FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

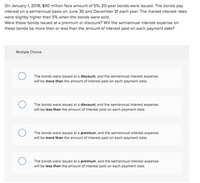

Transcribed Image Text:On January 1, 2019, $40 million face amount of 5%, 20-year bonds were issued. The bonds pay

interest on a semiannual basis on June 30 and December 31 each year. The market interest rates

were slightly higher than 5% when the bonds were sold.

Were these bonds issued at a premium or discount? Will the semiannual interest expense on

these bonds be more than or less than the amount of interest paid on each payment date?

Multiple Choice

The bonds were issued at a discount, and the semiannual interest expense

will be more than the amount of interest paid on each payment date.

The bonds were issued at a discount, and the semiannual interest expense

will be less than the amount of interest paid on each payment date.

The bonds were issued at a premium, and the semiannual interest expense

will be more than the amount of interest paid on each payment date.

The bonds were issued at a premium, and the semiannual interest expense

will be less than the amount of interest paid on each payment date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] On January 1, 2019, Drennen Inc. issued $3.1 million face amount of 7-year, 10% stated rate bonds when market interest rates were 8%. The bonds pay semiannual interest each June 30 and December 31 and mature on December 31, 2025. Table 6-4, Table 6-5 (Use appropriate factor from the table provided.) b-1. Assume instead that the proceeds were $3,052.000. Use the horizontal model to record the payment of semiannual interest and the related discount amortization on June 30, 2019, assuming that the discount of $48,000 is amortized on a straight-line basis. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Income Statement Assets Liabilities + Stockholders' Equity - Net Income Revenues Expensesarrow_forwardSheffield Company issued $400,000, 12%, 10-year bonds on January 1, 2022, for $423,557. This price resulted in an effective-interest rate of 11% on the bonds. Interest is payable annually on January 1. Sheffield uses the effective-interest method to amortize bond premium or discount. (a) Your answer is correct. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Date Jan. 1, 2022 Account Titles and Explanation Cash Premium on Bonds Payable eTextbook and Media Date Bonds Payable List of Accounts Dec. 31, 2022 Your answer is partially correct. Account Titles and Explanation Interest Expense Premium on Bonds Payable Debit Prepare the journal entry to record the accrual of interest and the premium amortization on December 31, 2022. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.)…arrow_forwardOn January 1, 2019, Company X issued $550,000 of twenty-year bonds when a market rate was 2%. The annual Interest payment each year is $22,000. What is the carrying value of the bonds after the interest payment on December 31, 2020? Select one: A. $550,000 B. $628,780.90 C. $631,826.11 D. $714,912.34arrow_forward

- Crane Company issues $26400000, 8.0%, 5-year bonds dated January 1, 2024 on January 1, 2024. The bonds pay interest semiannually on June 30 and December 31. The bonds are issued to yield 7.0%. Given the following present value factors, what are the proceeds from the bond issue? Present value of a single sum for 5 periods Present value of a single sum for 10 periods Present value of an annuity for 5 periods Present value of an annuity for 10 periods $27487261 $26400000 $27446108 O $27497828 3.5% 0.84197 4.0% 4.51505 0.82193 0.70892 0.67556 4.45182 8.31661 8.11090 7.0% 0.71299 0.50835 4.10020 7.02358 8.0% 0.68058 0.46319 3.99271 6.71008arrow_forwardBonds with a stated interest rate of 9% and a face value totaling $610,000 were issued for $634 400 on January 1.2021 whe market interest rate was 8%. The company uses effective-interest bond amortization Required: Determine the carrying value of the bonds at December 31, 2022. (Round your answer to nearest whole dolar) Carrying Valuearrow_forwardOn June 30, 2021, the market interest rate is 5%. Champs Corporation issues $600,000 of 10%, 30-year bonds payable. The bonds pay interest on June 30 and December 31. The company amortizes bond premium using the effective-interest method. Read the requirements. Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is Requirements 1. 2. 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare a bond amortization table for the first four semiannual interest periods. Record the issuance of bonds payable on June 30, 2021; the payment of interest on December 31, 2021; and the payment of interest on June 30, 2022. Print Done Xarrow_forward

- On June 30, 2021, Allen Corporation issued $4 million of its 8% bonds for $3.5 million. The bonds were priced to yield 9.4%. The bonds are dated June 30, 2021. Interest is payable semiannually on December 31 and July 1. If the effective interest method is used, by how much should the bond discount be reduced for the six months ended December 31, 2021? A. $4,800. B. $4,500. C. $3,500. D. $9,000.arrow_forward$60,000, 5-year bonds, with a 10% stated rate of interest are issued at $55,584 on January 1, 2021. Interest payments are made semi-annually on June 30 and December 31. How much interest expense would be recognized on the first interest payment date? Assume straight-line amortization is used. Round your answer to the nearest dollar.arrow_forwardHow to calculate the issue price of the bonds with normal calculator?arrow_forward

- A $650,000 bond issue on which there is an unamortized discount of $45,00, is redeemed for $600,000. What journal entry would you make to record the redemption of the bond?arrow_forwardOn January 1, 2024, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Payment Cash Payment Effective Interest Increase in Balance Outstanding Balance 6,095,749 1 228,000 243,830 15,830 6,111,579 2 228,000 244,463 16,463 6,128,042 3 228,000 245,122 17,122 6,145,164 4 228,000 245,807 17,807 6,162,971 5 228,000 246,519 18,519 6,181,490 6 228,000 247,260 19,260 6,200,750 ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ 38 228,000 295,564 67,564 7,456,656 39 228,000 298,266 70,266 7,526,922 40 228,000 301,078 73,078 7,600,000 Required: What is the face amount of the bonds? What is the initial selling price of the bonds? What is the term to maturity in years? Interest is determined by what approach? What is the stated annual interest rate? What is the effective annual interest rate? What is the total cash interest paid over the term to maturity? What is the total effective interest…arrow_forward3. On July 1, 2018, Volunteer Inc. issued bonds with a $500,000 face value at 108.0 and the 5-year bonds have a 10% interest rate in a market with a rate of 8%. Interest is payable semi-annually and the effective-interest method is used for amortization. Prepare journal entries for the following transactions. Premium on Bonds Payable Interest Income Discount on Bonds Payable Interest Expense Cash Bonds Payable PLEASE NOTE: For each of the following journal entries there is one account's treatment (DR or CR), that depends on whether it is a bond issued at a premium or a discount. You are to identify if it is a DR or a CR. You must enter the account names exactly as written above and all dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345). July 1, 2018: to record issuing the bonds DR DR/CR ? CR Dec. 31, 2018: to record the amortization & payment of interest to bondholders: DR…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education