Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

GENERAL ACCOUNTING 2.4

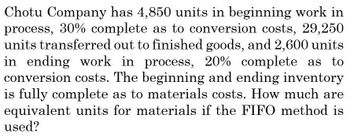

Transcribed Image Text:Chotu Company has 4,850 units in beginning work in

process, 30% complete as to conversion costs, 29,250

units transferred out to finished goods, and 2,600 units

in ending work in process, 20% complete as to

conversion costs. The beginning and ending inventory

is fully complete as to materials costs. How much are

equivalent units for materials if the FIFO method is

used?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardCool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?arrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forward

- The following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work in process for conversion. Given that materials are added 50% at the beginning of the process and 50% at the end of the process, what are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardThe Bottling Department of Mountain Springs Water Company had 4,400 liters in beginning work in process inventory (25% complete). During the period, 55,400 liters were completed. The ending work in process inventory was 3,000 liters (65% complete). All inventories are costed by the first-in, first-out method. What are the equivalent units for conversion costs under the FIFO method? what are the equivalent units for conversion costsarrow_forward

- Sheffield Company has unit costs of $6 for direct materials and $15 for conversion costs. There are 4000 units in ending Work in Process inventory that are 30% complete related to conversion costs, and fully complete related to direct materials cost. How much is the total cost assigned to the ending Work in Process inventory if the weighted-average method is used? a. $84000 b. $18000 c. $42000 d. $24000arrow_forwardBeginning Work-in-Process is 3,350 units; 66,600 units completed, and ending Work-in-Process is 5,450 units, which are 100% complete for direct materials and 50% complete for conversion costs. The beginning WIP Inventory is 100% complete for direct materials and 50% complete for conversion. Required: 1. What are the equivalent units for materials and conversion using the weighted-average method? 2. What are the equivalent units for materials and conversion using the FIFO method?arrow_forwardWaterway’s Manufacturing has 7400 units in beginning Work in Process inventory, 15% complete related to conversion costs, 15200 units transferred out to Finished Goods inventory, and 2100 units in ending Work in Process inventory 10% complete related to conversion costs. Direct materials are fully added at the beginning of the process. How much are equivalent units of production for conversion costs if the FIFO method is used? 14300 16310 16520 14210arrow_forward

- Bramble’s Manufacturing has 6000 units in beginning Work in Process inventory, 15% complete as to conversion costs, 14500 units transferred out to Finished Goods inventory, and 1600 units in ending Work in Process inventory 10% complete related to conversion costs. Direct materials are fully added at the beginning of the process. How much are equivalent units of production for direct materials if the FIFO method is used? 14500 10100 22100 18900arrow_forwardThe costs per equivalent unit of direct materials and conversion in the Filling Department of Eve Cosmetics Company are $1.65 and $0.55, respectively. The equivalent units to be assigned costs are as follows: The beginning work in process inventory had a cost of $1,340. Determine the cost of completed and transferred-out production and the ending work in process inventory. If required, round to the nearest dollar.arrow_forwardSunland Company uses the FIFO method to compute equivalent units. It has 4500 units in beginning work in process, 20% complete as to conversion costs and 50% complete as to materials costs, 65500 units started, and 5900 units in ending work in process, 30% complete as to conversion costs, and 80% complete as to materials cost. How much are the equivalent units for materials under the FIFO method? 65500 70000 O66570 O68650arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College