SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

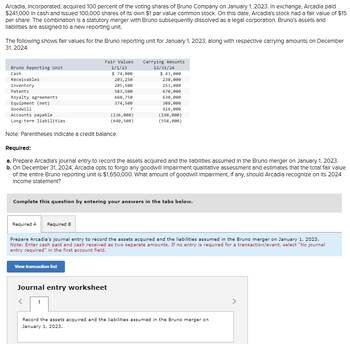

Transcribed Image Text:Arcadia, Incorporated, acquired 100 percent of the voting shares of Bruno Company on January 1, 2023. In exchange, Arcadia pald

$241,000 in cash and Issued 100,000 shares of its own $1 par value common stock. On this date, Arcadia's stock had a fair value of $15

per share. The combination is a statutory merger with Bruno subsequently dissolved as a legal corporation. Bruno's assets and

liabilities are assigned to a new reporting unit.

The following shows fair values for the Bruno reporting unit for January 1, 2023, along with respective carrying amounts on December

31, 2024.

Bruno Reporting Unit

Cash

Receivables

Inventory

Patents

Royalty agreements

Equipment (net)

Goodwill

Accounts payable

Long-term liabilities

Fair Values

1/1/23

$ 74,000

Carrying Amounts

12/31/24

$ 43,000

203,250

238,000

205,500

253,000

583,500

670,000

660,750

630,000

374,500

308,000

?

416,000

(136,000)

(640,500)

(198,000)

(558,000)

Note: Parentheses indicate a credit balance.

Required:

a. Prepare Arcadia's journal entry to record the assets acquired and the liabilities assumed in the Bruno merger on January 1, 2023.

b. On December 31, 2024, Arcadia opts to forgo any goodwill impairment qualitative assessment and estimates that the total fair value

of the entire Bruno reporting unit is $1,650,000. What amount of goodwill Impairment, if any, should Arcadia recognize on its 2024

Income statement?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare Arcadia's journal entry to record the assets acquired and the liabilities assumed in the Bruno merger on January 1, 2023.

Note: Enter cash paid and cash received as two separate amounts. If no entry is required for a transaction/event, select "No journal

entry required" in the first account field.

View transaction list

Journal entry worksheet

<

1

Record the assets acquired and the liabilities assumed in the Bruno merger on

January 1, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Arcadia, Incorporated, acquired 100 percent of the voting shares of Bruno Company on January 1, 2023. In exchange, Arcadia paid $324,250 in cash and issued 100,000 shares of its own $1 par value common stock. On this date, Arcadia's stock had a fair value of $15 per share. The combination is a statutory merger with Bruno subsequently dissolved as a legal corporation. Bruno's assets and liabilities are assigned to a new reporting unit. The following shows fair values for the Bruno reporting unit for January 1, 2023, along with respective carrying amounts on December 31, 2024. Bruno Reporting Unit Cash Receivables Inventory Patents Royalty agreements Equipment (net) Goodwill Accounts payable Long-term liabilities Fair Values 1/1/23 $ 90,500 Carrying Amounts 12/31/24 $ 48,500 210,250 243,500 219,500 258,500 390,500 501,500 681,500 658,000 386,000 289,000 ? 556,000 (178,000) (532,000) (246,000) (448,000) Note: Parentheses indicate a credit balance. Required: a. Prepare Arcadia's journal…arrow_forwardArcadia, Incorporated, acquired 100 percent of the voting shares of Bruno Company on January 1, 2023. In exchange, Arcadia paid $241,000 in cash and issued 100,000 shares of its own $1 par value common stock. On this date, Arcadia's stock had a fair value of $15 per share. The combination is a statutory merger with Bruno subsequently dissolved as a legal corporation. Bruno’s assets and liabilities are assigned to a new reporting unit. The following shows fair values for the Bruno reporting unit for January 1, 2023, along with respective carrying amounts on December 31, 2024. Bruno Reporting Unit Fair Values 1/1/23 Carrying Amounts 12/31/24 Cash $ 74,000 $ 43,000 Receivables 203,250 238,000 Inventory 205,500 253,000 Patents 583,500 670,000 Royalty agreements 660,750 630,000 Equipment (net) 374,500 308,000 Goodwill ? 416,000 Accounts payable (136,000) (198,000) Long-term liabilities (640,500) (558,000) Note: Parentheses indicate a credit balance. Required: a.…arrow_forwardManjiarrow_forward

- Arcadia, Incorporated, acquired 100 percent of the voting shares of Bruno Company on January 1, 2023. In exchange, Arca $461,000 in cash and issued 100,000 shares of its own $1 par value common stock. On this date, Arcadia's stock had a fair per share. The combination is a statutory merger with Bruno subsequently dissolved as a legal corporation. Bruno's assets liabilities are assigned to a new reporting unit. The following shows fair values for the Bruno reporting unit for January 1, 2023, along with respective carrying amounts or 31, 2024. Bruno Reporting Unit Cash Receivables Inventory Patents Royalty agreements. Equipment (net) Goodwill Accounts payable Long-term liabilities Note: Parentheses indicate a credit balance. Fair Values 1/1/23 $ 89,000 189,750 218,750 776,500 586,000 355,000 ? (114,500) (591,500) Required: a. Calculate the goodwill recognized in the combination. Carrying Amounts $ 48,000 243,000 12/31/24 258,000 860,000 546,000 269,000 452,000 (184,000) (518,000)arrow_forwardAlfonso Inc. acquired 100 percent of the voting shares of BelAire Company on January 1, 2020. In exchange, Alfonso paid $326,750 in cash and issued 100,000 shares of its own $1 par value common stock. On this date, Alfonso’s stock had a fair value of $15 per share. The combination is a statutory merger with BelAire subsequently dissolved as a legal corporation. BelAire’s assets and liabilities are assigned to a new reporting unit. The following shows fair values for the BelAire reporting unit for January 1, 2020 along with respective carrying amounts on December 31, 2021. BelAire Reporting Unit Fair Values1/1/20 Carrying Amounts12/31/21 Cash $ 99,500 $ 51,500 Receivables 196,000 246,500 Inventory 215,000 261,500 Patents 731,000 840,500 Customer relationships 617,250 590,000 Equipment (net) 322,500 241,000 Goodwill ? 436,000 Accounts payable (176,000 ) (256,000 ) Long-term liabilities (614,500 )…arrow_forwardAlfonso Inc. acquired 100 percent of the voting shares of BelAire Company on January 1, 2020. In exchange, Alfonso paid $263,500 in cash and issued 100,000 shares of its own $1 par value common stock. On this date, Alfonso's stock had a fair value of $15 per share. The combination is a statutory merger with BelAire subsequently dissolved as a legal corporation. BelAire's assets and liabilities are assigned to a new reporting unit. The following shows fair values for the BelAire reporting unit for January 1, 2020 along with respective carrying amounts on December 31, 2021. BelAire Reporting Unit Cash Receivables Inventory Patents Customer relationships Equipment (net) Goodwill Accounts payable Long-term liabilities Note: Parentheses indicate credit balance. Fair Values 1/1/20 68,000 182,500 219,000 $ 371,500 603,500 404,500 ? (123,500) (524,000) Carrying Amounts $ 12/31/21 41,000 236,000 251,000 467,000 574,000 339,000 562,000 (188,000) (452,000) a. Prepare Alfonso's journal entry to…arrow_forward

