Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Need answer please

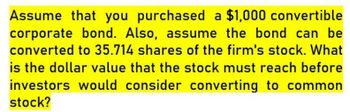

Transcribed Image Text:Assume that you purchased a $1,000 convertible

corporate bond. Also, assume the bond can be

converted to 35.714 shares of the firm's stock. What

is the dollar value that the stock must reach before

investors would consider converting to common

stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A$1,000 face value convertible bond has a conversion ratio of 31 and is about to mature. Ignoring any transaction costs, what price must the stock surpass in order for you to convert? The required price per share will be $ (Round to the nearest cent.)arrow_forwardDo fast answer of this accounting questionsarrow_forwardCurrently the common stock is selling for $13; the yield on nonconvertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock? What would be the value of each security if it lacked the conversion feature? Please Give Step by Step Answer Otherwise I give DISLIKES !!arrow_forward

- You own a convertible corporate bond that has a par value of R1000. You are considering exercising the embedded option, which has a conversion price of 106. If the firm's share price is currently 180.23, what is the conversion value of your bond?Provide your answer in Rands (R), correct to TWO decimal places. However, do not write the sign (R) only write down the value and do not leave any spaces between numbers.arrow_forwardA convertible bond can be converted into 1 share of stock. The bond is zero-coupon, i.e., it pays no interest, but matures to a value of $100 in two periods. The stock price is currently $100. In each period the stock can increase in each period by a factor of 1.4, or fall by a factor of 0.8. Each period the stock pays a dividend of 5%, at which point it can be converted. The risk-free rate is 10% and time to maturity is 2-years. Find the price at which the convertible bond can be issuedarrow_forwardCalculate the market conversion price for a convertible bond with par value of $4000, coupon rate of 5%, market price of $4000, a conversion ratio of 16, and current stock price of $202. 1. Assuming, the issuing company pays an annual dividend of $12 per share, what is the favorable income differential (yield advantage) per share for this bond? 2. Calculate the premium payback period for this bond.arrow_forward

- If the stocks are less risky than bonds, then the risk premium on stock may be zero. Assuming that the risk-free interest rate is 2 percent, the growth rate of dividends is 1 percent and the current level of dividends is $70, use the dividend-discount model to compute the level of the S&P 500 that is warranted by the fundamentals. Compare the result to the current S&P 500 level of 4300, and explain one possible reason for the difference.arrow_forward(please use Excel) Preferred stock B sells for $45 in the market and pays an annual dividend of $4.60.a) If the market required yield is 10 percent, what is the value of the stock to investors?b) Should investors buy the shares? Include reasonsarrow_forwardSuppose XYZ stock pays no dividends and has a current price of $50. The forward price for delivery in 1 year is $55. Suppose the 1-year eective annual interest rate is 10%. (a) Graph the payo and prot diagrams for a forward contract on XYZ stock with a forward price of $55. (b) Is there any advantage to investing in the stock or the forward contract? Why? (c) Suppose XYZ paid a dividend of $2 per year and everything else stayed the same. Now is there any advantage to investing in the stock or the forward contract? Why?arrow_forward

- A bond has a face value of $100 and a conversion ratio of 25. What is a good time to convert to equity for bond holders given the following stock price? A) $0.3 B) $3 C) $5 D) $4arrow_forwardQuestion A .The price of an American call on a non-dividend-paying stock is $4. The stock price is $31, the strike price is $30, and the expiration date is in 3 months. The risk-free interest rate is 8%. The upper and lower bounds for the price of an American put on the same stock with the same strike price and expiration date is $3.00 and $2.41, respectively. Explain carefully the arbitrage opportunities if the American put price is greater than the calculated upper bound. Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardConsider a convertible bond trading at $1,000 with a conversion ratio of 37.383, coupon rate of 9.5%, and par value of $1,000. If the firm's stock trades at $23 and provides an annual dividend of $0.75, what is the premium payback period? 1.81 1.99 2.23 2.09 <-000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning