Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I want to answer this question

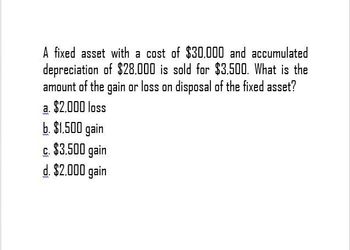

Transcribed Image Text:A fixed asset with a cost of $30,000 and accumulated

depreciation of $28.000 is sold for $3.500. What is the

amount of the gain or loss on disposal of the fixed asset?

a. $2,000 loss

b. $1.500 gain

c. $3,500 gain

d. $2.000 gain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A fixed asset with a cost of $32,167.00 and accumulated depreciation of $28,950.30 is sold for $5,468.39. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. A. $2,251.69 loss B. $2,251.69 gain C. $3,216.70 gain D. $3,216.70 lossarrow_forwardWhat's the amount of gain/loss?arrow_forwardWhat is the amount of the gain or loss on disposal of fixed assets?arrow_forward

- A fixed asset with a cost of $31,365.00 and accumulated depreciation of $28,228.50 is sold for $5,332.05. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $3,136.50 loss $2,195.55 loss $2,195.55 gain $3,136.50 gainarrow_forwardA fixed asset with a cost of $30,000 and accumulated depreciation of $28,000 is sold for $3,500. What is the amount of the gain or loss on disposal of the fixed asset? a. $2,000 loss b. $1,500 gain c. $3,500 gain d. $2,000 gainarrow_forwardPlease find the fixed assets? General accountingarrow_forward

- A fixed asset with a cost of $33,769.00 and accumulated depreciation of $30,392.10 is sold for $5,740.73. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $2,363.83 gain $2,363.83 loss $3,376.90 loss $3,376.90 gainarrow_forwardA fixed asset with a cost of $28,000 and accumulated depreciation of $25,200 is sold for $4,760. What is the amount of the gain or loss on disposal of the fixed asset? a.$1,960 loss b.$2,800 gain c.$2,800 loss d.$1,960 gainarrow_forwardSolve this questionarrow_forward

- An asset which costs $25,000 and has accumulated depreciation of $6,000 is sold for $11,000. What amount of gain or loss will be recognized when the asset is sold? a. A gain of $14,000 b. A loss of $14,000 c. A gain of $8,000 d. A loss of $8,000arrow_forwardAn asset that costs $97,600 and has accumulated depreciation of $82,000 is sold for $18,000. What amount of gain or loss will be recognized when the asset is sold? Question 5 options: A gain of $15,600. A loss of $15,600. A loss of $2,400. A gain of $2,400.arrow_forwardA fixed asset with a cost of dollar 42,200 and accumulated depreciation of dollar 36,500 is sold for dollar 9,850. What is the amount of the gain or loss on disposal of the fixed asset?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning