FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

infoPractice Pack

Question

infoPractice Pack

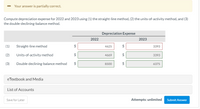

Transcribed Image Text:**Depreciation Expense Calculation for 2022 and 2023**

The task involves computing depreciation expense for the years 2022 and 2023 using three different methods:

1. **Straight-line Method**

- 2022: $4,625

- 2023: $3,393

2. **Units-of-activity Method**

- 2022: $4,669

- 2023: $3,393

3. **Double-declining-balance Method**

- 2022: $8,500

- 2023: $6,375

### Table Explanation:

The table presents the depreciation expenses calculated for each year using the different methods. The expenses for 2022 are listed in the left column, and for 2023 in the right column. The data is displayed in a tabular format with three rows representing each method and two columns for each year's expense values.

### Additional Features:

- A "Your answer is partially correct" message is displayed at the top.

- There are buttons labeled "eTextbook and Media" and "List of Accounts" for additional resources.

- A "Save for Later" option is provided.

- Users have unlimited attempts to submit their answers, as indicated by the "Attempts: unlimited" message next to the "Submit Answer" button.

Transcribed Image Text:**Depreciation Calculation for Whispering Winds Corp.**

**Background Information:**

Whispering Winds Corp. purchased a delivery truck for $34,000 on January 1, 2022. The truck has the following characteristics:

- Expected salvage value: $5,000

- Estimated useful life: 8 years

- Estimated mileage: 100,000 miles

**Actual Mileage:**

- 2022: 16,100 miles

- 2023: 11,700 miles

**Objective:**

Calculate the depreciable cost per mile using the units-of-activity method.

**Calculation:**

1. **Depreciable Cost:**

- Initial Cost: $34,000

- Salvage Value: $5,000

- Total Depreciable Amount: $34,000 - $5,000 = $29,000

2. **Depreciation per Mile:**

- Total Estimated Mileage: 100,000 miles

- Depreciable Cost per Mile: $29,000 / 100,000 miles = $0.29 per mile

**Result:**

The depreciable cost per mile is $0.29.

**Confirmation:**

Your answer is correct.

**Components of the Image:**

- A green confirmation box indicating the correctness of the provided answer.

- Instructions specify rounding to two decimal places.

- Buttons for accessing additional resources, such as eTextbook and Media, and a List of Accounts.

- Unlimited attempts allowed for practice.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Joseph Geary, the controller of Carla Vista Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2022. Here are his findings: Useful Life (in Years) Salvage Value Accumulated Depreciation, Old Type of Asset Old Date Acquired Proposed Proposed Cost Jan. 1, 2022 Building Jan. 1, 2014 $2,717,000 $536,600 40 50 $124,000 $93,000 ● Warehouse Jan. 1, 2017 256,000 64,000 25 20 19,000 15,000 All assets are depreciated by the straight-line method. Carla Vista Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Joseph's proposed changes. (The "Proposed" useful life is total life, not remaining life.)arrow_forwardPlease do not give solution in image format thankuarrow_forwardFE20 Below details are from Carryit Inc and have approached you to assist with depreciationEquipment Cost $1,055,000Salvage Value $25,000Expected life Years 10Calculate Depreciation as per straight line method, provide necessary journal entry fordepreciation and advise the closing balance of the equipment at the end of year 3.arrow_forward

- A fixed asset with a cost of $33,769.00 and accumulated depreciation of $30,392.10 is sold for $5,740.73. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $2,363.83 gain $2,363.83 loss $3,376.90 loss $3,376.90 gainarrow_forwardBased on the information below, what amount should be recorded for depreciation at the end of Year 2 assuming Straight-Line Depreciation is used? Cost of Equipment $100,000 Salvage Value $5,000 Useful Life 20 years $9,750 $5,000 $4,750 $250arrow_forwardPharoah Limited purchased a machine on account on April 1, 2024, at an invoice price of $356,620. On April 2, it paid $2,130 for delivery of the machine. A one-year, $3,970 insurance policy on the machine was purchased on April 5. On April 19, Pharoah paid $7,590 for installation and testing of the machine. The machine was ready for use on April 30. Pharoah estimates the machine's useful life will be five years or 6,212 units with a residual value of $73,690. Assume the machine produces the following numbers of units each year: 896 units in 2024; 1,400 units in 2025; 1,405 units in 2026; 1,396 units in 2027; and 1,115 units in 2028. Pharoah has a December 31 year end. - Show Transcribed Text Your answer is partially correct. Ű Ć Assume that the company, after recording depreciation using the straight-line method, for the first four months of 2026, determined on May 1, 2026 that the machine could be operated for one more year than originally estimated. Because of this, the residual…arrow_forward

- Please do not give solution in image format thankuarrow_forwardBlossom Computer Company sold two pieces of equipment in 2028. The following information pertains to the two pieces of equipment: Machine #1 #2 Cost $68,800 $76,000 Purchase Useful Salvage Date Life Value 7/1/24 1/1/27 5 yrs. 5 yrs. $4,800 $4,000 Depreciation Method Straight-line Date Sold 7/1/28 Double-declining-balance 12/31/281 Sales Price $16,000 $29,600arrow_forwardComplete the tablearrow_forward

- Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following data are used for equipment purchased on January 1, 2020. Cost and residual value Estimated service life: Acquisition cost $26,250 Years 5 Residual value $1,050 Service hours 21,000 Productive output (units) 50,400 e. Double-declining-balance method: Compute the depreciation amount for each year. 2020 2021 2022 2023 2024 Answer Answer Answer Answer Answerarrow_forwardA fixed asset with a cost of $31,365.00 and accumulated depreciation of $28,228.50 is sold for $5,332.05. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $3,136.50 loss $2,195.55 loss $2,195.55 gain $3,136.50 gainarrow_forwardThe fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can make it difficult for a financial analyst to compare periodic performance from firm to firm. Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining- balance depreciation method. Company B uses the straight-line method. You have the following information taken from the 12/31/2021 year-end financial statements for Company B: Income Statement Depreciation expense $10,000 Balance Sheet Assets: Plant and equipment, at cost Less: Accumulated depreciation Net $ 200,000 (40,000) $ 160,000 You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that all of the $200,000 represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are zero. Required: 1. In order to compare…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education