Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

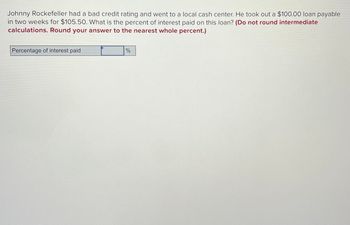

Transcribed Image Text:Johnny Rockefeller had a bad credit rating and went to a local cash center. He took out a $100.00 loan payable

in two weeks for $105.50. What is the percent of interest paid on this loan? (Do not round intermediate

calculations. Round your answer to the nearest whole percent.)

Percentage of interest paid

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You have a $1,400 balance on your 15% credit card. You have lost your job and been unemployed for 6 months. You have been unable to make any payments on your balance. However, you received a tax refund and want to pay off the credit card. How much will you owe on the credit card if you have not made a payment for 6 months? Note: Round your answers to the nearest cent. How much interest will have accrued? Note: Round your answer to the nearest cent. What will be the effective rate of interest after the 6 months?arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it’s your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round to the nearest cent)arrow_forwardHelp me with correct explanation. Not solve in excel works.arrow_forward

- Meghan Pease purchased a small sailboat for $8,350. She made a down payment of $1,700 and financed the balance with monthly payments of $239.38 for 36 months. (a) What is the finance charge (in $) on the loan? $ (b) Use Table 13-1 to find what annual percentage rate was charged on Meghan's loan. (Round your answer to two decimal places.) %arrow_forwardMr. Rich Mann, is the credit manager of MCC Inc. Mr. Mann would like to estimate the cost of credit sales. From experience, credit customers have paid their bills in an average of 40 days and a standard deviation of 12 days. Customers who pay their bills in 10 days receive a 2% discount. Accounts that are not paid within 75 days are written off as bad debts. (Assume a normal distribution) a. What percentage of accounts is within 25 and 60 days old? b. What percentage of the accounts is written off as bad debts or receives the discount For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS E E A v 、工%ロ启 Q Paragraph Arial 10pt ...arrow_forwardEnzo borrowed $4800 from the bank for 18 months. The bank discounted the loan at 4.7%. How much was the interest? (State your result to the nearest penny). How much did Enzo receive from the bank? ( State your result to the nearest penny) What was the actual rate of interest? (State your result to the nearest hundredth of a percent.) Need only handwritten solution only (not typed one).arrow_forward

- How do we work out how much was saved by making the partial payment? I know the answer is $26.91, but I don't know how to get there. Please help me. Polly Flynn borrowed $6,000 for 90 days at 7%. On day 20, Polly made a $2000 partial payment. (Assume ordinary interest) What is Polly’s ending balance due? How much did Polly save by making the partial payment?arrow_forward3) Carlos and Rosa applied for the same credit card from the same bank. The bank checked both of their FICO scores. Carlos had an excellent Credit rating and Rosa had a poor credit rating. a. Carlos was given an APR of 10% while Rosa got a 18%. What are their monthly percentage rate? (Round to the nearest hundredth of a percent) b. If they both had an average daily balance of $1000 for a specific month, and had to pay a finance charge, who would pay more and by how much?arrow_forward2. On April 1 Kendrick opened a savings account at a bank that paid 3.55 $1,000. On April 20 he withdrew $500. On April 30 the bank calculated the daily percent interest. His initial deposit was $3,200. On April 9 he deposited another interest. a) How much simple interest did his money earn? b) How much was in the account after the bank calculated the daily interest on April 30?arrow_forward

- Consider the following conditions:(a) In your new job you are paid each month, instead of weekly.(b) The rate of interest on bonds and other financial assets rises.(c) An automatic teller machine (ATM) is installed next door and you have a debit card.(d) Bond prices are expected to fall.Would you decide to increase or decrease your average holding of money (i.e. cash and/orcheque deposit balances)? Which of the three motives for holding money is involved in eachcase?arrow_forwardAs a jewelry store manager, you want to offer credit, with interest on outstanding balances paid monthly. To carry receivables, you must borrow funds from your bank at a nominal 10%, monthly compounding. To offset your overhead, you want to charge your customers an EAR (or EFF%) that is 3% more than the bank is charging you. What APR rate should you charge your customers? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it is your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round dollars to the nearest cent.) AmountFinanced Number ofPayments MonthlyPayment PaymentsMade RebateFraction FinanceChargeRebate LoanPayoff $1,800 18 $126.89 12 $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education