FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

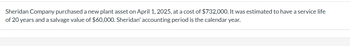

Transcribed Image Text:Sheridan Company purchased a new plant asset on April 1, 2025, at a cost of $732,000. It was estimated to have a service life

of 20 years and a salvage value of $60,000. Sheridan' accounting period is the calendar year.

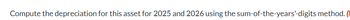

Transcribed Image Text:Compute the depreciation for this asset for 2025 and 2026 using the sum-of-the-years'-digits method. (

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Joseph Geary, the controller of Carla Vista Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2022. Here are his findings: Useful Life (in Years) Salvage Value Accumulated Depreciation, Old Type of Asset Old Date Acquired Proposed Proposed Cost Jan. 1, 2022 Building Jan. 1, 2014 $2,717,000 $536,600 40 50 $124,000 $93,000 ● Warehouse Jan. 1, 2017 256,000 64,000 25 20 19,000 15,000 All assets are depreciated by the straight-line method. Carla Vista Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Joseph's proposed changes. (The "Proposed" useful life is total life, not remaining life.)arrow_forwardVisit www.sec.gov/edgar and search for the BJ's Wholesale annual report (10-K) for the year ended February 1, 2020, using EDGAR (Electronic Data Gathering, Analysis, and Retrieval system). Search or scroll within the annual report to find the balance sheet, labeled "Consolidated Balance Sheets." Required: 1. Find the amounts reported for accumulated depreciation for the period ended February 1, 2020, and February 2, 2019. Assuming no depreciable assets were sold during the year, determine the adjustment for BJ's depreciation for the year and compute the adjusted balances of the related accounts. 2. For simplicity, assume the entire amount reported for "Prepaid expenses and other current assets" represents the balance of the Supplies account. If the year-end balance of the Supplies account prior to any adjustment is $200,000 (in thousands), determine the adjustment that was made to Supplies (and Supplies Expense) at the end of the current year and compute the adjusted balances of the…arrow_forwardDetermine the Depreciation Expense for the calendar year 2019 on the following non - current assets of ABC Company based on straight line method of depreciation: Acquisition Salvage Est. Asset Cost Depreciation Date Value Life Computer Jun 01, 2019 P70,000 P10,000 4 ||arrow_forward

- Which of the following will cause a difference in book depreciation and federal depreciation? Choosing to depreciate a class of property using straight-line on the federal return and straight-line on the books. Depreciating property with a useful life of less than one year. Electing to take a Section 179 deduction on eligible property. Placing property in service mid-year.arrow_forwardDepreciation expense for 2020arrow_forwardBroad Ltd. decided on July 1, 2023 to dispose of an asset group consisting of land and a building. An active plan of disposal is being carried out, and sale is highly probable within the following year. The assets carrying values and estimated recoverable amounts at July 1.2023 are as follows: Land Building Cost $ 600 Carrying Value Estimated Recoverable Amount $ 600 $ 1,000 3,700 $4,300 2.500 2.400 $3.100 $3.400 On December 1, 2023, the asset group sold for $3,380, net of costs to sell. Required: Prepare journal entries that are appropriate to record the information above.arrow_forward

- What is the return on total assets given the figures attached?arrow_forwardwhat is the definition of this method of depreciation: Sum of years digits?arrow_forwardBlossom Computer Company sold two pieces of equipment in 2028. The following information pertains to the two pieces of equipment: Machine #1 #2 Cost $68,800 $76,000 Purchase Useful Salvage Date Life Value 7/1/24 1/1/27 5 yrs. 5 yrs. $4,800 $4,000 Depreciation Method Straight-line Date Sold 7/1/28 Double-declining-balance 12/31/281 Sales Price $16,000 $29,600arrow_forward

- Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following data are used for equipment purchased on January 1, 2020. Cost and residual value Estimated service life: Acquisition cost $26,250 Years 5 Residual value $1,050 Service hours 21,000 Productive output (units) 50,400 e. Double-declining-balance method: Compute the depreciation amount for each year. 2020 2021 2022 2023 2024 Answer Answer Answer Answer Answerarrow_forwardPlease not that the accumulated Depriciation for 2020 using both methods does not agree to my opening depreciation Opening depreciation according to TB = 3,451,709 Depreciation at 2020 RBal Meth = 1,770,854 Depreciation at 2020 UPro Meth=1,864,865 both = 3,635,719 There is a difference of 184,010arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education