Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

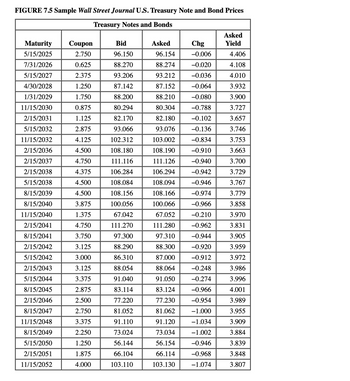

![Problem 7-16 Using Treasury Quotes [LO2]

Locate the Treasury issue in Figure 7.5 maturing in August 2045. Assume a par value of

$10,000.

a. What is its coupon rate?

Note: Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.

b. What is its bid price in dollars?

Note: Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.

c. What was the previous day's asked price in dollars?

Note: Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.

a. Coupon rate

b. Bid price

c. Previous day's price

%](https://content.bartleby.com/qna-images/question/7244493e-0d49-402e-be96-186f2cb836c6/247caad3-09fe-4ee6-b39e-5ffd1dfe9a17/85t4d1n_thumbnail.png)

Transcribed Image Text:Problem 7-16 Using Treasury Quotes [LO2]

Locate the Treasury issue in Figure 7.5 maturing in August 2045. Assume a par value of

$10,000.

a. What is its coupon rate?

Note: Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.

b. What is its bid price in dollars?

Note: Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.

c. What was the previous day's asked price in dollars?

Note: Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.

a. Coupon rate

b. Bid price

c. Previous day's price

%

Transcribed Image Text:FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices

