Concept explainers

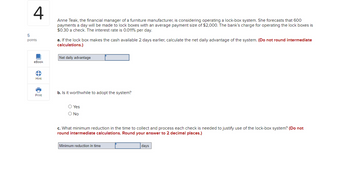

Anne Teak, the

a. If the lock box makes the cash available 2 days earlier, calculate the net daily advantage of the system. (Do not round intermediate calculations.)

b. Is it worthwhile to adopt the system?

multiple choice

-

Yes

-

No

c. What minimum reduction in the time to collect and process each check is needed to justify use of the lock-box system? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by stepSolved in 2 steps

- Sharla is comparing a credit plan to buying an appliance for cash. The sticker price is $1200. The down payment for the credit plan is 10% and then 24 monthly payments of $53.25. What is the cost of buying on credit?arrow_forwardNatalie decides to buy a poodle print. A poodle print is bought for 24 monthly payments of $200. What is the equivalent cash price if the rate is 18% compounded monthly and the first payment is made one month after the purchase? (Remember: Cash = Now)arrow_forwardZipCar auto parts store has $88,000 to invest in a project to detect and reduce insier theft in their stores. They have considering investing in one of two alternatives, identified as Y and Z. Z is the higher first-cost alternative, and the incremental initial investment between the two is $22,000 and will exhibit a rate of return of 12% per year. Z requires an investment of $88,000. They expect a rate of return on the $88,000 investment of 49 percent. Answer the following questions; (a) what is the size of the investment required in Y?, and, (b) what is the rate of return on Y? The size of the investment required in Y is $ The rate of return on Y is %.arrow_forward

- You ran a little short on your spring break vacation, so you put $1,000 on your other credit card. You can afford only the minimum payment of $60 per quarter. The interest rate on the credit card is 18 per year compounded quarterly. How many years will you need to pay off the $1,000? I want to solve this problem using the financial calculator so if your able to show me what to punch in that would be greatarrow_forwardEconomicarrow_forwardYour firm has an average receipt size of $90. A bank has approached you concerning a lockbox service that will decrease your total collection time by 2 days. You typically receive 9,100 checks per day. The daily interest rate is 0.019 percent. If the bank charges a fee of $200 per day, what is the NPV of the lockbox project? NPV What would the net annual savings be if the service were adopted? Net annual savingsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education