FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:Current Attempt in Progress

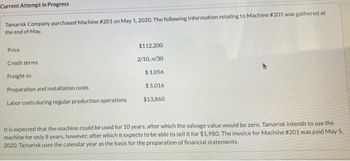

Tamarisk Company purchased Machine #201 on May 1, 2020. The following information relating to Machine #201 was gathered at

the end of May.

Price

Credit terms

Freight-in

Preparation and installation costs

Labor costs during regular production operations

$112,200

2/10,n/30

$1,056

$5,016

$13,860

It is expected that the machine could be used for 10 years, after which the salvage value would be zero. Tamarisk intends to use the

machine for only 8 years, however, after which it expects to be able to sell it for $1,980. The invoice for Machine #201 was paid May 5,

2020. Tamarisk uses the calendar year as the basis for the preparation of financial statements.

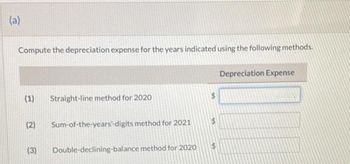

Transcribed Image Text:(a)

Compute the depreciation expense for the years indicated using the following methods.

(1) Straight-line method for 2020

(2)

(3)

Sum-of-the-years-digits method for 2021

Double-declining-balance method for 2020

s

Depreciation Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define Depreciation

VIEW Step 2: Computation of Total Cost of Machine is as follows:

VIEW Step 3: Computation of depreciation expense for 2020 using straight line Method is as follows:

VIEW Step 4: Computation of depreciation expense for 2021 using sum of years digit method is as follows:

VIEW Step 5: Computation of depreciation expense for 2020 using double declining balance method is as follows:

VIEW Solution

VIEW Step by stepSolved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is meant by Authorized and issued captial?arrow_forwardChoose the term that best describes static data? O Static data does not change once it is created. O Static data may change after it is recorded. O Static data is like a website. O Static data is very difficult to record.arrow_forwardSh7 Please help me Solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education