FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

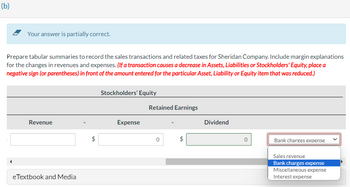

Transcribed Image Text:(b)

Your answer is partially correct.

Prepare tabular summaries to record the sales transactions and related taxes for Sheridan Company. Include margin explanations

for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a

negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)

Revenue

eTextbook and Media

$

tA

Stockholders' Equity

Expense

Retained Earnings

0

tA

Dividend

Bank charges expense

Sales revenue

Bank charges expense

Miscellaneous expense

Interest expense

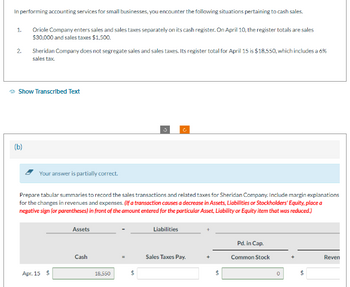

Transcribed Image Text:In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales.

Oriole Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales

$30,000 and sales taxes $1,500.

1.

2.

Sheridan Company does not segregate sales and sales taxes. Its register total for April 15 is $18,550, which includes a 6%

sales tax.

Show Transcribed Text

(b)

Your answer is partially correct.

Prepare tabular summaries to record the sales transactions and related taxes for Sheridan Company. Include margin explanations

for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a

negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)

Apr. 15 $

Assets

Cash

18,550

$

C

Liabilities

Sales Taxes Pay.

$

Pd. in Cap.

Common Stock

$

Reven

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are the accounts assistant in a small company called Autonomy Ltd. The company had the following transactions during June 2021: | Credit sales Receipts from trade receivables Discounts allowed |Sales returns Bad debts written off Contras between sales and purchase ledgers Balance of trade receivables at 1 June 2021 26,595 23,250 650 1,525 1,650 1,000 6,950 Required: a) Construct the sales ledger control account of Autonomy Ltd from the above details. Show clearly the balance carried down at 30 June 2021. b) Explain the purpose of a sales ledger control account.arrow_forwardThe sales journal for Carothers Company is shown below. SALES JOURNAL Date Sales Slip No. Customer Name Post.Ref. AccountsReceivableDebit Sales taxPayableCredit SalesCredit Dec. 1 824 Jim Danta 3,212 312 2,900 7 825 Tom Tome 645 45 600 22 826 Sue Wasco 666 66 600 31 Totals 4,523 423 4,100 Show how the amounts would be posted to the general ledger accounts.arrow_forwardA company reported the following transactions. Journalize transactions that should be recorded in a cash receipts journal. July 1 Smith, the owner, contributed $13,300 cash to the company. July 6 Sold merchandise costing $1,800 to Garcia for $2,030 on credit, terms n/20. July 8 Purchased merchandise for $10,600 on credit from Jones, terms n/30. July 23 Sold merchandise costing $1,030 to Taylor for $1,080 cash. July 25 Received $2,030 cash from Garcia in payment of the July 6 purchase. July 27 Purchased $565 of supplies on credit from a company, terms 1/10, n/30. July 30 Borrowed $9,800 cash in exchange for a note payable to a bank. Date July 01 July 06 July 08 July 23 July 25 July 27 July 30 Account Credited Smith, Capital Garcia Jones Cash Debit 13,300 CASH RECEIPTS JOURNAL Accounts Sales Discount Debit Receivable Credit 2,030 Sales Credit Other Accounts Credit Cost of Goods Sold Debit Inventory Credit 1,800arrow_forward

- Sales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions: a. Sold merchandise for cash, $22,060. The cost of the merchandise sold was $13,240. (Record the sale first.) fill in the blank 36fbb5ffffdef81_2 fill in the blank 36fbb5ffffdef81_3 fill in the blank 36fbb5ffffdef81_5 fill in the blank 36fbb5ffffdef81_6 fill in the blank 36fbb5ffffdef81_8 fill in the blank 36fbb5ffffdef81_9 fill in the blank 36fbb5ffffdef81_11 fill in the blank 36fbb5ffffdef81_12 b. Sold merchandise on account, $13,920. The cost of the merchandise sold was $8,350. (Record the sale first.) fill in the blank e95153f82fd6002_2 fill in the blank e95153f82fd6002_3 fill in the blank e95153f82fd6002_5 fill in the blank e95153f82fd6002_6 fill in the blank e95153f82fd6002_8 fill in the blank e95153f82fd6002_9 fill in the blank e95153f82fd6002_11 fill in the blank e95153f82fd6002_12…arrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 116,000 Allowance for doubtful accounts 12,700 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $258,000. Sold merchandise to Abbey Corp; invoice amount, $42,000. Sold merchandise to Brown Company; invoice amount, $53,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $56,000. Collected $119,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $48,400. Cavendish paid its account in full after the…arrow_forwardIvanhoe Auto Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $18,900. All sales are subject to a 5% sales tax.(a1) Compute sales taxes payable. Sales taxes payable (a2) Give the journal entry to record sales taxes payable and sales revenue. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit March 16arrow_forward

- The cash register tape for Tamarisk Industries reported sales of $8,103.30.Record the journal entry that would be necessary for each of the following situations. (a) Sales per cash register tape exceeds cash on hand by $59.85. (b) Cash on hand exceeds cash reported by cash register tape by $33.39. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Transactions Account Titles and Explanation Debit Credit (a) enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places enter an account title enter a debit amount rounded to 2 decimal places enter a credit amount rounded to 2 decimal places (b) enter an account title enter a debit amount rounded to 2 decimal…arrow_forwardThe following journal entry was included in the accounting records of Ostrosky Corporation on March 20: Debit Accounts payable $4,000, Credit Merchandise Inventory $40, Credit Cash $3,960 Based on this journal entry, it is likely that the company: A. Sold inventory for cash B. Collected cash for the inventory sold on credit and recorded a 1% sales discount C. Purchased inventory for cash D. Paid for the inventory purchased on credit and took advantage of the 1% purchase discountarrow_forwardJoey's Bike Shop sells new and used bicycle parts. Although a majority of its sales are cash sales, it makes a significant amount of credit sales. During Year 1, its first year of operations, Joey's Bike Shop experienced the following. Sales on account Cash sales Collections of accounts receivable Uncollectible accounts charged off during the year $288,300 696,700 273,885 1,413 Required a. Assume that Joey's Bike Shop uses the allowance method of accounting for uncollectible accounts and estimates that 1 percent of its sales on account will not be collected. Answer the following questions: (1) What is the Accounts Receivable balance at December 31, Year 1? (2) What is the ending balance of the Allowance for Doubtful Accounts at December 31, Year 1, after all entries and adjusting entries are posted? (3) What is the amount of uncollectible accounts expense for Year 1? (4) What is the net realizable value of accounts receivable at December 31, Year 1?arrow_forward

- don't give answer in image formatarrow_forwardConsider the following transactions of Johnson Software: Mar. 31 Apr. 6 Journalize the transactions for the company. Ignore cost of goods sold. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. Sent March sales tax to the state. Mar. 31: Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. (Prepare a single compound entry for this transaction.) Accounts and Explanation Date Mar. 31 Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education