SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

PLease answer. General Account.

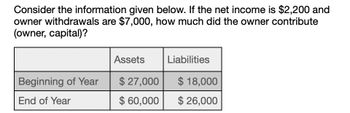

Transcribed Image Text:Consider the information given below. If the net income is $2,200 and

owner withdrawals are $7,000, how much did the owner contribute

(owner, capital)?

Assets

Liabilities

Beginning of Year

$27,000

$ 18,000

End of Year

$ 60,000

$ 26,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following, calculate total current assets. Prepaid insurance=$300Long-term investments=$1,200Cash=$540Prepaid Rent=$2,050Inventory=$640Plant assets, at cost=$16,800Accounts receivable=$5,900Accumulated depreciation=$6,600arrow_forwardHuron has provided the following year-end balances:· Cash, $25,000· Long-term Investments, $7,900· Accounts receivable, $9,300· Property, plant, and equipment, $98,700· Prepaid insurance, $3,600· Accumulated depreciation, $10,000· Inventory, $37,000· Retained earnings, $12,600How much are Huron's current assets? Group of answer choices a)$74,900. B)$163,600. c)$87,500.D)$95,400arrow_forwardThe financial information is presented below for Bob's Appliance for the fiscal year ended 12/31/2020. $720,000 12,000 31,000 25,000 8,000 10,000 400,000 24,000 12,000 6,000 120,000 48,000 9,000 8,000 4,000 24,000 95,000 38,000 Sales Tax-exempt interest Long-term capital gain Short-term capital loss Interest income Passive activity loss Cost of goods sold Depreciation Section 179 expense Charitable contributions Bob's salary expense Employee salary expense Payroll taxes on employee Medical insurance expense for Bob Medical insurance expense for employee Rent expense Other operating expenses Net operating loss (from year ended 12/31/2019) Bob is a sole proprietor of the company and he has 1 employee. Assume Bob is single, no dependents, and does not itemize his deductions. Other than the income from Bob's Appliance, Bob has a short term capital loss of 22,000. Question #1) What is the income from Bob's appliance business? Be sure to show and label all your work and cell reference.…arrow_forward

- What was Mary janane's beginning capital balance??arrow_forwardReturn on assets The financial statements of The Hershey Company (HSY) are shown in Exhibits 6 through 9. Based upon these statements, answer the following questions. 1. What are Hershey's sales (in millions)? 2. What is Hershey's cost of sales (in millions)? 3. What is Hershey's net income (in millions)? 4. What is Hershey's percent of the cost of the sales to sales? Round to one decimal place. 5. The percent that a company adds to its cost of sales to determine the selling price is called a markup. What is Hershey's markup percent? Round to one decimal place. 6. What is the percentage of net income to sales for Hershey? Round to one decimal place. 7. Hershey had total assets of $5,554 (millions) at the beginning of the year. Compute the return on assets for Hershey for the year shown in Exhibits 6–9. Round to one decimal place.arrow_forwardCompute for the gross income under accrual basis.arrow_forward

- Beginning of year assets 24000 & liabilities 18,000arrow_forwardwhat is the amount of rogers 2021 NOL? net loss from business - (30,000) salary from employment-10,000 int income from savings -3000 net loss from rental of property -(5000) bet long term capital gain from sale of business property -7000 net short term capital loss -(4000) standard deductio -12,400arrow_forwardPlease explain how you get the journal entries below. The DeVille Company reported pretax accounting income on its income statement as follows: 2021 $ 355,000 2022 275,000 2023 345,000 2024 385,000 Included in the income of 2021 was an installment sale of property in the amount of $30,000. However, for tax purposes, DeVille reported the income in the year cash was collected. Cash collected on the installment sale was $12,000 in 2022, $15,000 in 2023, and $3,000 in 2024.Included in the 2023 income was $10,000 interest from investments in municipal governmental bonds.The enacted tax rate for 2021 and 2022 was 40%, but during 2022, new tax legislation was passed reducing the tax rate to 25% for the years 2023 and beyond.Required:Prepare the year-end journal entries to record income taxes for the years 2021–2024. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- Financial Accounting Question need answer pleasearrow_forwardD. An entity reported the following information during the first year of operations:Pretax financial income 9,000,000Nontaxable interest received 1,000,000Nondeductible life insurance premiums paid 500,000Long-term loss accrual in excess of deductible amount 1,500,000Tax depreciation in excess of financial depreciation 2,000,000Income tax rate 25%1. What is the current tax expense?2. What is the total tax expense?3. What is the deferred tax liability at year-end?4. What is the deferred tax asset at year-end?arrow_forwardThe following revenues were among those reported by Tosa Township in 2018:Net rental revenue (after depreciation) from a parking garage owned by Tosa . . . . . . $ 40,000Interest earned on investments held for employees’ retirement benefits. . . . . . . . . . . . . 100,000Property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,000,000What amount of the foregoing revenues should be accounted for in Tosa’s governmental funds?a. $6,140,000b. $6,100,000c. $6,040,000d. $6,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you