FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

A.Establish the Total Sales and Average Sales at an appropriate area in the spreadsheet.

B.In an appropriate area of the spreadsheet calculate the following as it relates to the

sales volumes: Minimum, Maximum, Middle values

C. There was an error in the calculated sales volumes, wherein all sales volumes should

have increased by 5%. To the right of the sales volume heading, create a heading called

Increased Sales Volumes where this 5% increase must be reflected below

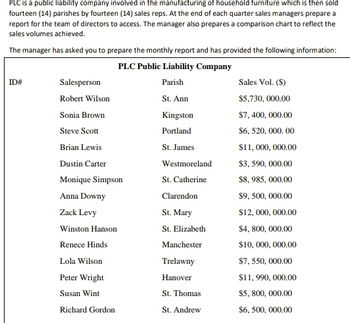

Transcribed Image Text:PLC is a public liability company involved in the manufacturing of household furniture which is then sold

fourteen (14) parishes by fourteen (14) sales reps. At the end of each quarter sales managers prepare a

report for the team of directors to access. The manager also prepares a comparison chart to reflect the

sales volumes achieved.

The manager has asked you to prepare the monthly report and has provided the following information:

PLC Public Liability Company

Parish

St. Ann

Kingston

Portland

St. James

Westmoreland

St. Catherine

ID#

Salesperson

Robert Wilson

Sonia Brown

Steve Scott

Brian Lewis

Dustin Carter

Monique Simpson

Anna Downy

Zack Levy

Winston Hanson

Renece Hinds

Lola Wilson

Peter Wright

Susan Wint

Richard Gordon

Clarendon

St. Mary

St. Elizabeth

Manchester

Trelawny

Hanover

St. Thomas

St. Andrew

Sales Vol. (S)

$5,730,000.00

$7,400,000.00

$6,520,000.00

$11,000,000.00

$3,590,000.00

$8,985,000.00

$9,500,000.00

$12,000,000.00

$4,800,000.00

$10,000,000.00

$7,550,000.00

$11,990,000.00

$5, 800,000.00

$6,500,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

D.Insert a column called percentage contribution in an appropriate area of the spreadsheet, to display the total contribution to overall sales by each salesperson. The answer is to be formatted as percentage.

e.Company policy dictates that all sales volumes exceeding nine million ($8,000, 000.00)

but not exceeding ten million ($10, 000, 000.00) should receive an incentive of US

$700.00, otherwise they should receive US $200.00. In an appropriate area of the

spreadsheet create a heading called Special Incentive 1 and make the necessary

calculations using the necessary function

f.Company policy also dictates that all sales volumes exceeding ten million ($10,000,

000.00) but less than or equal to twelve million ($12, 000, 000.00) should receive a trip

to any Air Jamaica destination, otherwise they should not receive a trip. In an

appropriate area of the spreadsheet create a heading called Special Incentive 2 and

make the necessary calculations using the necessary function

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

D.Insert a column called percentage contribution in an appropriate area of the spreadsheet, to display the total contribution to overall sales by each salesperson. The answer is to be formatted as percentage.

e.Company policy dictates that all sales volumes exceeding nine million ($8,000, 000.00)

but not exceeding ten million ($10, 000, 000.00) should receive an incentive of US

$700.00, otherwise they should receive US $200.00. In an appropriate area of the

spreadsheet create a heading called Special Incentive 1 and make the necessary

calculations using the necessary function

f.Company policy also dictates that all sales volumes exceeding ten million ($10,000,

000.00) but less than or equal to twelve million ($12, 000, 000.00) should receive a trip

to any Air Jamaica destination, otherwise they should not receive a trip. In an

appropriate area of the spreadsheet create a heading called Special Incentive 2 and

make the necessary calculations using the necessary function

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Showing 1-6 of 6 items. 1. Which of the following statements is true? Gross margin = Net sales - Cost of goods sold ONet sales + Cost of goods sold Gross margin Gross margin - Cost of goods sold = Net sales Net sales + Gross margin = Cost of goods soldarrow_forwardchapter 3 4. Given the information below, what is the profit percent? Round your answer to two decimal places and add a percent sign (i.e. 15.37%) Gross Sales $341,420 Customer Returns 29,870 Cost of Goods Sold 161,570 Expenses 138,140arrow_forwardPrepare a cost of quality report. Round the percents of total quality cost to the nearest whole number and the percents of total sales to one decimal place. Cost of Quality Report Percent of Total Quality Quality Cost Classification Quality Cost Percent of Total Sales Cost Prevention Appraisal Internal failure External failure Total % 1.1.0.0.0 % % % % %arrow_forward

- Current assets: Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) Land T Total assets Total plant and equipment Assets Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term liabilities: Mortgage note payable despaces Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ $ $ $ Show Transcribed Text S $ LOGIC COMPANY Comparative Balance Sheet December 31, 2019 and 2020 2020 $ $ $ $ $ $ Amount www. 93,200 13,700 7,700 21,400 22,700 44,100 12,700 17,200 9,200 21,700 27,400 49,100 93,200 24,700 63.800 15,200 14,200 29,400 93,200 Percent. $ $ $ $ S $ $ $ $ $ $ $ ---- 69,900 7,700 5,700 13,400 21,200 34,600 21,700 13,600 35,300 69,900 Amount 2019 9,700 13,200 14,700 10,700 48.300 11,900 9,700 21,600 69,900 Percentarrow_forwardhow do i calculate the gross prfoit rate under each tab ( LIFO,FIFO AVERAGE-COST) base off the attachment?arrow_forward7-4 In the cost-volume-profit graph, a. the break-even point is found where the total revenue curve crosses the x-axis. b. the area of profit is to the left of the break-even point. c. the area of loss cannot be determined. d. both the total revenue curve and the total cost curve appear. e. neither the total revenue curve nor the total cost curve appear.arrow_forward

- The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 120 units @ $90 2. Second purchase (cash) 205 units @ $98 3. Sales (all cash) 350 units @ $197 4. Paid $13,950 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes $16, 800 17,600 (200 units @ $88) 15, 700 18,700 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Cost of goods sold Ending inventory Req…arrow_forwardSubject;arrow_forwardDefine the term key performance indicator. The text provides you with examples of KPIs applicable to revenue cycle activities. Extend that line of thinking and identify at least five possible KPIs relating to inventory accounts.arrow_forward

- eBook Inventory $5,000 $4,900 65,000 29,000 230,000 froze Income Statement Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 54,100 units will be produced, with the following total costs: Direct materials Direct labor Variable overhead Fixed overhead Next year, Pietro expects to purchase $120,500 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct materials nirxas. F en pizzes Work-in-Process Inventory $14,000 $16,000 Beginning Ending Next year, Pietro expects to produce 54,100 units and sell 53,400 units at a price of $18.00 each. Beginning inventory of finished goods is $42,500, and ending inventory of finished goods is expected to be $34,000. Total selling expense is projected at $27,000, and total administrative expense is projected at $108,000. Required: erat. Contin no Ing. 1. Prepare an income statement in good form. Round the percent to four decimal places before…arrow_forwardVery important please be correct thank you need all 11 requiredarrow_forwardOne item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 17 % = 10 % x (a) (b) = 28 % x 0.75 18 % = (c) x 1.5 10 % = 20 % x (d) (e) = 15 % x 1.2 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank (b) fill in the blank % (c) fill in the blank % (d) fill in the blank (e) fill in the blank %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education