Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting

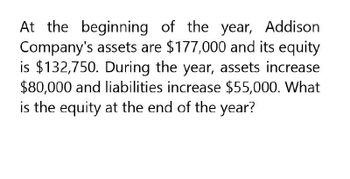

Transcribed Image Text:At the beginning of the year, Addison

Company's assets are $177,000 and its equity

is $132,750. During the year, assets increase

$80,000 and liabilities increase $55,000. What

is the equity at the end of the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Swifty Incorporated had average total assets in 2025 of $6343000. It reported sales for of $8209000 that year. Average liabilities for the year were $5187000. Net income for the year was $964136. What is Swifty' return on assets for 2025? O 15.20% 18.59% O 11.74% 6.60%arrow_forwardAt the beginning of the year, Keller Company's liabilities equal $60,000. During the year, assets increase by $80,000, and at year-end assets equal $180,000. Liabilities decrease $10,000 during the year. What are the beginning and ending amounts of equity?arrow_forwardThe Kretovich Company had a quick ratio of 1.4, a current ratio of 3.0, a days’ sales outstanding of 36.5 days (based on a 365-day year), total current assets of $810,000, and cash and marketable securities of $120,000. What were Kretovich’s annual sales?arrow_forward

- At the beginning of the year, Quaker Company's liabilities equal $70,000. During the year, assets increase by $60,000, and at year - end assets equal $190,000. Liabilities decrease $5,000 during the year. What are the beginning and ending amounts of equity?arrow_forwardFor the year ended December 31, 2022, Settles Incorporated earned an ROI of 8.8 %. Sales for the year were $9 million, and average asset turnover was 2.2. Average stockholders' equity was $2.9 million. Required: a. Calculate Settles Incorporated's margin and net income. Note: Round "Margin" answer to 1 decimal place. Enter the net income answer in dollars, i.e., $5 million should be entered as 5,000,000. b. Calculate Settles Incorporated's return on equity. Note: Round your answer to 1 decimal place. a. Margin a. Net income % b. Return on equity %arrow_forwardCapital introduced is $50. Profits brought forward at the beginning of the year amount to $100 and liabilities are $70. Assets are $90. What is the retained profit for the year?arrow_forward

- QUESTION: At the beginning of the year, Keller Company's liabilities equal $60,000. During the year, assets increase by $80,000, and at year-end assets equal $180,000. Liabilities decrease by $10,000 during the year. What are the beginning and ending amounts of equity?arrow_forwardGive true answerarrow_forwardThe following information is available for Advanced Micro Devices (AMD) for the current year: Assets at beginning of year $ ?Assets at end of year $4,556,000,000Liabilities at beginning of year $2,956,000,000Liabilities at end of year $ ?Stockholders’ equity at end of year $ ? During the year, AMD’s assets increased by $1,004,000,000 and its liabilities increased by $334 million. Calculate AMD’s stockholders’ equity at the end of the year. Do NOT include the dollar sign ($) when you enter your answer.arrow_forward

- What do the following data, taken from a comparative balance sheet, indicate about the company’s ability to borrow additional long-term debt in thecurrent year as compared to the preceding year? Current Year Preceding YearFixed assets (net) $1,260,000 $1,360,000Total long-term liabilities 300,000 400,000arrow_forwardHendo Inc. is constructing its pro forma financial statements for this year. At years end, Assets were $650,000 and Accounts Payable (the only liabilities account) was $175,000. Sales for the year were $825,000. Hendo expects to grow by 12% this year. Assets and Accounts Payable are expected to grow proportionally to Sales. Common Stock currently equals $175,000 and Retained Earnings are $127,000. Hendo plans to sell $18,000 of new common stock this year. The firm's profit margin on Sales is 5.5%, and 45% of its earnings will be paid out in dividends. How much NEW long-term debt financing will Hendo need this year to finance its expected growth? Hendo is currently operating at full capapcity.arrow_forwardFor the year ended December 31, 2022, Settles Incorporated earned an ROI of 10.5%. Sales for the year were $9 million, and average asset turnover was 2.1. Average stockholders' equity was $2.8 million. Required: Calculate Settles Incorporated's margin and net income. Note: Round "Margin" answer to 1 decimal place. Enter the net income answer in dollars, i.e., $5 million should be entered as 5,000,000. Calculate Settles Incorporated's return on equity. Note: Round your answer to 1 decimal place.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning