FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

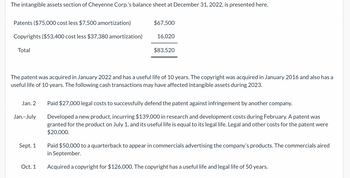

Transcribed Image Text:The intangible assets section of Cheyenne Corp.'s balance sheet at December 31, 2022, is presented here.

Patents ($75,000 cost less $7,500 amortization)

$67,500

Copyrights ($53,400 cost less $37,380 amortization)

16,020

Total

$83,520

The patent was acquired in January 2022 and has a useful life of 10 years. The copyright was acquired in January 2016 and also has a

useful life of 10 years. The following cash transactions may have affected intangible assets during 2023.

Jan. 2

Paid $27,000 legal costs to successfully defend the patent against infringement by another company.

Jan.-July

Sept. 1

Oct. 1

Developed a new product, incurring $139,000 in research and development costs during February. A patent was

granted for the product on July 1, and its useful life is equal to its legal life. Legal and other costs for the patent were

$20,000.

Paid $50,000 to a quarterback to appear in commercials advertising the company's products. The commercials aired

in September.

Acquired a copyright for $126,000. The copyright has a useful life and legal life of 50 years.

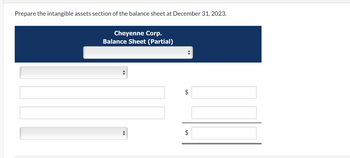

Transcribed Image Text:Prepare the intangible assets section of the balance sheet at December 31, 2023.

Cheyenne Corp.

Balance Sheet (Partial)

$

+A

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardIn January 1, 2015, Fun company purchased Company A for $40,000 in cash and paid immediately. Fun company assumed all of Company A's assets and assumed Company A's liabilities. company A has assets valued at $60,000 and liabilities valued at $50,000. question: what is the amount of GOODWILL that should be recorded on Fun company's books? provide the journal entry for the acquisition of company A. Make sure to include account classifications and label debits and credits. please show work so I can understand. Thanks!arrow_forwardRequired information [The following information applies to the questions displayed below] On October 1, 2024, the Allegheny Corporation purchased equipment for $299,000. The estimated service life of the equipment is 10 years and the estimated residual value is $2,000. The equipment is expected to produce 540,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. 1. Straight-line. Formula Amounts Year 2024 2025 Choose Numerator: Annual Depreciation Straight-Line Depreciation Choose Denominator: Fraction of Year B M Annual Depreciation Annual Depreciation Depreciation expensearrow_forward

- Sh9arrow_forwardPlease solved the subparts Thank you Tableleaf Inc. purchased a patent a number of years ago. The patent is being amortized on a straight-line basis over its estimated useful life. The company’s comparative balance sheets as of December 31, 2017 and 2016, included the following line item: 12/31/17 12/31/16 Patent, less accumulated amortization of$119,000 (2017) and $102,000 (2016) $170,000 $187,000 Required: 1. How much amortization expense was recorded during 2017?$fill in the blank 1 2. What was the patent's acquisition cost?$fill in the blank 2 In what year was it acquired?2011 What is its estimated useful life?fill in the blank 4 years How was the acquisition of the patent reported on that year's statement of cash flows? 3. Assume that Tableleaf uses the indirect method to prepare its statement of cash flows. How is the amortization of the patent reported annually on the statement of cash flows? Assuming the indirect method is used, the amortization expense relating…arrow_forward1.How much is the carrying amount of property, plant and equipment as of December 31, 2020?a. P435,160 c. P763,440b. P729,840 d. P860,400arrow_forward

- Required information [The following information applies to the questions displayed below.] Hero Sandwich Shop had the following long-term asset balances as of January 1, 2024: Land Building Equipment Patent Cost $86,000 451,000 227,900 205,000 Accumulated Depreciation Book Value $86,000 288,640 179,700 123,000 • Hero purchased all the assets at the beginning of 2022. • The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual Land Building Equipment Patent 0 value. • The equipment is depreciated over a 9-year service life using the straight-line method with an estimated residual value of $11,000. HERO SANDWICH SHOP December 31, 2024 $(162,360) (48,200) (82,000) • The patent is estimated to have a five-year useful life with no residual value and is amortized using the straight-line method. • Depreciation and amortization have been recorded for 2022 and 2023 (first two years). 3. Calculate the book value for each of the…arrow_forwardIntangibles: Balance Sheet Presentation and Income Statement Effects Clinton Company has provided information on intangible assets as follows: A patent was purchased from Lou Company for $1,680,000 on January 1, 2018. Clinton estimated the remaining useful life of the patent to be 10 years. The patent was carried in Lou's accounting records at a net book value of $1,440,000 when Lou sold it to Clinton. During 2019, a franchise was purchased from Rink Company for $500,000. In addition, 6% of revenue from the franchise must be paid to Rink. Revenue from the franchise for 2019 was $1,800,000. Clinton estimates the useful life of the franchise to be 10 years and takes a full year's amortization in the year of purchase. Clinton incurred R&D costs in 2019 as follows: Materials and equipment $125,000 Personnel 162,000 Indirect costs 78,000 $365,000 Clinton estimates that these costs will be recouped by December 31, 2020. On January 1, 2019, Clinton estimates, based on new…arrow_forwardRequired information [The following information applies to the questions displayed below.] On January 1, 2024, the Allegheny Corporation purchased equipment for $162,000. The estimated service life of the equipment is 10 years and the estimated residual value is $8,000. The equipment is expected to produce 350,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. 2. Double-declining-balance. Formula Amount for 2024 Amount for 2025 Double-Declining-Balance Method X X X = Depreciation Expense % = % =arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Stevens Sandwich Shop had the following long-term asset balances as of January 1, 2024: Land Building Equipment Patent Cost $82,000 Accumulated Depreciation Book Value 0 $82,000 447,000 226,300 185,000 $(160,920) 286,080 (47,400) 178,900 (74,000) 111,000 • Stevens purchased all the assets at the beginning of 2022. • The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. • The equipment is depreciated over a 9-year service life using the straight-line method with an estimated residual value of $13,000. • The patent is estimated to have a five-year useful life with no residual value and is amortized using the straight-line method. • Depreciation and amortization have been recorded for 2022 and 2023 (first two years).arrow_forwardDetermining Carrying Value and Amortization of Intangible Assets Review the following information pertaining to Denzel Company. 1. A patent was purchased on January 2 of Year 1 for $104,000 when the remaining legal life was 16 years. On January 2 of Year 3, Denzel determined that the remaining useful life of the patent was only eight years from the date of its acquisition. 2. On January 1 of Year 3, Denzel Company purchased a second patent for $128,000 cash. At January 1 of Year 3, a total of 6 years of the patent's legal life of 20 years had expired. 3. On June 30 of Year 3, Denzel Company paid a firm $12,800 for a new trademark. Denzel considers the life of the trademark to be indefinite. 4. On November 1 of Year 3, Denzel Company acquired all noncash assets and assumed all liabilities of Lee Company at a cash purchase price of $192,000. Denzel determined that the fair value of the identifiable net assets acquired in the transaction is $187,200. Required a. What is the carrying value…arrow_forward! Required information [The following information applies to the questions displayed below.] Stevens Sandwich Shop had the following long-term asset balances as of January 1, 2024: Cost Accumulated Depreciation Book Value Land $ 88,000 0 $ 88,000 Building Equipment 453,000 256,000 $ (86,070) 366,930 207,400 Patent 215,000 129,000 (48,600) (86,000) ⚫ Stevens purchased all the assets at the beginning of 2022. ⚫ The building is depreciated over a 20-year service life using the double-declining-balance method and estimating no residual value. ⚫ The equipment is depreciated over a 10-year service life using the straight-line method with an estimated residual value of $13,000. • The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. • Depreciation and amortization have been recorded for 2022 and 2023 (first two years). Required: 1. For the year ended December 31, 2024 (third year), record the adjusting entry for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education