FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

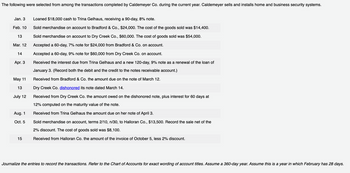

Transcribed Image Text:The following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer sells and installs home and business security systems.

Jan. 3

Feb. 10

13

Mar. 12

14

Apr. 3

May 11

13

July 12

Aug. 1

Oct. 5

15

Loaned $18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note.

Sold merchandise on account to Bradford & Co., $24,000. The cost of the goods sold was $14,400.

Sold merchandise on account to Dry Creek Co., $60,000. The cost of goods sold was $54,000.

Accepted a 60-day, 7% note for $24,000 from Bradford & Co. on account.

Accepted a 60-day, 9% note for $60,000 from Dry Creek Co. on account.

Received the interest due from Trina Gelhaus and a new 120-day, 9% note as a renewal of the loan of

January 3. (Record both the debit and the credit to the notes receivable account.)

Received from Bradford & Co. the amount due on the note of March 12.

Dry Creek Co. dishonored its note dated March 14.

Received from Dry Creek Co. the amount owed on the dishonored note, plus interest for 60 days at

12% computed on the maturity value of the note.

Received from Trina Gelhaus the amount due on her note of April 3.

Sold merchandise on account, terms 2/10, n/30, to Halloran Co., $13,500. Record the sale net of the

2% discount. The cost of goods sold was $8,100.

Received from Halloran Co. the amount of the invoice of October 5, less 2% discount.

Journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. Assume this is a year in which February has 28 days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- shobhaarrow_forwardManiarrow_forwardDerry Co. is a company in the industry of selling and installing laundry systems, Derry choose financial period ending by December 31. The following were selected from among the transactions completed during 2020. 2019 Oct 10 Sold merchandise to Edin, and received $6,000 cash. The cost of the merchandise sold was $3,800. Nov 13 Sold $25,000 merchandise to Flora, receive $12,000 in cash this day and the rest would follow Derry’s credit policy of 1/15, n/30. The cost of merchandise sold was $15,300. Dec 31 During 2019, Derry Co. offered sales of 30,000 laundry devices with one-year warranty-on-part policy. A provision was made by Derry Co., based on the management’s experience, 900 units (3%) will be defective and that warranty repair costs will average $4 per unit. Journalize this provision. Dec 31 Based on an analysis of the $92,000 of accounts receivable, it was estimated that $9,848 will be uncollectible, given the balance of the account Allowance for doubtful accounts…arrow_forward

- Assuming that a Retail Merchandise business purchased 500 numbers of HP three in one printer for OMR 40 each on 1st December 2020 under the credit terms of 5/20, n/60. On 3rd December 2020 the business discovers that 100 numbers of HP three in one Printer are HP two in one. Therefore, the business returned the goods to supplier. On 5th December 2020, the business settles full cash. Which of the following journal entry is correct on 3rd December 2020 assumes that the business uses periodic inventory system? a. Debit Accounts payable OMR 16,000 Credit Cash OMR 15,200 Credit Discount OMR 800 b. Debit Purchase OMR 20,000 Credit Accounts payable OMR 20,000 c. Debit Accounts payable OMR 4000 Credit Purchase return and allowances OMR 4000 d. Debit Accounts payable OMR 20,000 Credit Merchandise Inventory OMR 20,000arrow_forwardThe following transactions were selected from among those completed by Bennett Retallers in November and December: November 20 November 25 Sold 20 items of merchandise to Customer 8 at an invoice price of $6,400 (total); terms 2/10, n/30. Sold two items of merchandise to Customer C, who charged the $700 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 1 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,600 (total); terms 2/10, n/38. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. December 6 Customer D paid the account balance in full. December 20 Customer 8 paid in full for the invoice of November 20. November 28 November 29 Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your…arrow_forwardPlease help mearrow_forward

- Record these transactions in general journal ledger: Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. Dec 4: Accepted a sales return from Eastern for an item having an original gross sales price of $6,000. The original sale to Eastern occurred in November with terms 2/15, n/30. Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.’s terms are n/30 Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year.…arrow_forwardPresented below is information from Culver Computers Incorporated. July 1 Sold $14,100 of computers to Larkspur Company with terms 3/15, n/60. Culver uses the gross method to record cash discounts. 10 Culver received payment from Larkspur for the full amount owed from the July 1 transaction. 17 Sold $108,100 in computers and peripherals to The Clark Store with terms of 3/10, n/30. 30 The Clark Store paid Culver for its purchase of July 17. Prepare the necessary journal entries for Culver Computers. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)arrow_forwardIn providing accounting services to small businesses, you encounter the following situations. Sunland Corporation rings up cash sales and sales taxes separately on its cash register. On April 10, the register totals are pre-tax sales of sales $6,100 plus GST of $305 and PST of $488. 2. Jennifer Corporation receives its annual property tax bill in the amount of $8,400 on May 31. (i) During the month of March, Ayayai Corporation's employees earned gross salaries of $60,000. Withholdings deducted from employee earnings related to these salaries were $3,254 for CPP, $948 for El, $7,820 for income taxes. (ii) Ayayai's employer portions were $3,254 for CPP and $1,327 for El for the month. 1. 3. Prepare the journal entries to record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education