Treasury Notes and Bonds

Asked

Maturity

Coupon

Bid

Asked

Chg

Yield

5/15/2025

2.750

96.150

96.154

-0.006

4.406

7/31/2026

0.625

88.270

88.274

-0.020

4.108

5/15/2027

2.375

93.206

93.212

-0.036

4.010

4/30/2028

1.250

87.142

87.152

-0.064

3.932

1/31/2029

1.750

88.200

88.210

-0.080

3.900

11/15/2030

0.875

80.294

80.304

-0.788

3.727

2/15/2031

1.125

82.170

82.180

-0.102

3.657

5/15/2032

2.875

93.066

93.076

-0.136

3.746

11/15/2032

4.125

102.312

103.002

-0.834

3.753

2/15/2036

4.500

108.180

108.190

-0.910

3.663

2/15/2037

4.750

111.116

111.126

-0.940

3.700

2/15/2038

4.375

106.284

106.294

-0.942

3.729

5/15/2038

4.500

108.084

108.094

-0.946

3.767

8/15/2039

4.500

108.156

108.166

-0.974

3.779

8/15/2040

3.875

100.056

100.066

-0.966

3.858

11/15/2040

1.375

67.042

67.052

-0.210

3.970

2/15/2041

4.750

111.270

111.280

-0.962

3.831

8/15/2041

3.750

97.300

97.310

-0.944

3.905

2/15/2042

3.125

88.290

88.300

-0.920

3.959

5/15/2042

3.000

86.310

87.000

-0.912

3.972

2/15/2043

3.125

88.054

88.064

-0.248

3.986

5/15/2044

3.375

91.040

91.050

-0.274

3.996

8/15/2045

2.875

83.114

83.124

-0.966

4.001

2/15/2046

2.500

77.220

77.230

-0.954

3.989

8/15/2047

2.750

81.052

81.062

-1.000

3.955

11/15/2048

3.375

91.110

91.120

-1.034

3.909

8/15/2049

2.250

73.024

73.034

-1.002

3.884

5/15/2050

1.250

56.144

56.154

-0.946

3.839

2/15/2051

1.875

66.104

66.114

-0.968

3.848

11/15/2052

4.000

103.110

103.130

-1.074

3.807

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Problem 6-1 Financial Pages (LO1) Consider the table given below to answer the following question. Maturity Coupon Bid Price Asked Price Chg Asked Yield toMaturity (%) 15-02-2020 1.375 98.3281 98.3438 − 0.0078 2.228 15-02-2021 2.25 99.5781 99.5938 0.0313 2.391 15-02-2025 7.625 130.6719 130.6875 0.1094 2.770 15-02-2029 5.25 121.8516 121.9141 0.2344 2.908 15-02-2036 4.5 120.9063 120.9688 0.5313 2.986 15-02-2041 4.75 127.2422 127.3047 0.6641 3.084 15-02-2048 3 97.2656 97.2969 0.7266 3.140 a. What is the current yield of the 2.25% 2021 maturity bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardQuestion 5 The March 2024 S&P 500 cash index is 930 while the S&P 500 futures index is 950 and the contract value of each index point is $100. You are convinced the futures market will rise 10% by expiry. You are only prepared to buy or sell one futures contract. (i) Will you buy or sell a contract in the futures market? (2 marks) (ii) What is your profit (+) in dollars if you are correct? (2 marks) (iii) What is your profit (+)/loss (-) if the futures price on expiry is 1200? (2 marks) (iv) What is your profit (+)/loss (-) if the futures price on expiry is 700? (2 marks) (v) Explain what is meant by “initial margin” on a futures contract. (2 marks)arrow_forwardProblem 6-16 Expectations hypothesis and interest rates (LO6-4] Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. (Input your answers as a percent rounded to 2 decimal places.) Interest Rate 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 2 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 5% 78 9% 11% Expected Return 2-year security 3-year security 4-year security % %arrow_forward

- Don't answer by pen paper and don't use chatgptarrow_forwardQuèstion 10 In year 2019, the rate on one-year Treasury securities was 12 percent and inflation was measured at 3 percent. What was the real rate of interest in year 20197 O 9% O 15% O 12% O 4% O None of the listed items is correct A Moving to another question will save this response. MacBook Air esc % 2 з 4 Q W E Rarrow_forward20EMarrow_forward

- Problem 6-23 Real Returns (LO3) Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a (real) coupon of 4.4% paid annually. If you buy the bond at its face value of $1,000, and the inflation rate is 8.60% in each year. a. What will be your cash flow in year 1? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Cash flow b. What will be your cash flow in year 2? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Cash flow c. What will be your real rate of return over the two-year period? Note: Enter your answer as a percent rounded to 1 decimal place.arrow_forwardProblem 6-13 Unbiased Expectations Theory (LG6-7) Suppose we observe the following rates: 1R₁ = 8%, 1R2 = 10%. If the unbiased expectations theory of the term structure of interest rates holds, what is the 1-year interest rate expected one year from now, E(2/1)? Note: Do not round intermediate calculations. Round your percentage answer to 2 decimal places (i.e., 0.1234 should be entered as 12.34). Answer is complete but not entirely correct. Interest rate 10.00 %arrow_forwardProblem 9-24 Treasury Bills (LO1, CFA1) A Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount rate of 3.32 percent, what are the price and bond equivalent yield? Use Excel to answer this question. Note: Round your price answer to 2 decimal places. Enter your yield answer as a percent rounded to 3 decimal places. Answer is complete but not entirely correct. $ 99,147.64 1.665 Price Bond equivalent yield %arrow_forward

- Grammal Question 20 As a currency trader, you see the following quotes on your computer screen: Exch. Rate Spot 1-month 2-month 3-month 6-month JPY/USD 98.75/85 12/10 20/16 25/19 45/35 Suppose you want to swap out of JPY 10,000,000 and into USD for 6 months. What are the cash flows associated with the swap? O Receive 101,266$ now and pay 101,523$ in 6 months Receive 101,163$ now and pay 101.729$ in 6 months Receive 101,266$ now and pay 101,729$ in 6 months Receive 101,163$ now and pay 101,523$ in 6 monthsarrow_forwardQuestion 32arrow_forwardces Problem 6-13 Unbiased Expectations Theory (LG6-7) Suppose we observe the following rates: 1R₁ = 10%, 1R2 = 12%. If the unbiased expectations theory of the term structure of interest rates holds, what is the 1-year interest rate expected one year from now, E(21)? Note: Do not round intermediate calculations. Round your percentage answer to 2 decimal places (i.e., 0.1234 should be entered as 12.34). Interest rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education