FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

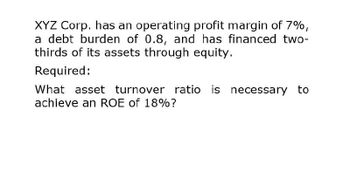

Transcribed Image Text:XYZ Corp. has an operating profit margin of 7%,

a debt burden of 0.8, and has financed two-

thirds of its assets through equity.

Required:

What asset turnover ratio is necessary to

achieve an ROE of 18%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Croc Gator Removal has a profit margin of 8 percent, total asset turnover of 1.0, and ROE of 14.46 percent. What is this firm's debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardCroc Gator Removal has a profit margin of 10 percent, total asset turnover of 1.02 and ROE of 14.44 percent. What is the firm's debt-equity ratio? ( Do not round intermediate calculations and round your answer to 2 decimal places, e.g.,32.16) Debt-equity ratio________ timesarrow_forwardNeed answer with this accounting questionarrow_forward

- Please Need Answer of this Questionarrow_forwardAssume that the Profit Margin for Teebow, Inc., is 4.92%. The company's Total Asset Turnover is 1.8 times. Given that the equity multiplier for the company is 1.67 times, what are its ROA and ROE? It cannot be determined from the information given ROA=8.85% ; ROE = 14.79% ROA=10% ; ROE=15% ROA=13.04% ; ROE=18.85%arrow_forwardKelso's has a return on equity of 15.2 percent, a debt-equity ratio of 44 percent, a capital intensity ratio of 1.08, a current ratio of 1.25, and current assets of $138,000. What is the profit margin? {Hint: capital intensity ratio is related to total asset turnover.} 13.65% 9.72% 7.45% 11.40% 12.15%arrow_forward

- ABC Company has a debt-equity ratio of 50 percent, a total asset turnover of 1.25, and a profit margin of 5.4 percent. What is the value of the ROE? (Hint: See the Ch 03 Practice Problems) 10.13% 3.38% 4.50% 6.75% 8.10%arrow_forwardconsider a company with ROE of 14.5% and a profit margin of 6.5%. if the total asset turnover is 1.8 what is the firm's debt equity ratioarrow_forwardKeller Cosmetics maintains an operating profit margin of 6% and asset turnover ratio of 1. a. What is its ROA? (Enter your answer as a whole percent.) ROA % b. If its debt-equity ratio is 1, its interest payments are $9,700 and taxes are $11,400, and EBIT is $28,500, what is its ROE? (Do not round intermediate calculations. Enter your answer as a whole percent.) ROE %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education