Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

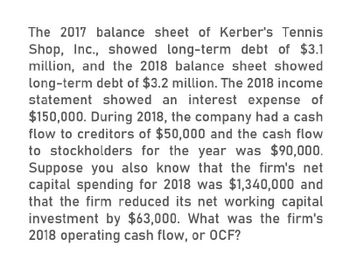

Transcribed Image Text:The 2017 balance sheet of Kerber's Tennis

Shop, Inc., showed long-term debt of $3.1

million, and the 2018 balance sheet showed

long-term debt of $3.2 million. The 2018 income

statement showed an interest expense of

$150,000. During 2018, the company had a cash

flow to creditors of $50,000 and the cash flow

to stockholders for the year was $90,000.

Suppose you also know that the firm's net

capital spending for 2018 was $1,340,000 and

that the firm reduced its net working capital

investment by $63,000. What was the firm's

2018 operating cash flow, or OCF?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are a financial Manager of Chevron Corp. You need to assess the effectiveness of working capital management of the company for 2018 using the following data. What is the 2018 Receivable turnover? 2017 Account Receivable = 15,353 000 2018 Account Receivable = 15.050,00O 2017 Inventory = 5,585.000 2018 Inventory = 5 704.00O 2017 Accounts Payable= 14 565 00I 2018 Accounts Payable = 13 953 000 2017 Sales 134,674 000 2018 Sales 158.902 000. 2017 Cost of Sales = 95 114.000 2018 Cost of Sales = 113 997 000 2017 Purchases= 95 114 000 2018 PurchaSes = 123 435 000arrow_forwardThe 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.5 million, and the 2021 balance sheet showed long-term debt of $2.65 million. The 2021 income statement showed an interest expense of $100,000. During 2021, the company had a cash flow to creditors of –$50,000 and the cash flow to stockholders for the year was $60,000. Suppose you also know that the firm’s net capital spending for 2021 was $1.31 million and that the firm reduced its net working capital investment by $57,000. What was the firm’s 2021 operating cash flow, or OCF? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forwardThe 2017 balance sheet of Kerber's Tennis Shop, Incorporated, showed $3.05 million in long-term debt, $790,000 in the common stock account, and $6.05 million in the additional paid-in surplus account. The 2018 balance sheet showed $3.8 million, $905,000, and $8.45 million in the same three accounts, respectively. The 2018 income statement showed an interest expense of $300,000. The company paid out $660,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $790,000, and the firm reduced its net working capital investment by $165,000, what was the firm's 2018 operating cash flow, or OCF? Multiple Choice O O $-2,305,000 $-3,000,000 $2,635,000 $-1,680,000 $-4,250,000arrow_forward

- The 2020 balance sheet of Osaka’s Tennis Shop, Incorporated, showed long-term debt of $2.25 million, and the 2021 balance sheet showed long-term debt of $2.66 million. The 2021 income statement showed an interest expense of $305,000. During 2021, Osaka’s Tennis Shop, Incorporated, realized the following: Cash flow to creditors –$ 105,000 Cash flow to stockholders $ 209,000 Suppose you also know that the firm’s net capital spending for 2021 was $1.5 million and that the firm reduced its net working capital investment by $55,000. What was the firm’s 2021 operating cash flow, or OCF?arrow_forwardThe 2018 balance sheet of Speith's Golf Shop, Inc., showed long-term debt of $6.2 million, and the 2019 balance sheet showed long-term debt of $6.45 million. The 2019 income statement showed an interest expense of $215,000. The 2018 balance sheet showed $610,000 in the common stock account and $2.5 million in the additional paid-in surplus account. The 2019 balance sheet showed $650,000 and $3 million in the same two accounts, respectively. The company paid out $610,000 in cash dividends during 2019. Suppose you also know that the firm's net capital spending for 2019 was $1,470,000, and that the firm reduced its net working capital investment by $89,000. What was the firm's 2019 operating cash flow, or OCF? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) t Operating cash flow 3 F5 F6 ences Mc Graw :0 F2 20 F3 000 F4 ◄◄ F7 ▶11arrow_forwardSquare Hammer Corporation shows the following information on its 2018 income statement: Sales = $196,000; Costs = $84,000; Other expenses = $5,100; Depreciation expense = $9,000; Interest expense = $13,300; Taxes = $29,610; Dividends = $10,300. In addition, you're told that the firm issued $7,100 in new equity during 2018 and redeemed $8,700 in outstanding long-term debt. a. What is the 2018 operating cash flow? Operating cash flow b. What is the 2018 cash flow to creditors? Cash flow to creditorsarrow_forward

- The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.25 million, and the 2021 balance sheet showed long-term debt of $2.66 million. The 2021 income statement showed an interest expense of $305,000. During 2021, Osaka's Tennis Shop, Incorporated, realized the following: Cash flow to creditors Cash flow to stockholders $105,000 $ 209,000 Suppose you also know that the firm's net capital spending for 2021 was $1.5 million and that the firm reduced its net working capital investment by $55,000. What was the firm's 2021 operating cash flow, or OCF? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Operating cash flowarrow_forwardThe 2017 balance sheet of Kerber’s Tennis Shop, Incorporated, showed $2.4 million in long-term debt, $720,000 in the common stock account, and $6.05 million in the additional paid-in surplus account. The 2018 balance sheet showed $4.1 million, $895,000, and $8.3 million in the same three accounts, respectively. The 2018 income statement showed an interest expense of $190,000. The company paid out $600,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $860,000, and the firm reduced its net working capital investment by $115,000, what was the firm's 2018 operating cash flow, or OCF?arrow_forwardThe 2017 balance sheet of Kerber's Tennis Shop , Incorporated, showed $2.4 million long-term debt, $760,000 in the common stock account, and $5.95 million in the additional paid-in surplus account. The 2018 balance sheet showed $3.95 million $985,000, and $8.05 million in the same three accounts , respectively . The 2018 income statement showed an interest expense of $ 310,000 . The company paid out $590,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $690,000 , and the firm reduced its net working capital Investment by $185,000 , what was the firm's 2018 operating cash flow , or OCF ? Typed solutionarrow_forward

- The 2023 balance sheet of Swiatek’s Tennis Shop, Incorporated, showed long-term debt of $2.4 million, and the 2024 balance sheet showed long-term debt of $2.73 million. The 2024 income statement showed an interest expense of $265,000. During 2024, the firm realized the following: Cash flow to creditors −$ 65,000 Cash flow to stockholders $ 309,000 Suppose you also know that the firm’s net capital spending for 2024 was $1.5 million and that the firm reduced its net working capital investment by $55,000. What was the firm’s 2024 operating cash flow, or OCF?arrow_forwardcan you please solve this general accountionsarrow_forwardThe 2022 balance sheet of Fast Auto Manufacturers, showed $1.4 million in long-term debt, $470,000 in the common stock account, and $4.15 million in the additional paid-in surplus account. The 2023 balance sheet showed $3.15 million, $755,000, and $6.2 million in the same three accounts, respectively. The 2023 income statement showed an interest expense of $280,000. The company paid out $500,000 in cash dividends during 2023. If the firm's net capital spending for 2023 was $330,000, and the firm reduced its net working capital investment by $265,000, what was the firm's 2023 operating cash flow, or OCF? O $-3,240,000 O $-4,130,000 O $4,530,000 $-3,400,000 O $5,155,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning