FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

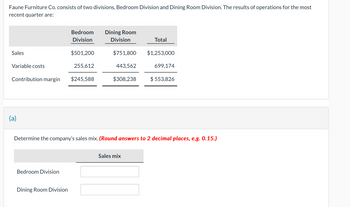

Transcribed Image Text:Faune Furniture Co. consists of two divisions, Bedroom Division and Dining Room Division. The results of operations for the most

recent quarter are:

Bedroom

Division

Dining Room

Division

Total

Sales

$501,200

$751,800 $1,253,000

Variable costs

255,612

443,562

699,174

Contribution margin $245,588

$308,238

$553,826

(a)

Determine the company's sales mix. (Round answers to 2 decimal places, e.g. 0.15.)

Bedroom Division

Dining Room Division

Sales mix

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fernstrom Corporation has two divisions: East and West. Data from the most recent month appear below: Sales. Variable expenses Traceable fixed expenses Multiple Choice The company's common fixed expenses total $52,140. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income? $0 East $330,000 $132,000 $140,000 ($235,140) West $144,000 $ 76,320 $ 43,000arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,360,000 1,375,000 2,985,000 2,220,000 $ 765,000 Department Hardware $ 3,160,000 962,000 2,198,000 1,320,000 $ 878,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Linens $ 1,200,000 413,000 787,000 900,000 $ (113,000) A study indicates that $371,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the sales of the Hardware Department.arrow_forwardCrane Trivia Co. manufactures and sells two trivia products, the Square Trivia Game and the Round Trivia Game. Last quarter's operating profits, by product, and for the company as a whole, were as follows: Square Round Total Sales revenue $11,000 $6,860 $17,860 Variable expenses 5,000 2,910 7,910 Contribution margin 6,000 3,950 9,950 Fixed expenses 2,750 4,200 6,950 Operating income $ 3,250 $(250) $ 3,000 Forty percent of the Round Game's fixed costs could have been avoided if the game had not been produced or sold. If the Round Game had been discontinued before the last quarter, what would operating income have been for the company as a whole? Operating income without round $arrow_forward

- A company, has two departments—Hardware and Linens. The company’s most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $ 4,070,000 $ 3,000,000 $ 1,070,000 Variable expenses 1,350,000 950,000 400,000 Contribution margin 2,720,000 2,050,000 670,000 Fixed expenses 2,320,000 1,470,000 850,000 Net operating income (loss) $ 400,000 $ 580,000 $ (180,000) A study indicates $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 20% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department?arrow_forwardBuckley Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. BUCKLEY COMPANY Income Statements for Year 2 Segment A B C Sales $ 330,000 $ 480,000 $ 500,000 Cost of goods sold (242,000 ) (184,000 ) (190,000 ) Sales commissions (30,000 ) (44,000 ) (44,000 ) Contribution margin 58,000 252,000 266,000 General fixed operating expenses (allocation of president’s salary) (92,000 ) (92,000 ) (92,000 ) Advertising expense (specific to individual divisions) (6,000 ) (20,000 ) 0 Net income (loss) $ (40,000 ) $ 140,000 $ 174,000 Required Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Options for required A table are: Advertising…arrow_forwardGough Corporation has two divisions. Domestic and Foreign. Data from the most recent month appears below: 6. Total Company $668,000 Domestic Foreign $321,000 147,660 173,340 134,000 $ 39,340 Sales... Variable expenses. Contribution margin. Traceable fixed expenses. 220,530 447,470 335,000 112,470 $347,000 72,870 274,130 201,000 $ 73,130 Segment margin.. Common fixed expenses.. 73,480 $ 38,990 Net operating income.. The break-even in sales dollars for the company as a whole is closest to: A. $502,579 B. $107,216 C. $436,424 D. $609,794arrow_forward

- Caldwell Supply, a wholesaler, has determined that its operations have three primary activities: purchasing, warehousing, and distributing. The firm reports the following operating data for the year just completed: Cost Driver Number of purchase orders Number of moves Distributing Number of shipments Activity Purchasing Warehousing Quantity of Cost Driver 1,200 8,900 700 Cost per Unit of Cost Driver $170 per order 39 per move 100 per shipment Caldwell buys 102,000 units at an average unit cost of $19 and sells them at an average unit price of $29. The firm also has fixed operating costs of $252,000 for the year. Maximum cost Caldwell's customers are demanding a 19% discount for the coming year. The company expects to sell the same amount if the demand for price reduction can be met. Caldwell's suppliers, however, are willing to give only a 13% discount. Required: Caldwell has estimated that it can reduce the number of purchase orders to 880 and can decrease the cost of each shipment by…arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,130,000 1,223,000 2,907,000 2,160,000 $ 747,000 Department Hardware $ 3,060,000 814,000 2,246,000 1,310,000 $936,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) Linens $ 1,070,000 409,000 661,000 850,000 $ (189,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 18% decrease in the sales of the Hardware Department.arrow_forwardsolve this Question as per fast to posiblearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education