Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

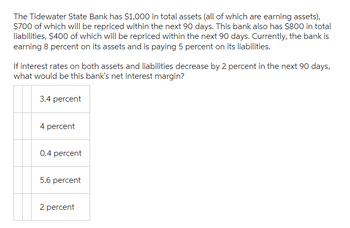

Transcribed Image Text:The Tidewater State Bank has $1,000 in total assets (all of which are earning assets),

$700 of which will be repriced within the next 90 days. This bank also has $800 in total

liabilities, $400 of which will be repriced within the next 90 days. Currently, the bank is

earning 8 percent on its assets and is paying 5 percent on its liabilities.

If interest rates on both assets and liabilities decrease by 2 percent in the next 90 days,

what would be this bank's net interest margin?

3.4 percent

4 percent

0.4 percent

5.6 percent

2 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Lorena's Cart took out a loan from the bank today for $245,600.00. The loan requires Lorena's Cart to make a special payment of $86,000.00 to the bank in 4 years and also make regular, fixed payments of X to the bank each year forever. The interest rate on the loan is 11.60 percent per year and the first regular, fixed annual payment of X will be made to the bank in 1 year. What is X, the amount of the regular, fixed annual payment? O $55,442.36 (plus or minus 3 dollars) O $18,513.60 (plus or minus 3 dollars) O $22,058.29 (plus or minus 3 dollars) O $28,489.60 (plus or minus 3 dollars) none of the answers are within 3 dollars of the correct answerarrow_forwardSuppose that the liabilities of "Bank X" are all demand deposits and 3-month time deposits. Meanwhile, the bank's main assets are 5-year term loans to corporations with BB credit ratings. The loan interest rates are fixed for five years. Briefly describe the risks which Bank X is exposed toarrow_forwardMirror Bank pays 5 percent simple interest on its saving account, whereas Collar Bank pays 5 percent interest compounded annually. [answer to 2 decimal places] a)If you deposit $55123 today at Mirror Bank, what is account balance in 5 years?b)If you deposit $55123 today at Collar Bank, what is account balance in 5 years? c)Based on a) and b), which Bank offers a higher account balance in 5 years? (Mirror/Collar) Why? (Interest earned only on the original principle/ interest earned in principle and on interest received)arrow_forward

- Titusville Petroleum Company is considering pledging its receivables to finance an increase in working capital. Citizens National Bank will lend the company 85 percent of the pledged receivables at 3 percentage points above the prime rate (currently 6%). The bank charges a service fee equal to 1.4 percent of the pledged receivables. The interest costs and the service fee are payable at the end of the borrowing period. Titusville has $2 million in receivables that can be pledged as collateral. The average collection period is 40 days. Assume that there are 365 days per year. Determine the annual financing cost to Titusville of this receivables-backed loan. Round your answer to two decimal places. %arrow_forwardIf 8000 dollars is invested in a bank account at an interest rate of 7 per cent per year, Find the amount in the bank after 15 years if interest is compounded annually: Find the amount in the bank after 15 years if interest is compounded quarterly: Find the amount in the bank after 15 years if interest is compounded monthly: Finally, find the amount in the bank after 15 years if interest is compounded continuously: Check Answerarrow_forwardThe Bluebird Company has a $10,000 liability it must pay three years from today. The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $2,500 a year for the next three years, starting one year from today. The account pays a 3% rate of return. How much does the Bluebird Company need to deposit today? a) $1,867.74 b ) 2,079.89 c) 3, 108.09 d) 4,276.34 e) 4,642.28arrow_forward

- A bank features a savings account that has an annual percentage rate of r=3.4% with interest compounded weekly. Alfonso deposits $11,500 into the account. The account balance can be modeled by the exponential formula S(t)=P(1+r/n)^nt, where S is the future value, P is the present value, rr is the annual percentage rate, nn is the number of times each year that the interest is compounded, and tt is the time in years. What values should be used for P, r, and n?P= , r= , n= How much money will Alfonso have in the account in 10 years?Answer = $ .Round answer to the nearest penny. What is the effective annual rate for the savings account?effective rate = %.Round answer to 3 decimal places.arrow_forwardYou borrowed $200,000 from the Bank of Nova Scotia. The loan is to be repaid at the end of five (5) years. The bank is to receive 8% interest on the loan balance that is outstanding. i. Calculate the yearly payment on a $200 000 loan. ii. Prepare an amortization schedule for this loan. iii. What is the loan balance just after the end of year two (2)? iv. What is the total interest paid over the life of the loan? v. What is the effective rate of interest on the loan if interest is compounded quarterly?arrow_forwardMelody Dairy has a line of credit with its bank. The firm plans to borrow $400,000 at a rate of 10 percent. The bank requires a 15% compensating balance and the firm currently maintains $20,000 in its account at the bank that can be used to meet the compensating balance requirement. Determine the annual finance cost to Melody of this loan.arrow_forward

- SureWin Company owes an amount of debt to a bank and the bank proposed the following annual payments to pay off the debt. Year 0 (Today): 20,000 Year 1: 24,000; Year 2: 30,000; Year 3: 30,000; Year 4: 35,000; (1) If the appropriate interest rate that bank is charging is APR 6% annual compounding, what would be the amount to debt owed today? (2) If SureWin can negotiate with the bank to pay yearly equal instalments over 4 years starting from the end of year 1 with the same 6% annual interest rate, what would be the amount of yearly payment? (3) If the bank accepts SureWin proposal in (2), what would be the interest amount paid to the bank in the first year?arrow_forwardK Oidhat Financial starts its first day of operations with $9 million in capital. A total of $140 million in checkable deposits are received. The bank makes a $30 milion commercial loan and another $50 milion in mortgages, with the following terms: 200 standard 30-year, foxed-rate mortgages with a nominal annual rate of 5.25%, each for $250,000. Assume that required reserves are 8% Complete the bank's balance sheet provided below. (Round your responses to the nearest whole number) Assets The leverage ratio is%, and the bank is Required reserves Excess reserves Loans $11 million $ 58 million $ 80 million Liabilities Checkable deposits Bank capital 1 (Round your response to two decimal places) $140 million $9 millionarrow_forward(Related to Checkpoint 18.2) (Estimating the cost of bank credit) Paymaster Enterprises has arranged to finance its seasonal working-capital needs with a short-term bank loan. The loan will carry a rate of 16 percent per annum with interest paid in advance (discounted). In addition, Paymaster must maintain a minimum demand deposit with the bank of 7 percent of the loan balance throughout the term of the loan. If Paymaster plans to borrow $110,000 for a period of 6 months, what is the annualized cost of the bank loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education