FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

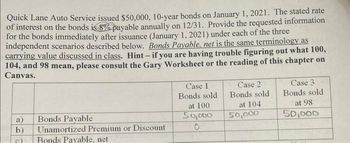

Transcribed Image Text:Quick Lane Auto Service issued $50,000, 10-year bonds on January 1, 2021. The stated rate

of interest on the bonds is 8% payable annually on 12/31. Provide the requested information

for the bonds immediately after issuance (January 1, 2021) under each of the three

independent scenarios described below. Bonds Payable, net is the same terminology as

carrying value discussed in class. Hint - if you are having trouble figuring out what 100,

104, and 98 mean, please consult the Gary Worksheet or the reading of this chapter on

Canvas.

a)

b)

c)

Bonds Payable

Unamortized Premium or Discount

Bonds Payable, net

Case 1

Bonds sold

at 100

50,000

0

Case 2

Bonds sold

at 104

50,000

Case 3

Bonds sold

at 98

50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following section is taken from Oriole Ltd.s balance sheet at December 31, 2019. Non-current liabilities Bonds payable, 7%, due January 1, 2024 HK$ 1,585,000 Current liabilities Interest payable 110,950 Bond interest is payable annually on January 1. The bonds are callable on any interest date. Journalize the payment of the bond interest on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 1 eTextbook and Media List of Accounts Debit Credit Assume that on January 1, 2020, after paying interest, Oriole calls bonds having a face value of $503,000. The call price is 103. Record the redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 1 eTextbook and Media List of Accounts Debit Credit Prepare the entry to record the accrual of interest on December 31, 2020. (Credit…arrow_forwardNeed help with E.arrow_forwardpage On January 1, 2019, $40 million face amount of 5%, 20-year bonds were issued. The bonds pay interest on a semiannual basis on June 30 and December 31 each year. The market interest rates were slightly higher than 5% when the bonds were sold. Were these bonds issued at a premium or discount? Will the semiannual interest expense on these bonds be more than or less than the amount of interest paid on each payment date? O a. The bonds were issued at a premium, and the semiannual interest expense will be less than the amount of interest paid on each payment date. O b. The bonds were issued at a premium, and the semiannual interest expense will be more than the amount of interest paid on each payment date. O c. The bonds were issued at a discount, and the semiannual interest expense will be more than the amount of interest paid on each payment date. O d. The bonds were issued at a discount, and the semiannual interest expense will be less than the amount of interest paid on each payment…arrow_forward

- On March 1, 2021, FLAXSEED Inc. issued at 97, including accrued interest, 2,550 of its 10%, ₱1,000 bonds. The bonds are dated January 1, 2021 to mature on January 1, 2031. Interest is payable semi-annually on January 1 and July 1. From the bond issuance, how much cash did FLAXSEED receive? (Solution must be in good accounting form. Excel format would be good for a good accounting form! Thanks a lot, Tutor! I hope you can help me)arrow_forwardE-Tech Initiatives Limited plans to issue $650,000, 10-year, 7.00 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2019. Show how the bonds would be reported on the January 2, 2019, balance sheet if they are issued at 105. How would I create a partial balance sheet with the carrying vaule for the problem above?arrow_forwardOn August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forward

- 1. a) the amt of interest pd in cash every payment period, 1. b) the amt of amorization to be recorded at each interest payment date.(use the straight -line methodarrow_forwardony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date cash paid Interest Expense Increase in carrying value carrying value 01/01/2021 $218,690 06/30/2021 $11,500 $13,121 $1,621 220,311 12/31/2021 11,500 13,219 1,719 222,030 06/30/2022 11,500 13,322 1,822 223,852 12/31/2022 11,500 13,431 1,931 225,783 06/30/2023 11,500 13,547 2,047 227,830 12/31/2023 11,500 13,670 2,170 230,000 THA issued the bonds for: Multiple Choice $230,000. $218,690. $299,000. Cannot be determined from the given information.arrow_forwardOn January 1, 2021, a company issues 3-year bonds with a face value of $160,000 and a stated interest rate of 7%. Because the market interest rate is 5%, the company receives $168,714 for the bonds. Required: Fill in the table assuming the company uses effective-interest bond amortization. (Round your answers to the nearest whole dollar.) Period Ended Cash Paid 01/01/2021 12/31/2021 12/31/2022 12/31/2023 Interest Expense Amortized Premium $ 0 0 0 Bonds Payable Premium on Bonds Payable Carrying Value $ 0 0 0 0arrow_forward

- Please Explain Proper Step by Step and do not give solution in image format ??arrow_forwardLopez Plastics Co. (LPC) issued callable bonds on January 1, 2021. LPC's accountant has projected the following amortizatic schedule from issuance until maturity: Cash Effective Decrease in Date Outstanding interest interest balance balance 1/1/2021 24 207,020 6/30/2021 2$ 7,000 $4 6,211 24 789 206,230 12/31/2021 7,000 6,187 813 205,417 6/30/2022 7,000 6,163 837 204,580 12/31/2022 7,000 6,137 863 203,717 6/30/2023 7,000 6,112 888 202,829 12/31/2023 7,000 6,085 915 201,913 943 200,971 6/30/2024 7,000 6,057 971 200,000 7,000 6,029 12/31/2024 LPC issued the bonds:arrow_forwardBlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education