FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Hello, I need help solving this accounting problem.

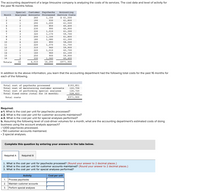

Transcribed Image Text:The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for

the past 16 months follow.

Special Customer Paychecks

Accounting

Month

Analyses Accounts Processed Service Costs

1,150

930

1,200

850

990

1,010

1,170

1,100

1,080

890

1,070

940

1,010

$ 61,500

61,800

61,500

1

3

260

2

190

3

1

290

4

300

60,400

60,900

61,300

59,700

230

330

320

200

61,800

61,300

58,000

180

10

220

61,700

59,900

60,700

61,100

59,900

11

1

220

12

310

13

220

14

160

960

15

1

250

900

16

330

1,040

60,400

Totals

32

4,010

16,290

$971,900

In addition to the above information, you learn that the accounting department had the following total costs for the past 16 months for

each of the following.

Total cost of paychecks processed

Total cost of maintaining customer accounts

Total cost of performing special analyses

Total fixed costs (total for 16 months)

$193,851

122,706

126,720

528,623

Total conts

$971,900

Required:

a-1. What is the cost per unit for paychecks processed?

a-2. What is the cost per unit for customer accounts maintained?

a-3. What is the cost per unit for special analyses performed?

b. Assuming the following level of cost-driver volumes for a month, what are the accounting department's estimated costs of doing

business using the account analysis approach?

• 1,000 paychecks processed.

• 150 customer accounts maintained.

• 3 special analyses.

Complete this question by entering your answers in the tabs below.

Required A

Required B

1. What is the cost per unit for paychecks processed? (Round your answer to 2 decimal places.)

2. What is the cost per unit for customer accounts maintained? (Round your answer to 2 decimal places.)

3. What is the cost per unit for special analyses performed?

Activity

Cost per unit

1. Process paychecks

2.

Maintain customer accounts

3. Perform special analyses

Transcribed Image Text:The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for

the past 16 months follow.

Special Customer Paychecks

Accounting

Month

Analyses Accounts Processed Service Costs

1,150

930

1,200

$ 61,500

61,800

3

260

190

61,500

60,400

60,900

3

1

290

4

2

300

850

5

1

230

990

4

330

1,010

61,300

59,700

1,170

1,100

1,080

890

1,070

320

61,800

61,300

200

9

180

10

220

58,000

61,700

59,900

60,700

11

1

220

12

310

940

1,010

960

13

2

220

61,100

59,900

14

1

160

15

1

250

900

16

330

1,040

60,400

Totals

32

4,010

16,290

$971,900

In addition to the above information, you learn that the accounting department had the following total costs for the past 16 months for

each of the following.

Total cost of paychecks processed

Total cost of maintaining customer accounts

Total cost of performing special analyses

Total fixed costs (total for 16 months)

$193,851

122,706

126,720

528,623

Total costs

$971,900

Required:

a-1. What is the cost per unit for paychecks processed?

a-2. What is the cost per unit for customer accounts maintained?

a-3. What is the cost per unit for special analyses performed?

b. Assuming the following level of cost-driver volumes for a month, what are the accounting department's estimated costs of doing

business using the account analysis approach?

• 1,000 paychecks processed.

• 150 customer accounts maintained.

• 3 special analyses.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Assuming the following level of cost-driver volumes for a month, what are the accounting department's estimated costs of

doing business using the account analysis approach?

• 1,000 paychecks processed.

• 150 customer accounts maintained.

• 3 special analyses.

(Round "Unit cost" to 2 decimal places. Round "Average fixed cost" and final answer to the nearest whole dollar amount.)

Show less A

Estimated cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why are we studying IT controls, functions, and job responsibilities in an accounting course?arrow_forwardcan you help me with D,E,F,G,and Harrow_forwardin your own words, what is accounting information system (AIS)? List and discuss the three sub system of AIS and identify which one you consider the most important of the three and state why?arrow_forward

- When it comes to modern accounting, how important is the Accounting Information System to the process?arrow_forwardWe discussed what seemed to most as a new term, bright-line accounting. Please researchand describe in your own opinion what bright-line accounting means to you.arrow_forwardWhat is meant by the term fresh start accounting ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education