Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Answer do fast and step by step calculation with explanation for the general accounting

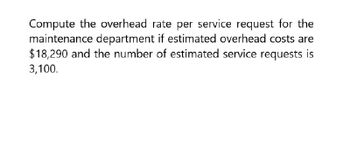

Transcribed Image Text:Compute the overhead rate per service request for the

maintenance department if estimated overhead costs are

$18,290 and the number of estimated service requests is

3,100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Meed Company estimates the company will incur $65,000 in overhead costs and 5,000 direct labor hours during the year. Actual direct labor hours were 4,550. Calculate the predetermined overhead allocation rate using direct labor hours as the allocation base, and prepare the journal entry for the allocation of overhead. Calculate the predetermined overhead allocation rate. Fill in the labels and complete the formula below. Predetermined overhead ÷ = allocation rate ÷ = per direct labor hour Prepare the journal entry for the allocation of overhead. First, select the formula to calculate the overhead costs allocated. Fill in the labels and complete the formula below. × = Allocated overhead costs × = Prepare the journal entry for the allocation of overhead. Date Accounts and Explanation Debit Creditarrow_forwardMill Company estimates the company will incur $82,800 in overhead costs and 4,600 direct labor hours during the year. Actual direct labor hours were 4,850. Calculate the predetermined overhead allocation rate using direct labor hours as the allocation base, and prepare the journal entry for the allocation of overhead.arrow_forwardDaud Company has an overhead application rate of 172% and allocates overhead based on direct material cost. During the current period, direct labor cost is $59,000 and direct materials used cost is $97,000. Determine the amount of overhead Daud Company should record in the current period. What's final answerarrow_forward

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardA company has the following information relating to its production costs: Compute the actual and applied overhead using the companys predetermined overhead rate of $23.92 per machine hour. Was the overhead over applied or under applied, and by how much?arrow_forward

- Steeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardA company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- 1. Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service department. A. Using employee headcount as the allocation base. B. Using occupied space as the allocation base. C. Using productive capacity as the allocation base. D. Using the 3-year average use as the allocation base.arrow_forwardFor the current year BSJ Industries estimated overhead would be $2,145,000 and there would be 78,000 machine hours. Using machines hours as the allocation base, how much overhead would be assigned to each of the jobs listed below? (Do not round intermediate calculations.) Job Machine Hours 246 6,700 247 4,750arrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College