0.388

Period 15 0.861 0.743 0.642 0.555 0.481

0.287 0.237 0.215 | 0.195

0.356 0.319 0.257 | 0.208 | 0.187 | 0.168

0.229 0.182 | 0.163 | 0.145

0.205 0.160 | 0.141 0.125

0.183 0.140 0.123 0.108

0.475

0.429 0.388 0.350

0.397

0.326 0.290

0.340 0.299 0.263

0.315 0.275 0.239

0.415

0.368

0.417 0.362

Period 16 0.853 0.728 0.623 0.534 0.458

Period 17 0.844| 0.714 0.605 0.513 0.436 0.371

Period 18 0.836 0.700 0.587 0.494 0.416 | 0.350 0.296

Period 19 0.828 0.686 0.570 0.475 0.396 0.331

Period 20 0.820 0.673 0.554 | 0.456 0.377

0.292 0.252 0.218

0.270 0.231 0.198

0.250 0.212 0.180

0.232 0.194 0.164

0.178 0.149

0.163 0.123 0.107 0.093

0.146 0.108 | 0.093 | 0.080

0.130 0.0950.081 | 0.069

0.083 0.070 0.060

0.394

0.339

0.317

0.277

0.116

0.312 0.258

0.215

0.104

0.073 0.061

0.051

Period 21 0.811 0.660 | 0.538 0.439 0.359

Period 22 0.803 0.647 0.522 0.422 0.342 0.278

Period 23 0.795| 0.634 | 0.507 0.406 0.326 | 0.262

Period 24 0.788 0.622 0.492 0.390 0.310

Period 25 0.780| 0.610 | 0.478 | 0.375 | 0.295

0.199 0.164 0.135

0.184 0.150 0.123

0.170 0.138 0.112

0.158 0.126 0.102

0.116 0.092

0.093 0.064 0.053 0.044

0.056 0.046 0.038

0.074 0.049 0.040 | 0.033

0.066 0.043 | 0.035 0.028

0.038 0.030 | 0.024

0.294

0.242

0.226

0.083

0.211

0.247 | 0.197

0.233

0.184

0.146

0.059

Expert Solution

arrow_forward

Step 1

Bond valuation is the process of finding the fair value of the bond. It means to find the present value of a stream of cash flows that it generates. The discounting factor determines the present value of the bond. It can be calculated as follows:

Where,

C = Periodic coupon payments

F = Face value of the bond

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2018, when the market interest rate is 10%, Willis Realty issues $1,000,000 of 11.25%, 10-year bonds payable. The bonds pay interest semiannually. Willis Realty received $1,077,988 in cash at issuance. Requirements 1. Prepare an amortization table using the effective interest amortization method for the first two semiannual interest periods. (Round to the nearest dollar.) 2. Using the amortization table prepared in Requirement 1, journalize issuance of the bonds and the first two interest payments. Requirement 1. Prepare an amortization table using the effective interest amortization method for the first two semiannual interest periods. (Round to the nearest dollar.) Interest Carrying Cash Paid Expense Amortized Amount 12/31/2018 06/30/2019 12/31/2019 Requirement 2. Using the amortization table prepared in Requirement 1, journalize issuance of the bonds and the first two interest payments. (Record debits first, then credits. Select explanations on the last line of the…arrow_forwardTano Company issues bonds with a par value of $80,000 on January 1, 2021. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $75,938. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much total bond interest expense will be recognized over the life of these bonds? Total Bond Interest Expense Over Life of Bonds: Amount repaid 6 payments of $ Par value at maturity Total repaid Less amount borrowed Total bond interest expense 3,200 $ $ 19.200 19.200 19,200 Prev 2 of 3 Moxtarrow_forward1. On July 1, 2018, Volunteer Inc. issued bonds with a $500,000 face value at 108.0 and the 5-year bonds have a 10% interest rate in a market with a rate of 8%. Interest is payable annually and the effective-interest method is used for amortization. Prepare journal entries for the following transactions. Premium on Bonds Payable Interest Income Discount on Bonds Payable Interest Expense Cash Bonds Payable PLEASE NOTE: For each of the following journal entries there is one account's treatment (DR or CR), that depends on whether it is a bond issued at a premium or a discount. You are to identify if it is a DR or a CR. You must enter the account names exactly as written above and all dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345). July 1, 2018: to record issuing the bonds DR DR/CR ? CR June 30, 2019: to record the amortization & payment of interest to bondholders: DR DR/CR ?…arrow_forward

- Quatro issues bonds dated January 1, 2021, with a par value of $900,000. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and there was bonds Issuance costs of $ 29,850 1. What is the price of these bonds at issuance? 2. Prepare the journal entries to record how much total bond interest expense will be recognized over the life of these bonds and the Bond issuance costs 3 Prepare an amortization table for these bonds using the effective interest method.arrow_forwardEllis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Calculate the total bond interest expense over the bonds' life. 2. Prepare a straight-line amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid: payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense $ 0 0arrow_forwardOn January 1, 2018, Splash City issues $470,000 of 7% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate on the issue date is 8% and the bonds issued at $423,487. Required: 1. Using an amortization schedule, show that the bonds have a carrying value of $425,566 on December 31, 2019. (Round Interest expense to nearest whole dollar.) Date Cash Paid 01/01/18 6/30/18 12/31/18 6/30/19 12/31/19 Interest Expense Increase in Carrying Value Carrying Value Required informationarrow_forward

- please answerarrow_forwardHillside issues $1,900,000 of 5%, 15-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $1,641,812. Required: 1. Prepare the January 1 journal entry to record the bonds’ issuance. 2(a) For each semiannual period, complete the table below to calculate the cash payment. 2(b) For each semiannual period, complete the table below to calculate the straight-line discount amortization. 2(c) For each semiannual period, complete the table below to calculate the bond interest expense. 3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 4. Prepare the first two years of a straight-line amortization table. 5. Prepare the journal entries to record the first two interest payments.arrow_forwardOn January 1, 2018, Lane Unlimited issues 15%, 10-year bonds payable with a face value of $180,000. The bonds are issued at 105 and pay interest on June 30 and December 31. Requirements: Journalize the semiannual interest payment and amortization of bond premium on December 31, 2018. Journalize the retirement of the bond at maturity, assuming the last interest payment has already been recorded. (Give the date.)arrow_forward

- Cullumber Company issued $468,000 of 10%, 7-year bonds on January 1, 2021 The bonds pay interest annually. Click here to view the factor table. Present Value of 1 Click here to view the factor table. Present Value of an Annuity of 1 (a) Assuming the market interest rate on January 1, 2021, was 9%, calculate the bond's issue price. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, eg. 1,575) Bond issue price %24arrow_forwardOn January 1, 2022, Eleanor Co. issued ten-year bonds with a face value of $5,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. Required: Calculate the issue price of the bonds if the market interest rate is 4%. Calculate the issue price of the bonds if the market interest rate is 8%.arrow_forwardAri Goldstein, Inc. issued $500,000 of 7%, 12-year bonds payable on January 1, 2018. The market interest rate at the date of issuance was 6%, and the bonds pay interest semiannually. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Requirements (Use the factor tables provided with factors rounded to three decimal places. Round all currency amounts to the nearest dollar.) 1. How much cash did the company receive upon issuance of the bonds payable? (Round to the nearest dollar.) Prepare an amortization table for the bond using the effective-interest method, through the first two interest payments. (Round to the nearest dollar.) Journalize the issuance of the bonds on January 1, 2018, and the first and second payments of the semiannual interest amount and amortization of the bonds on June 30,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education