FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

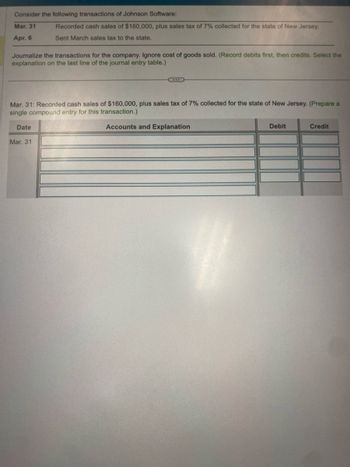

Transcribed Image Text:Consider the following transactions of Johnson Software:

Mar. 31

Apr. 6

Journalize the transactions for the company. Ignore cost of goods sold. (Record debits first, then credits. Select the

explanation on the last line of the journal entry table.)

Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey.

Sent March sales tax to the state.

Mar. 31: Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. (Prepare a

single compound entry for this transaction.)

Accounts and Explanation

Date

Mar. 31

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Company had cash sales of $77,328 (including taxes) for the month of June. Sales are subject to 8.00% sales tax. Prepare the entry to record the sales. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardThe following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer sells and installs home and business security systems. Jan. 3 Feb. 10 13 Mar. 12 14 Apr. 3 May 11 13 July 12 Aug. 1 Oct. 5 15 Loaned $18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note. Sold merchandise on account to Bradford & Co., $24,000. The cost of the goods sold was $14,400. Sold merchandise on account to Dry Creek Co., $60,000. The cost of goods sold was $54,000. Accepted a 60-day, 7% note for $24,000 from Bradford & Co. on account. Accepted a 60-day, 9% note for $60,000 from Dry Creek Co. on account. Received the interest due from Trina Gelhaus and a new 120-day, 9% note as a renewal of the loan of January 3. (Record both the debit and the credit to the notes receivable account.) Received from Bradford & Co. the amount due on the note of March 12. Dry Creek Co. dishonored its note dated March 14. Received from Dry Creek Co. the amount owed on the…arrow_forwardPresented below is information from Larkspur Computers Incorporated. July 1 Sold $19,200 of computers to Robertson Company with terms 3/15, n/60. Larkspur uses the gross method to record cash discounts. Larkspur estimates allowances of $1,248 will be honored on these sales. 10 Larkspur received payment from Robertson for the full amount owed from the July transactions. 17 Sold $192,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30. 30 The Clark Store paid Larkspur for its purchase of July 17. Prepare the necessary journal entries for Larkspur Computers.arrow_forward

- Questio Venus Corp. sold goods, with a selling price of $16,221, for cash. The state sales tax rate is 8%. What amount is credited to the Sales Revenue account? (Round calculations to the nearest dollar.) O $15,843 O $1378 O $17,221 O $16,221 Question 1 of 41>>arrow_forwardIn performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. Crane Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $23,000 and sales taxes $1,150. 1. 2. Sunland Company does not segregate sales and sales taxes. Its register total for Alpril 15 is $11,340, which includes a 8% sales tax.arrow_forwardSales Tax Transactions Journalize the entries to record the following selected transactions. a. Sold $5,100 of merchandise on account, subject to a sales tax of 7%. The cost of merchandise sold was $3,010. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Paid $47,320 to the state sales tax department for taxes collected.arrow_forward

- In performing accounting services for small businesses, you encounter these situations pertaining to cash sales. 1. Oriole Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $53,000 and sales taxes $2,650. Sheffield Company does not segregate sales and sales taxes. Its register total for April 15 is $24,300, which includes a 89% sales tax. 2. Prepare the entries to record the sales transactions and related taxes for each client. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit ORIOLE COMPANY SHEFFIELD COMPANY >arrow_forwardKathy's Corner Store has total cash sales for the month of $34,000 excluding sales taxes. If the sales tax rate is 5%, which journal entry is needed? (Ignore Cost of Goods Sold.) A. debit Cash $35,700, credit Sales Revenue $35,700 B. debit Cash $32,300, debit Sales Tax Receivable for $1,700 and credit Sales Revenue for $34,000 C. debit Cash $34,000 and credit Sales Revenue $34,000 D. debit Cash $35,700, credit Sales Revenue $34,000 and credit Sales Tax Payable $1,700arrow_forwardPresented below is information from Metlock Computers Incorporated. July 1 10 Sold $19,600 of computers to Robertson Company with terms 3/15, n/60. Metlock uses the gross method to record cash discounts. Metlock estimates allowances of $1,274 will be honored on these sales. (Metlock records these estimates at point of sale.) Metlock received payment from Robertson for the full amount owed from the July transactions. 17 Sold $196,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30. 30 The Clark Store paid Metlock for its purchase of July 17. Prepare the necessary journal entries for Metlock Computers. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date July 1 Account Titles and Explanation Accounts…arrow_forward

- During December, Far West Services makes a $3,600 credit sale. The state sales tax rate is 6% and the local sales tax rate is 2.5%. (Note: the sales tax amount is in addition to the credit sale amount.) Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardJournalize the entries to record the following selected transactions. Refer to the Chart of Accounts for exact wording of account titles. A. Sold $61,700 of merchandise on account, subject to a sales tax of 6%. The cost of the goods sold was $38,720. B. Paid $40,670 to the state sales tax department for taxes collected. CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 131 Estimated Returns Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 216 Salaries Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales…arrow_forwardAccounting Question: The following are independent situations: Record the sales transactions and related taxes for each client. Show steps please. 1. Max rang up $14,000 of sales, plus HST of 13%, on it's cash register on April 10. 2. Quince rang up $35,400 of sales, before sales taxes, on its cash register on April 21. The company charges 5% GST and No PST. 3. Jace charges 5% GST and 7% PST on all sales. On April 27, the company collected $23,200 sales in cash plus sales taxes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education