Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

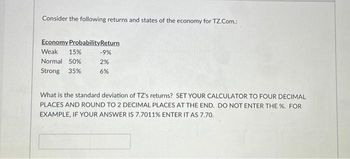

Transcribed Image Text:Consider the following returns and states of the economy for TZ.Com.:

Economy ProbabilityReturn

Weak 15%

Normal 50%

Strong 35%

-9%

2%

6%

What is the standard deviation of TZ's returns? SET YOUR CALCULATOR TO FOUR DECIMAL

PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE %. FOR

EXAMPLE, IF YOUR ANSWER IS 7.7011% ENTER IT AS 7.70.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Given the following information, calculate the expected value for Firm C's EPS. Data for Firms A and B are as follows: E(EPSA) = $5.10, and σA = $3.63; E(EPSB) = $4.20, and σB = $2.94. Do not round intermediate calculations. Round your answer to the nearest cent. Probability 0.1 0.2 0.4 0.2 0.1 Firm A: EPSA ($1.61) $1.80 $5.10 $8.40 $11.81 Firm B: EPSB (1.20) 1.30 4.20 7.10 9.60 Firm C: EPSC (2.59) 1.35 5.10 8.85 12.79 E(EPSC): $ You are given that σc = $4.12. Discuss the relative riskiness of the three firms' earnings using their respective coefficients of variation. Do not round intermediate calculations. Round your answers to two decimal places. CV A B C The most risky firm is .arrow_forwardFollowing are three economic states, their likelihoods, and the potential returns: Economic State Fast growth Slow growth Recession Probability 0.27 0.35 0.38 Standard deviation Return 32% 4 -22 Determine the standard deviation of the expected return. (Do not round intermediate calculations and round your answe decimal places.) %arrow_forwardSuppose rRF = 4%, rM = 11%, and bi = 1.5. What is ri, the required rate of return on Stock i? Round your answer to two decimal places. % 1. Now suppose rRF increases to 5%. The slope of the SML remains constant. How would this affect rM and ri? Both rM and ri will decrease by 1%. Both rM and ri will remain the same. Both rM and ri will increase by 1%. rM will remain the same and ri will increase by 1%. rM will increase by 1% and ri will remain the same.arrow_forward

- Consider the following returns and states of the economy for TZ.Com.: Economy Probability Return Weak 40% 1% Normal 50% 8% Strong 10% 39% What is the standard deviation of TZ's returns? SET YOUR CALCULATOR TO FOUR DECIMAL PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE %. FOR EXAMPLE, IF YOUR ANSWER IS 7.70% ENTER IT AS 7.70.arrow_forwardThis is a three-part question. Answer to part one is 2.4%; please help me solve for parts two and three. Thank you.arrow_forwardUse the following information on states of the economy and stock returns to calculate the expected return for Dingaling Telephone:arrow_forward

- What is the market numbers for Sharpe Ratio, Treynor Ratio, and Jensen's Alphaarrow_forwarda. Fill in the missing values in the table. (Leave no cells blank - be certain to enter O wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Security Firm A Expected Return Standard Deviation Correlation Beta 0.119 0.22 0.95 Firm B 0.131 0.41 1.50 Firm C 0.112 0.75 0.26 The market portfolio 0.12 0.19 The risk-free asset 0.05 * With the market portfolio b-1. What is the expected return of Firm A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forwardSuppose the market risk premium is 5% and the risk-free interest rate is 5%. Using the data in the table here, a. Starbucks's stock. b. Hormel's stock. c. Avis Budget Group's stock. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Hormel 0.16 Avis Budget Group 2.55 Beta Starbucks 1.05 X " calculate the expected return of investing inarrow_forward

- Suppose rRF = 6%, rM = 12%, and bi = 1.1. What is ri, the required rate of return on Stock i? Round your answer to one decimal place. % 1. Now suppose rRF increases to 7%. The slope of the SML remains constant. How would this affect rM and ri? rM will remain the same and ri will increase by 1 percentage point. rM will increase by 1 percentage point and ri will remain the same. Both rM and ri will decrease by 1 percentage point. Both rM and ri will remain the same. Both rM and ri will increase by 1 percentage point. 2. Now suppose rRF decreases to 5%. The slope of the SML remains constant. How would this affect rM and ri? rM will remain the same and ri will decrease by 1 percentage point. Both rM and ri will increase by 1 percentage point. Both rM and ri will remain the same. Both rM and ri will decrease by 1 percentage point. rM will decrease by 1 percentage point and ri will remain the same. 1. Now assume that rRF remains at 6%, but rM increases to 13%.…arrow_forwardYou are building out your 1 x 3 point and figure chart that is currently in a column of X's with the last X at $17. When you look at the high, low, close data for today you see that the high was $17.99 and the low was $14.01. The stock closed at $15.01. What do you add to the chart for today? O a. A new trend line b. You add noting to the chart c. A new column of O's to the $15 level d. A new X at $18arrow_forwardSuppose that stock market returns are normally distributed with a mean of 7% and a standard deviation of 20%. There should be about a 16% chance of getting a return less than _______%. Write your answer as a whole number: eg, -15% = -15.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education