Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

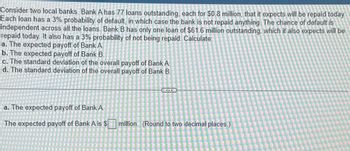

Transcribed Image Text:Consider two local banks. Bank A has 77 loans outstanding, each for $0.8 million, that it expects will be repaid today.

Each loan has a 3% probability of default, in which case the bank is not repaid anything. The chance of default is

independent across all the loans. Bank B has only one loan of $61.6 million outstanding, which it also expects will be

repaid today. It also has a 3% probability of not being repaid. Calculate:

a. The expected payoff of Bank A.

b. The expected payoff of Bank B.

c. The standard deviation of the overall payoff of Bank A.

d. The standard deviation of the overall payoff of Bank B.

a. The expected payoff of Bank A.

The expected payoff of Bank A is $

million. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose a bank currently has $250,000 in deposits and $27,000 in reserves. The required reserve ratio is 10%. If at the end of the day, there is an unexpected withdrawal of $4,000 in reserves, what is the bank's resulting reserve ratio (expressed as a %)? Using the information from the prior problem, how much would the bank need to borrow in either the Fed Funds market or at the discount window, to be in complicance with the required reserve ratio?arrow_forwardAnne Teak, the financial manager of a furniture manufacturer, is considering operating a lockbox system. She forecasts that 220 payments a day will be made to lockboxes with an average payment size of $3,300. The bank’s charge for operating the lockboxes is $0.58 a check. Assume an interest rate of 8% and a 365-day year. What reduction in the time to collect and process each check is needed to justify use of the lockbox system? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardSuppose First Main Bank, Second Main Bank, and Third Main Bank all hold zero excess reserves. The required reserve ratio is 20%. Suppose that the Federal Reserve buys a government bond worth $1,500,000 from Jack, a client of First Main Bank. He immediately deposits the money into his checking account at First Main Bank. As a result of this transaction, the required reserves for First Main Bank will increase by $ type your answer... and its excess reserves will increase by $ type your answer...arrow_forward

- In the example below, we will use year-end assets. Bank A receives $70 in deposits at 5% and, together with 40 in equity, makes a loan of $90 at 7%. The remaining of assets is G-Bond. We will ignore taxes for the moment. Bank A Cash Reserves for Deposit ? Loan 7% $90 G-Bond 5% ? Deposits 5% $70 Equity $40 Total Assets $? Total Equity and Deposit $110 If Cash Reserves for deposit is at least 8% of the deposit under the Basel Accord, how much of the G-Bond Bank A should purchase? $17 $14 $16 $18 $20 $15 $19 $21arrow_forwardAnne Teak, the financial manager of a furniture manufacturer, is considering operating a lock-box system. She forecasts that 400 payments a day will be made to lock boxes with an average payment size of $3,000. The bank's charge for operating the lock boxes is $0.50 a check. The interest rate is 0.012% per day. a. If the lock box makes the cash available 2 days earlier, calculate the net daily advantage of the system. Note: Do not round intermediate calculations. b. Is it worthwhile to adopt the system? c. What minimum reduction in the time to collect and process each check is needed to justify use of the lock-box system? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Net daily advantage b. Is it worthwhile to adopt the system? c. Minimum reduction in time $ Yes (56) 1.39 daysarrow_forwardStep by step solutions pleasearrow_forward

- The amount of money (in billions of dollars) lent to customers with credit scores below 620 for subprime mortgages can be approximated by the function g(x) = 299.2e-0.15x, where x = 1 corresponds to the year 2001. (a) Find the value of subprime mortgage lending in 2011 for the described customer base. (b) If the trend continues, what is the first full year in which subprime lending falls below $4 billion? (a) Which of the following describes how to find the value of subprime mortgage lending in 2011 using the given information? Select the correct choice below and fill in the answer box to complete your choice. (Type an integer or a decimal.) A. To find the value of subprime mortgage lending in 2011, substitute g(x). for x and evaluate to find B. To find the value of subprime mortgage lending in 2011, find the intersection point of the graphs y=299.2e-0.15x and y=. The vahre of subprime mortgage lending in 2011 is represented by the y-coordinate. In 2011, the assets are about $ billion.…arrow_forwardConsider two local banks. Bank A has 87 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 3% probability of default, in which case the bank is not repaid anything. The chance of default is independent across all the loans. Bank B has only one loan of $87 million outstanding, which it also expects will be repaid today. It also has a 3% probability of not being repaid. Calculate the following: a. The expected overall payoff of each bank. b. The standard deviation of the overall payoff of each bank. a. The expected overall payoff of each bank. The expected overall payoff of Bank A is $ million. (Round to the nearest integer.)arrow_forwardConsider the following conditions:(a) In your new job you are paid each month, instead of weekly.(b) The rate of interest on bonds and other financial assets rises.(c) An automatic teller machine (ATM) is installed next door and you have a debit card.(d) Bond prices are expected to fall.Would you decide to increase or decrease your average holding of money (i.e. cash and/orcheque deposit balances)? Which of the three motives for holding money is involved in eachcase?arrow_forward

- A3)arrow_forwardWe have the following information about a bank's balance sheet. Rate sensitive assets = $10,000,000 Fixed-rate assets = $20,000,000 Rate sensitive liabilities = $4,000,000 Fixed-rate liabilities = $26,000,000 Let's do a simple gap analysis. If the interest rate falls by 5 percent, O a. The bank will lose $300,000. O b. The bank will lose $500,000. O c. The bank will lose $200,000. O d. The bank will gain $300,000. O e. The bank will gain $200,000.arrow_forwardJohnny Rockefeller had a bad credit rating and went to a local cash center. He took out a $100.00 loan payable in two weeks for $105.50. What is the percent of interest paid on this loan? (Do not round intermediate calculations. Round your answer to the nearest whole percent.) Percentage of interest paid %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education