Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

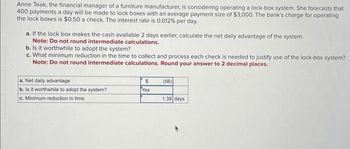

Transcribed Image Text:Anne Teak, the financial manager of a furniture manufacturer, is considering operating a lock-box system. She forecasts that

400 payments a day will be made to lock boxes with an average payment size of $3,000. The bank's charge for operating

the lock boxes is $0.50 a check. The interest rate is 0.012% per day.

a. If the lock box makes the cash available 2 days earlier, calculate the net daily advantage of the system.

Note: Do not round intermediate calculations.

b. Is it worthwhile to adopt the system?

c. What minimum reduction in the time to collect and process each check is needed to justify use of the lock-box system?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

a. Net daily advantage

b. Is it worthwhile to adopt the system?

c. Minimum reduction in time

$

Yes

(56)

1.39 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are looking for a bank in which to open a checking account for your new part-time business. You estimate that in the first year, you will be writing 30 checks per month and will make three debit transactions per month. Your average daily balance is estimated to be $900 for the first six months and $2,400 for the next six months. Use the following information to solve the problem. Bank Monthly Fees and Conditions Bank 1 $16.00 with $1,000 min. daily balance-or-$25.00 under $1,000 min. daily balance Bank 2 $4.50 plus $0.40 per check over 10 checks monthly$1.00 per debit transaction Bank 3 $5 plus $0.25 per check$2.00 per debit transaction Bank 4 $8 plus $0.15 per check$1.50 per debit transaction (a) Calculate the cost (in $) of doing business with each bank for a year. Bank 1 Bank 2 Bank 3 Bank 4 (b) Which bank should you choose for your checking account? Bank 1 Bank 2 Bank 3 Bank 4arrow_forwardJim Hayes wants to buy some electronic equipment for $800. Jim has decided to save uniformamount at the end of each month so that after 12 months he will have the required $800. If theinterest rate is 0.5% per month (a) Construct a cash flow diagram (b) determine how much Jim has to deposit each month by using tabulated factorsarrow_forwardYou have to test cash and PP&E of your client. Both accounts have the same balance at the end of the year: $25 million. In a typical company, which account will you spend more time testing AND WHY?arrow_forward

- You ran a little short on your spring break vacation, so you put $1,000 on your other credit card. You can afford only the minimum payment of $60 per quarter. The interest rate on the credit card is 18 per year compounded quarterly. How many years will you need to pay off the $1,000? I want to solve this problem using the financial calculator so if your able to show me what to punch in that would be greatarrow_forwardEconomicarrow_forwardIf you are attempting these questions ...then solve for both imagesarrow_forward

- First National Bank of Conway is considering installing two ATMs in its Southside branch. The new machines are expected to cost $37000 apiece. Installation costs will amount to about $15000 per machine. Each machine has a projected useful life of 10 years. Due to rapid growth in the Southside district, these two machines (combined) are expected to handle 50000 cash transactions per year. On average, each cash transaction is expected to save $0.30 in teller expenses. If First National has a 0.10 cost of capital, what is the NPV of this project?arrow_forwardYour neighbor goes to the post office once a month and picks up two checks, one for $13,000 and one for $3,000. The larger check takes 2 days to clear after it is deposited; the smaller one takes 4 days. Assume 30 days per month. 1. What is the total float for the month? 2. What is the average daily float? 3a. What is the average daily receipts? 3b. What is the weighted average delay?arrow_forwardMatthew wants to have $2000 in 10 years. Matthew plans on making no deposits or withdrawals. The following are the choices in which he can invest: A savings account earning 1.5% compounding weekly. A checking account earning 3.2% compounded monthly. A money market account earning 2.8% compounded quarterly. Explain which choice Matthew should choose. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial रु ते X Q Π 19 Ω ▪ = 3 A AR W lil € 10pt X² X₂ @ AÐ !!! 38¶¶‹ 由用图 † ( ABC Ⓒ [+ ~ ** Ix +arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education