FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

During the month of September, the following transactions occurred. The applicable sales tax rate is 6%.

| Sept. 2 | Sold merchandise on account to Sam Larson, $1,400, plus sales tax. | |

| 7 | Sold merchandise on account to David Mitchell, $1,900, plus sales tax. | |

| 12 | Issued credit memorandum to Sam Larson for $689, including sales tax of $39. | |

| 22 | Sold merchandise on account to Matt Feustal, $500, plus sales tax. | |

| 28 | Sold merchandise on account to Ana Cardona, $850, plus sales tax. |

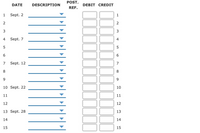

Enter the transactions in the general journal. If an amount box does not require an entry, leave it blank.

Page: 1

Transcribed Image Text:POST.

DATE

DESCRIPTION

DEBIT CREDIT

REF.

1

Sept. 2

1

3

3

4

Sept. 7

4

7

Sept. 12

7

8

8

9.

9.

10 Sept. 22

10

11

11

12

12

13 Sept. 28

13

14

14

15

15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $700 of merchandise on credit (that had cost $350) to Natara Morris. 5 Sold $6,700 of merchandise (that had cost $3,350) to customers who used their Zisa cards. 6 Sold $5,656 of merchandise (that had cost $2,828) to customers who used their Access cards. 8 Sold $4,680 of merchandise (that had cost $2,340) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $606 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required:Prepare journal…arrow_forwardi need the answer quicklyarrow_forwarddevuarrow_forward

- Excise and Sales Tax Calculations Barnes Company has just billed a customer for $1,144, an amount that includes a 10% excise tax and a 6% state sales tax. a. What amount of revenue is recorded? b. Prepare a general journal entry to record the transaction on the books of Barnes Company. Round all answers to the nearest dollar. a. Amount of recorded revenue $ 0 b. Date Dec.31 Excise Tax Payable Sales Tax Payable General Journal Description 수 $ + To record sale on account subject to excise tax and sales tax. Debit 0 $ 0 0 0 Credit 0 0 0 0arrow_forwardOn March 25, Osgood Company sold merchandise on account, $4,100, terms n/30. The applicable sales tax percentage is 7%. Journalize this transaction. If an amount box does not require an entry, leave it blank. March 25arrow_forwardMayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 4.5% service charge for sales on its credit card. Access deducts a 3.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $500 of merchandise on credit (that had cost $250) to Natara Morris. 5 Sold $6,800 of merchandise (that had cost $3,400) to customers who used their Zisa cards. 6 Sold $5,616 of merchandise (that had cost $2,808) to customers who used their Access cards. 8 Sold $4,890 of merchandise (that had cost $2,445) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $395 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required:Prepare journal…arrow_forward

- The following transactions took place at Nickle's Sports Gear during the first week of October 20X1. DATE TRANSACTIONS Oct. 1 Issued Check 3850 for $3,600 to pay the monthly rent. 1 Issued Check 3851 for 2 Issued Check 3852 for $3,200 to Fisher Company, a creditor, on account. $13,100 to purchase new equipment. 2 Issued Check 3853 for $1,520 to remit sales tax to the state sales tax authority. 3 Issued Check 3854 for $1,960 to Sports Emporium, a creditor, on account for invoice of $2,000 less cash discount of $40. 4 Issued Check 3855 for $3,925 to purchase merchandise. 6 Issued Check 3856 for $4,906 as a cash withdrawal for personal use by Nickie Martin, the owner. Indicate how these transactions would be entered in a cash payments journal. Date CK. No. Description CASH PAYMENTS JOURNAL Accounts Payable Debit Other Accounts Debit Account Name Amount Purchases Discounts Credit Cash Creditarrow_forwardon july , family company recorded merchandise inventory on account , $50,000. the sales were subject to sales tax on 5% on august 15 family company paid the sales tax owed to the state from the july 5 transaction . requirements:- (A) journalize the transaction to record the sale on july 5. ignore the cost of goods sold. (B) journalize the transaction to record the sales tax to state on august 15.arrow_forwardOn 1 August 20X5, Hans had an opening balance on the sales tax account as $6,360 credit. During the month, he makes sales gross of tax of $51,040 and purchases net of tax of $60,830. The sales tax rate is 10%. What is the balance on the sales tax account as at 1 September 20X5? A. $4,363 Dr B. $5,381 Cr C. $4,917 Cr D. $4,827 Drarrow_forward

- Sales Tax Transactions Journalize the entries to record the following selected transactions. a. Sold $5,100 of merchandise on account, subject to a sales tax of 7%. The cost of merchandise sold was $3,010. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Paid $47,320 to the state sales tax department for taxes collected.arrow_forwardKathy's Corner Store has total cash sales for the month of $34,000 excluding sales taxes. If the sales tax rate is 5%, which journal entry is needed? (Ignore Cost of Goods Sold.) A. debit Cash $35,700, credit Sales Revenue $35,700 B. debit Cash $32,300, debit Sales Tax Receivable for $1,700 and credit Sales Revenue for $34,000 C. debit Cash $34,000 and credit Sales Revenue $34,000 D. debit Cash $35,700, credit Sales Revenue $34,000 and credit Sales Tax Payable $1,700arrow_forwardMerchandise is sold for cash. The selling price of the merchandise is $6,000, and the sale is subject to a 7% state sales tax. The entry to journalize the sale would include a credit to Oa. Sales for $5,580 b. Sales Tax Payable for $420 c. Cash for $6,000 d. Sales for $6,420arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education