Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

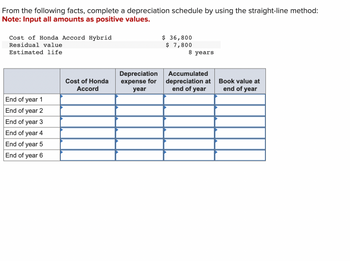

Transcribed Image Text:From the following facts, complete a depreciation schedule by using the straight-line method:

Note: Input all amounts as positive values.

Cost of Honda Accord Hybrid

Residual value

Estimated life

End of

year 1

End of year 2

End of year 3

End of year 4

End of year 5

End of year 6

Cost of Honda

Accord

Depreciation

expense for

year

$ 36,800

$ 7,800

8 years

Accumulated

depreciation at

end of year

Book value at

end of year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Use the straight-line method to fill in the row for year 3 of the depreciation table for an SUV that costs $43,000,has a residual value of $7,000 and an estimated life of six years. Year Annual depreciation Accumulated depreciation End-of-year book value 3 Complete the table. Year Annual depreciation Accumulated depreciation End-of-year book value 1 $6,000 $6,000 $37,000 2 $6,000 $12,000 $31,000 3 $enter your response here $enter your response here $enter your response herearrow_forwardPartial-year depreciation Equipment acquired at a cost of $110,000 has an estimated residual value of $7,000 and an estimated useful life of 10 years. It was placed into service on May 1 of t current fiscal year, which ends on December 31. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method. Round your answers to the nearest dollar. Year 1 Year 2 Year 1 Depreciation Year 2 $ b. Determine the depreciation for the current fiscal year and for the following fiscal year by the double-declining-balance method. Do not round the double-declin balance rate. Round your answers to the nearest dollar. Depreciation $ Incorrect $arrow_forwardA truck acquired at a cost of $60,000 has an estimated residual value of $2,000, has an estimated useful life of 200,000 miles, and was driven 15,000 miles during the year. Determine the following. If required, round your answer for the depreciation rate to 2 decimal places. Line Item Description Amount (a) The depreciable cost $fill in the blank 1 (b) The depreciation rate $fill in the blank 2 per mile (c) The units-of-activity depreciation for the year $fill in the blank 3arrow_forward

- Please do not give solution in image format thankuarrow_forwardIf a fixed asset, such as a computer, were purchased on January 1st for $2,101.00 with an estimated life of 4 years and a salvage or residual value of $107.00, what is the journal entry for monthly expense under straight-line depreciation? Select the correct answer. A. Depreciation Expense$41.54 Accumulated Depreciation$41.54 B. Accumulated Depreciation$41.54 Depreciation Expense$41.54 C. Accumulated Depreciation$498.50 Depreciation Expense$498.50 D. Depreciation Expense$498.50 Accumulated Depreciation$498.50arrow_forwardCan you help pleasearrow_forward

- Book value Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery period (years) 5 Elapsed time since purchase (years) 2 Asset A Installed cost $839,000 The remaining book value is $ (Round to the nearest dollar.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 2 3 4 5 6 7 8 3 years 33% 45% 15% 7% 9 10 11 Totals Percentage by recovery year* 5 years 7 years 20% 14% 32% 19% 12% 12% 5% 25% 18% 12% 9% 8% 7% 6% 6% 6% 4% 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year 10 years 10% 18%…arrow_forwardUnits-of-activity Depreciation A truck acquired at a cost of $250,000 has an estimated residual value of $15,500, has an estimated useful life of 35,000 miles, and was driven 3,200 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. (a) The depreciable cost (b) The depreciation rate %24 per mile (c) The units-of-activity depreciation for the yeararrow_forwardProvide step by step manual solution, given, and depreciation table for below mentioned problem. Make sure yet that your answer is the same as the given answer before sending your solution. An asset costing P50,000 has a life expectancy of 6 years and an estimated salvage value of P8,000. Calculate the depreciation charge at the end of the fourth period using fixed-percentage method. Answer. P5,263.87arrow_forward

- K Depreciation Norton Systems acquired two new assets. Asset A was research equipment costing $19,000 and having a 3-year recovery period. Asset B was duplicating equipment having an installed cost of $56,000 and a 5-year recovery period. Using the MACRS depreciation percentages, prepare a depreciation schedule for each of these assets. Complete the depreciation schedule for asset A below: Recovery Year 1 ... Depreciation (Round to the nearest dollar.) edit: 0 Qu Quarrow_forwardeBook Show Me How Revision of Depreciation A building with a cost of $1,200,000 has an estimated residual value of $250,000, has an estimated useful life of 40 years, and is depreciated by the straight-line method.arrow_forwardHelp pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education