Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Make a graph using this data and provide a step-by-step guide

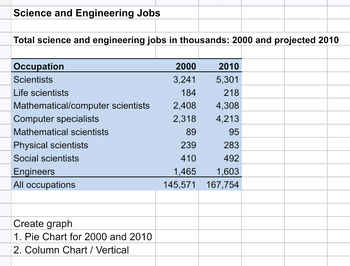

Transcribed Image Text:Science and Engineering Jobs

Total science and engineering jobs in thousands: 2000 and projected 2010

Occupation

2000

2010

Scientists

3,241

5,301

Life scientists

184

218

Mathematical/computer scientists

2,408

4,308

Computer specialists

2,318

4,213

Mathematical scientists

89

95

Physical scientists

239

283

Social scientists

410

492

Engineers

All occupations

1,465

1,603

145,571

167,754

Create graph

1. Pie Chart for 2000 and 2010

2. Column Chart / Vertical

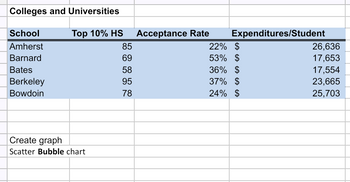

Transcribed Image Text:Colleges and Universities

School

Top 10% HS

Acceptance Rate

Expenditures/Student

Amherst

85

22% $

26,636

Barnard

69

53% $

17,653

Bates

58

36% $

17,554

Berkeley

95

37% $

23,665

Bowdoin

78

24% $

25,703

Create graph

Scatter Bubble chart

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 2302-018 Homework ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl Alamo Colleges : NLC... M Personal Email Google X C Question 1- Chapter 13 - Homewor X Canvas e M13-11 (Static) Identifying Relevant Ratios [LO 13-4, 13-5] f. YouTube a. How much net income does the company earn from each dollar of sales? b. Is the company financed primarily by debt or equity? How many dollars of sales were generated for each dollar invested in fixed assets? Identify the ratio that is relevant to answering each of the following questions. d. How many days, on average, does it take the company to collect on credit sales made to customers? + How much net income does the company earn for each dollar owners have invested in it? Does the company have sufficient assets to convert into cash for paying liabilities as they come due in the upcoming year?arrow_forwardmheducation.com/ext/map/index.html? con=con&external browser=D0&launchUrl=https%253A%252F%252Fblackboard.strayer.edu%252Fwebapps%252Fpc The. S A Coursein Miracles A New Earth MyNeopost ACTIVE | University.. E https://secure.times. Guide to forecastin. Assume Invent omework i Saved Help Sherry, who is 52 years of age, opened a Roth IRA three years ago. She has contributed a total of $12.900 to the Roth IRA ($4,300 a year). The current value of the Roth IRA is $21,700. In the current year Sherry withdraws $19.400 of the account balance to purchase a car. Assuming Sherry's marginal tax rate is 24 percent, how much of the $19,400 withdrawal will she retain after taxes to fund her car purchase? Amount of withdrawal Non-taxable amount Amount subject to tax 0. Tax rate Penalty rate Tax Penalty After tax withdrawal retainedarrow_forwardlaunchon-ntips%253A%252F%252Fnewconnect.mheducation.com%... R To nfor.. Scinapse | Academi. G Top 10 Soft Skills E.. (3 Universiti Teknologi. AllI Notes - Evernot. CAS MYUTM Login Page 6 UTMWIFI > Login O Sci-Hub: removing. I Other bookm ss Costing i Saved Help Save & Exit SL Romain Surgical Hospital uses the direct method to allocate service department costs to operating departments. The hospital has two service departments, Information Technology and Administration, and two operating departments, Surgery and Recovery. Service Department Operating Department Information Technology $ 34,850 Administration Recovery Surgery $ 516,070 Departmental costs $ 35,907 $ 714,110 Computer workstations Employees 38 30 69 54 34 20 80 40 Information Technology Department costs are allocated on the basis of computer workstations and Administration Department costs are allocated on the basis of employees. The total Surgery Department cost after service department allocations is closest to: Multiple…arrow_forward

- What is the amount of the total paid-in capital? What makes up this amount?arrow_forwarducation.com/ext/map/index.html?_con%3Dcon&external_browser=D0&launchUrl%=https%253A%252F%252Fblackboard.strayer.edu%252Fweb: S A Course in Miradles A New Earth MyNeopost ACTIVE University... E https://secure.times. Guide to forecastin.. ork 1 Saved Required information [The following information applies to the questions displayed below.] Seiko's current salary is $98,500. Her marginal tax rate is 32 percent and she fancies European sports cars. She purchases a new auto each year. Seiko is currently a manager for Idaho Office Supply. Her friend, knowing of her interest in sports cars, tells her about a manager position at the local BMW and Porsche dealer The new position pays only $87100 per year, but it allows employees to purchase one new car per year ata discount of $17,700. This discount qualifies as a nontaxable fringe benefit. In an effort to keep Seiko as an employee, Idaho Office Supply offers her a $12.400 raise. Answer the following questions about this analysis. c. What…arrow_forwardPlease see question in picture attached to fill in table. Thank youarrow_forward

