FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please don't give image based answer..thanku

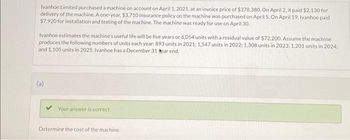

Transcribed Image Text:Ivanhoe Limited purchased a machine on account on April 1, 2021, at an invoice price of $378,380. On April 2, it paid $2,130 for

delivery of the machine. A one-year, $3,710 insurance policy on the machine was purchased on April 5. On April 19, Ivanhoe paid

$7,920 for installation and testing of the machine. The machine was ready for use on April 30.

Ivanhoe estimates the machine's useful life will be five years or 6,054 units with a residual value of $72,200. Assume the machine

produces the following numbers of units each year: 893 units in 2021: 1,547 units in 2022; 1,308 units in 2023; 1,201 units in 2024;

and 1,105 units in 2025. Ivanhoe has a December 31 par end.

(a)

Your answer is correct.

Determine the cost of the machine.

Transcribed Image Text:Calculate the annual depreciation and total depreciation over the asset's life using (Round the depreciation cost per unit to 2 decimal

places Round answers to 0 decimal places, eg 5,275)

(1) Straight-line method

2

Depreciable Amount

(2) Double-diminishing-balance method

Opening Carrying Amount

$

(3) Units-of-production method

Units-of-production

893

1547

1308

1201

Depreciation Expense

$

Depreciation Expense

Depreciation Expense

Accumulated Depreciation

$

Carrying Amount

Accumulated Depreciation

S

Accumulated Depreciation

$

Carrying Amount

72200

Carrying Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forwardWhat is the formula used for the questions without using excel?arrow_forwardhelp please, the answers I put are not correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education