Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

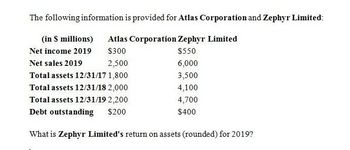

Transcribed Image Text:The following information is provided for Atlas Corporation and Zephyr Limited:

(in $ millions)

Atlas Corporation Zephyr Limited

Net income 2019

$300

$550

Net sales 2019

2,500

6,000

Total assets 12/31/17 1,800

3,500

Total assets 12/31/18 2,000

4,100

Total assets 12/31/19 2,200

4,700

Debt outstanding

$200

$400

What is Zephyr Limited's return on assets (rounded) for 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The following information is provided for Oceanic Ventures and Pinnacle Holdings: Oceanic Ventures Pinnacle Holdings (in $ millions) Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/202,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardThe following information is provided for Sunland Company and Culver Corporation. (in $ millions) Sunland Company Culver Corporation Net income 2022 $155 $405 Net sales 2022 1595 4530 Total assets 12/31/20 1040 2130 Total assets 12/31/21 1260 3020 Total assets 12/31/22 1165 4100 What is Sunland's asset turnover for 2022? (Round answer to 2 decimal places, e.g. 15.20.) 0.68 times 1.32 times 0.25 times 3.94 timesarrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Revenues Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/21 Current assets Copyrights Royalty agreements Investment in Stanza Liabilities Common stock Additional paid-in capital Penske $ (742,000) 264,700 187,000 Not given 80,000 (788,000) 498,000 990,000 772,000 Note: Parentheses indicate a credit balance. Consolidated copyrights Consolidated net income C. Consolidated retained earnings d. Consolidated goodwill Not given (600,000) (600,000) ($20 par) (150,000) a. b. Stanza $ (652,000) 163,000 224,000 0 60,000 (330,000) 598,000 384,000 1,190,000 Amounts 0 On January 1, 2021, Penske acquired all of Stanza's outstanding stock for $829,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $456,000 book value but a…arrow_forward

- The balance sheet of the proprietorship of Jacob as of June 30, 2018 showed the following assets andliabilities:Cash P 40,000Accounts Receivable 53,600Inventory 88,000Equipment 65,600Accounts Payable 63,520The cash balance included a 200- share certificate of BW Resources common at acquisition cost of P 1,600; the current market quotation is 70 per share. Of the accounts receivable, an estimated 5% is considered to be doubtful of collection. Certain inventory items, booked at a cost of P22,960, are currently worth P16,000. Depreciation has not been recorded; the equipment, acquired two years ago, has a remaining useful life of about eight more years. Prepaid expense of P 12,800 and accrued expense of P 6,120 have not been properly recognized. Emily and Bert will join Jacob in a partnership. Jacob will invest the net assets of his business, after effecting the appropriate adjustments, and he will be allowed credit for goodwill equal to 10% of his initial capital credit. Emily and Bert…arrow_forwardAngela Corporation (a private company) acquired all of the outstanding voting stock of Eddy Tech, Inc., on January 1, 2021, in exchange for $9,840,000 in cash. At the acquisition date, Eddy Tech's stockholders' equity was $7,260,000 including retained earnings of $3,405,000. At the acquisition date, Angela prepared the following fair value allocation schedule for its newly acquired subsidiary: $ 9,840,000 7,260,000 $ 2,580,000 Consideration transferred Eddy's stockholder's equity Excess fair over book value to patented technology (5-year remaining life) to trade names (indefinite remaining life) to equipment (8-year remaining life) $177,000 534,500 88,000 799,500 Goodwill $ 1,780,500 At the end of 2021, Angela and Eddy Tech report the following amounts from their individually maintained account balances, before consideration of their parent-subsidiary relationship. Parentheses indicate a credit balance. Sales Cost of goods sold Depr Amortization expense Angela $ (7,942,500) 3,998, 250…arrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2024: Accounts Revenues Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/24 Current assets Copyrights Royalty agreements Penske $ (742,000) 264,700 187,000 Not given. 80,000 (788,000) 498,000 990,000 Investment in Stanza Liabilities Common stock Additional paid-in capital 772,000 Not given (600,000) (600,000) ($20 par) (150,000) Stanza $ (652,000) 163,000 224,000 0 60,000 (330,000) 598,000 384,000 1,190,000 0 (1,357,088) (200,000) ($10 par) (80,000) Note: Parentheses indicate a credit balance. On January 1, 2024, Penske acquired all of Stanza's outstanding stock for $829,000 fair value in cash and common stock. Penske also paid $10,000 in stock Issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $456,000 book value but a fair value of $660,000. Required: a. As of December 31, 2024, what is…arrow_forward

- 3arrow_forwardThe financial statements of Parent and Subsidiary are found in the table below. Assuming that Parent Inc acquires 90% of Sub Inc on August 1, 2019 for cash of $180,000. Cash Parent Parent Sub Sub (carrying value) (fair value) (carrying value) (fair value) 180,000 180,000 36,000 36,000 Accounts Receivable 100,000 95,000 40,000 40,000 Inventory 60,000 68,000 24,000 27,000 Plant and Equipment (net) 200,000 270,000 80,000 93,000 Goodwill 0 8,000 Trademark 0 12,000 15,000 Total Assets 540,000 200,000 Current Liabilities 80,000 81,000 50,000 50,000 Bonds Payable 320,000 350,000 20,000 24,000 Common Shares 90,000 80,000 Retained Earnings 50,000 50,000 Total Equity 540,000 200,000 Required: Prepare the Consolidated Balance Sheet on the date of acquisition if the identifiable net assets (INA) method were used?arrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Revenues Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/21 Current assets Copyrights Royalty agreements Investment in Stanza Liabilities Penske $ (700,000) 250,000 150,000 Not given 80,000 (600,000) 400,000 900,000 600,000 Not given (500,000) (600,000) ($20 par) (150,000) Common stock Additional paid-in capital Note: Parentheses indicate a credit balance. $ Stanza (400,000) 100,000 200,000 0 60,000 (200,000) 500,000 400,000 1,000,000 0 (1,380,000) (200,000) ($10 par) (80,000) On January 1, 2021, Penske acquired all of Stanza's outstanding stock for $680,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $440,000 book value but a fair value of $560,000. a. As of December 31, 2021, what is the consolidated…arrow_forward

- 1- The following information relates to Panorama Corporation and its 70 percent-owned subsidiary, Scan, for the year 2022 is as follows (in thousands): Sales Income from Scan Cost of sales Depreciation expense Other expenses Panorama Scan $2,000 $800 98 (1,200) (400) (100) (80) (398) (180) I Required: a. Prepare a consolidated income statement for Panorama Corporation and Subsidiary for 2022. (Working paper not required) Assuming that Panorama acquired its 70 percent interest in Scan at book value on January 1, 2021, when the fair value of Scan'assets and liabilities were equal to recorded book values. There were no intercompany transactions during 2021 and 2022.arrow_forwardJosie Corporation reported the following information for 2022. Sales revenue $1000,000 Cost of goods sold 700,000 Operating expenses 110,000 Unrealized holding gain on available-for-sale securities 40,000 Cash dividends received on the securities 4,000 For 2022, Josie would report comprehensive income of O $194,000. O $230,000. O $234,000. O $40,000.arrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2024: Revenues Accounts Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/24 Current assets Copyrights Royalty agreements Penske $ (812,000) 289,200 223,000 Not given 80,000 (708,000) 448,000. 978,000 626,000 Stanza $ (680,000) 170,000 204,000 0 60,000 (270,000) 632,000 378,500 Investment in Stanza Liabilities Common stock Additional paid-in capital 1,048,000 Not given (506,000) 0 (1,262,500) (600,000) ($20 par) (150,000) (200,000) ($10 par) (80,000) Note: Parentheses indicate a credit balance. On January 1, 2024, Penske acquired all of Stanza's outstanding stock for $762,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $466,000 book value but a fair value of $622,000. Required: a. As of December 31, 2024, what is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning