FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:**Example Bond Issue Price and Journal Entries Calculation for an Educational Website**

---

### Bond Issue Price Calculation and Journal Entries

**Educational Content for Understanding Bonds**

In this exercise, we will calculate the issue price of bonds and illustrate how to make the necessary journal entries using the effective-interest method. This example will help students understand the financial accounting concepts related to bond issuance and interest payments.

**Problem Statement**

**Scenario 1:**

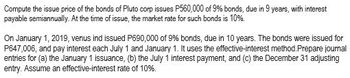

Compute the issue price of the bonds of Pluto Corp. Pluto Corp issues P650,000 of 9% bonds, due in 9 years, with interest payable semiannually. At the time of issuance, the market rate for such bonds is 10%.

**Solution:**

To find the issue price of the bonds, we need to calculate the present value (PV) of the future cash flows, i.e., the semiannual interest payments and the principal repayment at maturity. These cash flows are discounted using the market interest rate.

**Scenario 2:**

On January 1, 2019, Venus Ind. issued P690,000 of 9% bonds, due in 10 years. The bonds were issued for P647,006 and pay interest each July 1 and January 1. Venus Ind. uses the effective-interest method.

**Required:**

Prepare journal entries for the following transactions:

(a) The January 1 issuance

(b) The July 1 interest payment

(c) The December 31 adjusting entry

Assume an effective interest rate of 10%.

**Solution:**

**Journal Entries:**

1. **January 1 Issuance:**

- **Debit**: Cash P647,006

- **Debit**: Discount on Bonds Payable P42,994 (P690,000 - P647,006)

- **Credit**: Bonds Payable P690,000

2. **July 1 Interest Payment:**

Calculate the interest expense for the first semiannual period using the effective-interest rate:

- **Interest Expense** = P647,006 * 5% = P32,350.30

Actual interest payment:

- **Interest Payment** = P690,000 * 4.5% = P31,050

Amortization of the bond discount:

- **Discount Amortization** = P32,350.30 - P31,050 = P1,300.30

- **Journal Entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marwick Corporation issues 12%, 5-year bonds with a par value of $1,120,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%. What is the bond's issue (selling) price, assuming the following Present Value factors:arrow_forwardMarwick Corporation issues 12%, 5-year bonds with a par value of $1,230,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%. What is the bond's issue (selling) price, assuming the following Present Value factors: number of periods (n)- 5 10 5 10 Multiple Choice Present Value of an interest rate Annuity (series of $1,019,244 $1,324,958 $1,230,000 $660,139 $1,799,861 12% 10% 5% payments) 3.6048 7.3601 3.7908 7.7217 Present value of 1 (single sum) 0.5674 0.5584 0.6209 0.6139arrow_forwardGarcia Company issues 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%, which implies a selling price of 117 ¼.Prepare the journal entry for the issuance of these bonds for cash on January 1.arrow_forward

- Pharoah Corporation issues $460,000 of 9% bonds, due in 10 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Issue price of the bonds $arrow_forwardOn January 1, 2020, Bonita Industries issued eight-year bonds with a face value of $5950000 and a stated interest rate of 10%, payable semiannually on June 30 and December 31. The bonds were sold to yield 12%. Table values are: Present value of 1 for 8 periods at 10% 0.467 Present value of 1 for 8 periods at 12% 0.404 Present value of 1 for 16 periods at 5% 0.458 Present value of 1 for 16 periods at 6% 0.394 Present value of annuity for 8 periods at 10% 5.335 Present value of annuity for 8 periods at 12% 4.968 Present value of annuity for 16 periods at 5% 10.838 Present value of annuity for 16 periods at 6% 10.106 The present value of the principal is O $2403800. O $2778650. O $2344300. O $2725100. MacBook Airarrow_forwardPina Corporation issues $450,000 of 8% bonds, due in 9 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 58,971.) Issue price of the bonds $arrow_forward

- On January 1, 2025, Cullumber Co. issued five-year bonds with a face value of $510,000 and a stated interest rate of 10% payable semiannually on July 1 and January 1. The bonds were sold to yield 6%. Present value table factors are: Present value of 1 for 5 periods at 6% Present value of 1 for 5 periods at 10% Present value of 1 for 10 periods at 3% Present value of 1 for 10 periods at 5% Present value of an ordinary annuity of 1 for 5 periods at 6% Present value of an ordinary annuity of 1 for 5 periods at 10% Present value of an ordinary annuity of 1 for 10 periods at 3% Present value of an ordinary annuity of 1 for 10 periods at 5% Click here to view factor tables 0.74726 0.62092 0.74409 0.61391 4.21236 3.79079 8.53020 7.72173 Calculate the issue price of the bonds. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,582.)arrow_forwardEnviro Company issues 8%, 10-year bonds with a par value of $310,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%, which implies a selling price of 87 1/2. Prepare the journal entry for the issuance of the bonds for cash on January 1.arrow_forwardPearson Co issue its $193,400 at a price of 103, the stated rate is 9%, the bond term is 4 years, and the market rate is 6%. Assume the term of the bonds is 4 years. The annual interest payment on the bond will be $_______arrow_forward

- Flint Corporation issues $430,000 of 9% bonds, due in 9 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 58,971.) Issue price of the bondsarrow_forwardBrin Company issues bonds with a par value of $590,000. The bonds mature in 5 years and pay 9% annual Interest in semiannual payments. The annual market rate for the bonds is 12%. (Table B.1, Table B.2, Table B.3, and Table B.4) Note: Use appropriate factor(s) from the tables provided. 1. Compute the price of the bonds as of their Issue date. 2. Prepare the journal entry to record the bonds' issuance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the price of the bonds as of their issue date. Note: Round all table values to 4 decimal places, and use the rounded table values in calculations. Round intermediate calculations to the nearest dollar amount. Table Values are Based on: Cash Flow Par (maturity) value Interest (annuity) Price of bonds n= Table Value Amount Present Value $ 0 Required 1 Prepare the journal entry to record the bonds' issuance. Note: Round intermediate calculations to the nearest dollar amount. Required 2 View…arrow_forwardQuatro Company issues bonds dated January 1, 2021, with a par value of $760,000. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8 %, and the bonds are sold for $799, 828. What is the amount of the premium on these bonds at issuance? How much total bond interest expense will be recognized over the life of these bonds? Prepare an effective interest amortization table for these bondsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education