FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

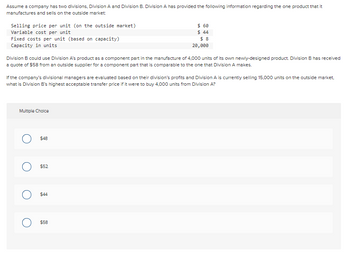

Transcribed Image Text:Assume a company has two divisions, Division A and Division B. Division A has provided the following information regarding the one product that it

manufactures and sells on the outside market:

Selling price per unit (on the outside market)

Variable cost per unit

Fixed costs per unit (based on capacity)

Capacity in units

Division B could use Division A's product as a component part in the manufacture of 4,000 units of its own newly-designed product. Division B has received

a quote of $58 from an outside supplier for a component part that is comparable to the one that Division A makes.

If the company's divisional managers are evaluated based on their division's profits and Division A is currently selling 15,000 units on the outside market.

what is Division B's highest acceptable transfer price if it were to buy 4,000 units from Division A?

Multiple Choice

$48

$52

$ 60

$ 44

$8

20,000

O $44

$58

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Merlot Manufacturing Ltd makes three different products, the details of which are as follows: Product (code name) 167X 325Y 7422 Selling price per unit (£) 40 30 28 Variable cost per unit (£) 15 18 14 Weekly demand (units) 45 50 20 Skilled labour time per unit (hours) 3. Skilled labour time is limited to 200 hours a week. Which combination of products should be manufactured if the business is to produce the highest profit? Show your answer by filling out the table below. (Round up units of product 167X units of product 325Y units of product 742Z Enter any number or expression in each of the edit fields. 26arrow_forwardFoc Give me correct answer with explanation.arrow_forwardJarvis Company uses the total cost concept of applying the cost-plus approach to product pricing. The costs and expenses of producing and selling 35,000 units of Product E are as follows: Variable costs: Direct materials $3.00 Direct labor 1.25 Factory overhead 0.75 Selling and administrative expenses 3.00 Total $8.00 Fixed costs: Factory overhead $50,000 Selling and administrative expenses 20,000 Jarvis desires a profit equal to a 14% rate of return on invested assets of $450,000. a. Determine the amount of desired profit from the production and sale of Product E. $ 63,000 b. Determine the total costs and the cost amount per unit for the production and sale of 35,000 units of Product E. Total manufacturing costs 350,000 V Cost amount per unit 10 c. Determine the markup percentage for Product E. 18 V % d. Determine the selling price of Product E. Round your answer to two decimal places.arrow_forward

- Curiumber Enterprises is considering manufacturing a new product. It projects the cost of direct materials and rent for a range or output as follows. Output in Units 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Rent Cost 11.000 $5,290 5,290 8,464 8,464 8,464 8,464. 8,464 8.464 10.580 10,000 10,580 10.580 Direct Materials $4,200 7,200 7,200 9,600. 12,000 14,400 16.800 19,200 30.999 37,030 46.552arrow_forwardPT Agile Box produces products 1,2 and 3 from one combined product process. Information relating to the allocation of combined production costs is as follows Production Product Points / Market / unit Volume Units price 1.200 unit 3 200.000 600 unit 250.000 3 500 unit 4 350.000 Total 2.300 unit Based on this data, you allocate a joint production cost of IDR 345,000,000 to each product and calculate the cost / unit of each product if PT DZAKI uses the following alternatives: a. Average unit method b. Weighted average method (based on points /units) 2. 1, 2.arrow_forwardLindstrom Company produces two fountain pen models. Information about its products follows: Product A Product B Sales revenue Less: Variable costs Contribution margin Total units sold Lindstrom's fixed costs total $86,500. Required: $ 76,600 41,400 $ 46,000 5,000 $ 123,400 52,800 $ 91,000 5,000 1. Determine Lindstrom's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Lindstrom's break-even point in units and in sales revenue. 3. Calculate the number of units that Lindstrom must sell to earn a $150,000 profit. 4. Calculate Lindstrom's margin of safety (in units and sales dollars) and margin of safety as a percentage of sales based on the sales data provided in the table above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the number of units that Lindstrom must sell to earn a $150,000 profit. Note: Do not round your intermediate calculations. Round your answer…arrow_forward

- The machining division of Cullumber International has a capacity of 2,000 units. Its sales and cost data are: Selling price per unit $80 Variable manufacturing costs per unit 25 Variable selling costs per unit 3 Total fixed manufacturing overhead 183,200 The machining division is currently selling 1,800 units to outside customers, and the assembly division of Cullumber International wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be $0/unit, and not $3/unit. If Cullumber's assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? The company profits would by $arrow_forwardanswer in text form please (without image)arrow_forwardSubject: acountingarrow_forward

- Division X of Bella Corporation sells Part A to other companies for $87.20 per unit. According to the company's accounting system, the costs to Division X to make a unit of Part A are: O $87.20 per unit O $62.60 per unit O $58.10 per unit O $79.95 per unit O None of the above Direct materials Direct labor $5.80 Variable Division Y of Bella Corporation uses a part much like Part A in one of its products. Division Y can buy this part from an outside supplier for $79.95 per unit. However, Division Y could use Part A instead of the part it purchases from the outside supplier. What is the most Division Y would be willing to pay the Division X for Part A? Question 21 $42.70 manufacturing $9.60 overhead Fixed manufacturing $4.50 overheadarrow_forwardSmart Stream Inc. uses the total cost concept of applying the cost-plus approach to product pricing. The costs of producing and selling 8,000 units of cellular phones are as follows: Variable costs: Fixed costs: Direct materials $ 87 per unit Factory overhead $349,300 Direct labor 40 Selling and admin. exp. 122,700 Factory overhead 26 Selling and admin. exp. 21arrow_forwardFUT manufactures two products.. Both products require manufacturing operations in two departments: Product 1 2 Profit/Unit $25 $20 Labour Hours Dept. A 6 8 Labour Hours Dept. B 12 10 For the coming production period, FUT has available 900 hours of labor that can be allocated to either of the two departments. Find the production plan and labor allocation (hours assigned in each department) that will maximize profit. (Use Excel Solver)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education