- Alfonso Inc. acquired 100 percent of the voting shares of BelAire Company on January 1, 2020. In exchange, Alfonso paid $461,000 in cash and issued 100,000 shares of its own $1 par value common stock. On this date, Alfonso's stock had a fair value of $15 per share. The combination is a statutory merger with BelAire subsequently dissolved as a legal corporation. BelAire's assets and liabilities are assigned to a new reporting unit. The following shows fair values for the BelAire reporting unit for January 1, 2020 along with respective carrying amounts on December 31, 2021. TT Fair Values 1/1/20 $ Carrying Amounts BelAire Reporting Unit Cash 12/31/21 $ 89,000 189,750 218,750 776, 500 586,000 355,000 48,000 243,000 258,000 860,000 546,000 269,000 452,000 (184,000) (518,000) Receivables Inventory Patents Customer relationships Equipment (net) Goodwill Accounts payable Long-term liabilities (114,500) (591,500) Note: Parentheses indicate a credit balance. a. Prepare Alfonso's journal entry…arrow_forwardFrancisco Inc. acquired 100 percent of the voting shares of Beltran Company on January 1, 2017. In exchange, Francisco paid $450,000 in cash and issued 104,000 shares of its own $1 par value common stock. On this date, Francisco’s stock had a fair value of $12 per share. The combination is a statutory merger with Beltran subsequently dissolved as a legal corporation. Beltran’s assets and liabilities are assigned to a new reporting unit.The following reports the fair values for the Beltran reporting unit for January 1, 2017, and December 31, 2018, along with their respective book values on December 31, 2018.a. Prepare Francisco’s journal entry to record the assets acquired and the liabilities assumed in the Beltran merger on January 1, 2017.b. On December 31, 2018, Francisco opts to forgo any goodwill impairment qualitative assessment and estimates that the total fair value of the entire Beltran reporting unit is $1,425,000. What amount of goodwill impairment, if any, should Francisco…arrow_forwardPlease help me to solve this problemarrow_forward

- Allison Corporation acquired all of the outstanding voting stock of Mathias, Incorporated, on January 1, 2023, in exchange for $5,936,500 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends. At the acquisition date, Mathias's stockholders' equity was $2,015,000 including retained earnings of $1,515,000. At the acquisition date, Allison prepared the following fair-value allocation schedule for its newly acquired subsidiary: Consideration transferred Mathias stockholders' equity Excess fair over book value to unpatented technology (8-year remaining life) $ 5,936,500 2,015,000 $ 3,921,500 to patents (10-year remaining life) to increase long-term debt (undervalued, 5-year remaining life) Goodwill $ 824,000 2,530,000 (115,000) 3,239,000 $ 682,500 Postacquisition, Allison employs the equity method to account for its investment in Mathias. During the two years following the business combination, Mathias reports the…arrow_forwardAllison Corporation acquired all of the outstanding voting stock of Mathias, Incorporated, on January 1, 2023, in exchange for $6,203,000 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends. At the acquisition date, Mathias’s stockholders’ equity was $2,080,000 including retained earnings of $1,580,000. At the acquisition date, Allison prepared the following fair-value allocation schedule for its newly acquired subsidiary: Consideration transferred $ 6,203,000Mathias stockholders' equity 2,080,000Excess fair over book value $ 4,123,000to unpatented technology (8-year remaining life) $ 928,000 to patents (10-year remaining life) 2,660,000 to increase long-term debt (undervalued, 5-year remaining life) (180,000) 3,408,000Goodwill $ 715,000Postacquisition, Allison employs the equity method to account for its investment in Mathias. During the two years following the…arrow_forwardAllison Corporation acquired all of the outstanding voting stock of Mathias, Incorporated, on January 1, 2023, in exchange for $6,059,500 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends. At the acquisition date, Mathias’s stockholders’ equity was $2,045,000 including retained earnings of $1,545,000. At the acquisition date, Allison prepared the following fair-value allocation schedule for its newly acquired subsidiary: Consideration transferred $ 6,059,500 Mathias stockholders' equity 2,045,000 Excess fair over book value $ 4,014,500 to unpatented technology (8-year remaining life) $ 872,000 to patents (10-year remaining life) 2,590,000 to increase long-term debt (undervalued, 5-year remaining life) (145,000) 3,317,000 Goodwill $ 697,500 Postacquisition, Allison employs the equity method to account for its investment in Mathias. During the two years following the business…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning