Question

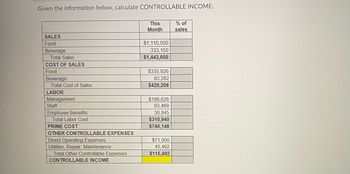

Transcribed Image Text:# Controllable Income Calculation

To calculate controllable income, we need to examine the breakdown of sales, costs, and expenses. Here's the data provided:

## Sales

- **Food**: $1,110,500

- **Beverage**: $333,150

- **Total Sales**: $1,443,650

## Cost of Sales

- **Food**: $335,926

- **Beverage**: $93,282

- **Total Cost of Sales**: $429,208

## Labor

- **Management**: $186,626

- **Staff**: $93,469

- **Employee Benefits**: $30,845

- **Total Labor Cost**: $310,940

## Prime Cost

- **Prime Cost**: $740,148

## Other Controllable Expenses

- **Direct Operating Expenses**: $71,000

- **Utilities, Repair, Maintenance**: $45,492

- **Total Other Controllable Expenses**: $115,492

## Controllable Income

- **Controllable Income**: $115,492

This layout highlights the essential components needed to calculate the controllable income, an important metric for assessing financial performance within an organization.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images