- What are two kinds of paid-in capital accounts?arrow_forwardNWP Assessment Builder UI App x w NWP Adaptive Assessment Playe X O WileyPLUS: Personal Finance, Enl x+ ôhttps://education.wiley.com/was/ui/v2/adaptive-assessment-player/index.html?launchld=D005b88a2-9bff-4b68-a4dd-b326ecc9384e#/ac.. actice [due Sat] 6.4 Mortgage Financing Jessica's mortgage payment, including principal, interest, taxes, and insurance, is $750 per month. She also has other monthly debt payments of $440. If her monthly gross income is $3,950. How would a bank assess Jessica's capacity to take on an additional credit card? O Asset ratio O Debt payment ratio O Debt ratio O Mortgage debt service ratio Save for Later Submit Answerarrow_forwardEdit View History Bookmarks People Tab Window Help N Academic Tools :: Northern Virgi X 63% Mon 12:07 PM weCS Virginia Community College Syst X N CHAPTER 08 HW NOVA learn.vccs.edu/courses/240149/assignments/4704240?module_item_id=17254910 https://checkout.wileyplus.com/ X des View Policies rse Evaluations Current Attempt in Progress A Policies Cullumber Co. has the following transactions related to notes receivable during the last 2 months of the year. The company does not make entries to accrue interest except at December 31. r.com: 24/7 On- Tutoring Nov. 1 Loaned $53,400 cash to C. Bohr on a 12-month, 9% note. ary Resources Dec. 11 Sold goods to K. R. Pine, Inc., receiving a $5,400, 90-day, 8% note. 16 Received a $9,600, 180-day, 8% note to settle an open account from A. Murdock. 31 Accrued interest revenue on all notes receivable. Journalize the transactions for Cullumber Co. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered.…arrow_forward

- xrernal_browser%3D0&launchUrl=https%6253A%5vi F%252Fnewconnect.mheducation.com%252F#/activi mheduca nc The... SA Course in Miracles A New Earth MyNeopost ACTIVE University... E https://securetimes.. Guide to forecastin. Assume Inve mework i Saved Help తడండి Required information [The following information applies to the questions displayed below.] Sandra would like to organize BAL as either an LLC (taxed as a sole proprietorship) or a C corporation. In either form, the entity is expected to generate an 8 percent annual before-tax return on a $610.000 investment Sandra's marginal income tax rate is 37 percent and her tax rate on dividends and.capital gains is 23.8 percent (including the 3.8 percent net investment income tax). If Sandra organizes BAL as an LLC, she will be required to pay an additional 2.9 percent for self- employment tax and an additional 0.9 percent for the additional Medicare tax. BAL'S income is not qualified business income (QBI) so Sandra is not allowed to claim the…arrow_forwardon%3Dconcexternal browser%3D08launchUrl=https%253A%252F%6252FBlackboard.strayer.edu%252Fwebapps%252Fr The... S A Course in Miracles A New Earth MyNeopost A ACTIVE | University.. E https://secure.times.. Guide to forecastin.. . Assurne Inver Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate compler Required information [The following information applies to the questions displayed below. Michael is single and 35 years old. He is a participant in his employer's sponsored retirement plan. How much can Michael contribute to a Roth IRA in 2019 in each of the following alternative situations? (Leave no answer blank. Enter zero if applicable.) c. Michael's AGI is $128,000 before any IRA contributions. Answer is complete but not entirely correct. Contribution to Roth IRAarrow_forwardezto.mheducation.com/ext/map/index.html?_con%3Dcon&extermal_browser%3D0&launchUrl-https%253A%252F9%252Fblackboard.strayer.edu%252Fwebapps%252Fportal.. SA Course in Miracles A New Earth MyNeopost 1 ACTIVE | University... E https://secure.times... Guide to forecastin... Assume Inventory d.. yHealing The... er 13 Homework 0 Saved Help Save Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Retur Alicia has been working for JMM Corp. for 32 years. Alicia participates in JMM's defined benefit plan. Under the plan. for every year of service for JMM she is to receive 2 percent of the average salary of her three highest years of compensation from JMM. She retired on January 1, 2019. Before retirement, her annual salary was $603,000, S633.000, and S663.000 for 2016, 2017. and 2018. What is the maximum benefit Alicia can receive in 2019? Answer is complete but not entirely correct. Maximum benefit in 2019 $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education