FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

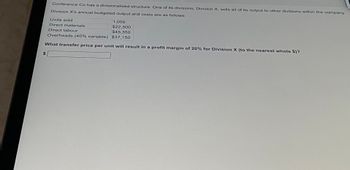

Transcribed Image Text:Conference Co has a divisionalised structure. One of its divisions, Division X, sells all of its output to other divisions within the company.

Division X's annual budgeted output and costs are as follows:

Units sold

1,050

$22,500

Direct materials

Direct labour

$45,350

Overheads (40% variable)

$37,150

What transfer price per unit will result in a profit margin of 20% for Division X (to the nearest whole $)?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide correct solutionarrow_forwardSkolnick Corporation has provided the following information: Cost per Unit Direct materials $ 5.20 Direct labor $ 4.70 Variable manufacturing overhead $ 1.80 Cost per Period Fixed manufacturing overhead $ 126,000 Sales commissions $ 1.40 Variable administrative expense $ 0.60 Cost per Period Fixed selling and administrative expense $39,600 Selling price $20.6 per unit. The value of break-even point sales is:arrow_forwardJarvis Company uses the total cost concept of applying the cost-plus approach to product pricing. The costs and expenses of producing and selling 35,000 units of Product E are as follows: Variable costs: Direct materials $3.00 Direct labor 1.25 Factory overhead 0.75 Selling and administrative expenses 3.00 Total $8.00 Fixed costs: Factory overhead $50,000 Selling and administrative expenses 20,000 Jarvis desires a profit equal to a 14% rate of return on invested assets of $450,000. a. Determine the amount of desired profit from the production and sale of Product E. $ 63,000 b. Determine the total costs and the cost amount per unit for the production and sale of 35,000 units of Product E. Total manufacturing costs 350,000 V Cost amount per unit 10 c. Determine the markup percentage for Product E. 18 V % d. Determine the selling price of Product E. Round your answer to two decimal places.arrow_forward

- The materials used by Hibiscus Company Division A are currently purchased from outside supplier at $53 per unit. Division B is able to supply Division A with 12,400 units at a variable cost of $47 per unit. The two divisions have recently negotiated a transfer price of $48 per unit for the 12,400 units. (a) By how much will each division's income increase as a result of this transfer? Enter an increase as a positive number and a decrease as a negative number. Division A $fill in the blank 1 Division B $fill in the blank 2 (b) What is the total increase in income for Hibiscus Company? $fill in the blank 3arrow_forwardCopr. Goedl Uplift, Inc. has two divisional units-Bha and Cha. Total fixed expenses fro the organization are $96,000. Data for the units is presented below: Sales Variable expenses Traceable fixed expenses $45,000 Bha $30,000 $100,000 $70,000 $24,000 Cha $90,000 $45,000 Compute the segment breakeven in sales dollars for Bha. $82,000 $70,000 $41,000 $80,000 SUBMITarrow_forwardEd Vaughn Corporation has two divisions; Outdoor Sports and Indoor Sports. The sales mix is 60% for Outdoor Sports and 40% for Indoor Sports. Vaughn incurs $2360000 in fıxed costs. The contribution margin ratio for the Outdoor Sports Division is 40%, while for the Indoor Sports Division it is 20%. What is the total contribution margin at the break-even point? O $11800000 O $2360000 O $1416000 O $944000arrow_forward

- Farrow Company reports the following annual results. Contribution Margin Income Statement Sales (420, 00 units) Variable costs Direct materials Direct labor Overhead Per Unit $ 15.00 Annual Total $ 6, 300, 000 2.00 4.00 2.50 840, 000 1,680, 000 1,050, 000 2,730, 000 Contribution margin Fixed costs Fixed overhead 6.50 2.00 840, 000 630, 000 Fixed general and administrative 1.50 Incone $ 3.00 $ 1, 260, 000 The company receives a special offer for 42,000 units at $12 per unit. The additional sales would not affect its normal sales. Variable costs per unit would be the same for the special offer as they are for the normal units. The special offer would require incremental fixed overhead of $168,000 and incremental fixed general and administrative costs of $181,000. (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? ces Complete this question by entering your answers in the tabs below. Required A Required B Compute the income or…arrow_forwardBarrington Box Enterprises has two divisions, large and small, that share the common costs of the company's communications network. The annual common costs are $4,800,000. You have been provided with the following information for the upcoming year: Large Small Calls 150,000 90,000 The cost accountant determined $2,760,000 of the communication network's costs were fixed and should be allocated based on the number of calls. The remaining costs should be allocated based on the time on the network. What is the total communication network costs allocated to the Large Box Division, assuming the company uses dual-rates to allocate common costs? Multiple Choice $2,760,000 $2,259,000 $2,541,000 Time on Network (hours) 160,000 240,000 $1,640,000arrow_forwardThe machining division of Cullumber International has a capacity of 2,000 units. Its sales and cost data are: Selling price per unit $80 Variable manufacturing costs per unit 25 Variable selling costs per unit 3 Total fixed manufacturing overhead 183,200 The machining division is currently selling 1,800 units to outside customers, and the assembly division of Cullumber International wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be $0/unit, and not $3/unit. If Cullumber's assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? The company profits would by $arrow_forward

- Kubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Amount per Unit $ 7.60 $ 4.60 $ 2.10 $ 5.60 $ 4.10 $ 3.10 $ 1.60 $ 1.10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required: 1. If 15,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 19,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 15,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 19,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 15,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 19,000 units are produced,…arrow_forwardKesterson Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Multiple Choice ( $15.15 Variable administrative expense Fixed selling and administrative expense The incremental manufacturing cost that the company will incur if it increases production from 10,000 to 10,001 units is closest to: $16.45 Cost per Unit $6.70 $ 3.30 $ 1.65 $13.95 $ 1.20 $ 0.80 Cost per Period $ 23,000 $ 5,000 Helarrow_forwardIndigo Chance Co. sells computers and video game systems. The business is divided into two divisions along product lines. Variable costing income statements for the current year are presented below: Computers VG Systems Total Sales $720,000 $480,000 $1,200,000 Variable costs 504,000 384,000 888,000 Contribution margin $216,000 $96,000 312,000 Fixed costs 255,060 Net income $56,940 (a) Determine the sales mix and contribution margin ratio for each division. Sales mix Computers VG Systemsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education