College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

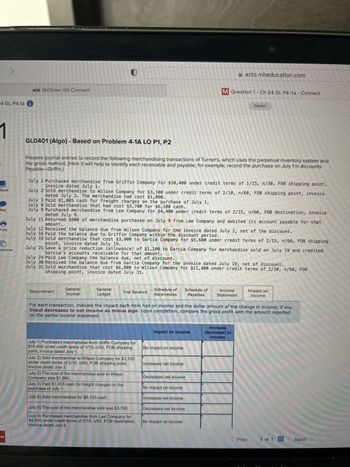

Transcribed Image Text:04 GL P4-1a

ts

1

eBook

MCC McGraw Hill Connect

218.mheducation.c

M Question 1- Ch 04 GL P4-1a

Saved

shipping point, invoice dated July 31.

July 31 Sold merchandise that cost $6,800 to Wilson Company for $11,400 under credit terms of 2/10, n/69

Requirement

General

Journal

General

Ledger

Trial Balance

Schedule of

Receivables

Schedule of

Payables

Income

Statement

Impact on

Income

For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any.

on the partial income statement.

Input decreases to net income as minus sign. Upon completion, compare the gross profit with the amount reported

Impact on income

Increase

(decrease) to

income

Ask

July 1) Purchased merchandise from Griffin Company for

$10,400 under credit terms of 1/15, n/30, FOB shipping

point, invoice dated July 1.

No impact on income

Print

erences

July 2) Sold merchandise to Wilson Company for $3,100

under credit terms of 2/10, n/60, FOB shipping point,

invoice dated July 2.

July 2) The cost of the merchandise sold to Wilson

Company was $1,860.

July 3) Paid $1,005 cash for freight charges on the

purchase of July 1.

July 8) Sold merchandise for $6,100 cash.

July 8) The cost of the merchandise sold was $3,700.

July 9) Purchased merchandise from Lee Company for

$4,400 under credit terms of 2/15, n/60, FOB destination,

invoice dated July 9.

July 11) Received a $900 credit memorandum from Lee

Company for the return of part of the merchandise

purchased on July 9.

July 12) Received the balance due from Wilson Company

for the invoice dated July 2, net of the discount.

July 16) Paid the balance due to Griffin Company within the

discount period.

July 19) Sold merchandise to Garcia Company for $5,600

under credit terms of 2/15, n/60, FOB shipping point,

invoice dated July 19.

July 19) The cost of the merchandise sold to Garcia

Company was $3,900.

July 21) Issued a $1,100 credit memorandum to Garcia

Company for an allowance on goods sold on July 19.

July 24) Paid Lee Company the balance due, net of

discount.

July 30) Received the balance due from Garcia Company

for the invoice dated July 19, net of discount.

July 31) Sold merchandise to Wilson Company for $11,400

under credit terms of 2/10, n/60, FOB shipping point,

invoice dated July 31.

July 31) The cost of the merchandise sold to Wilson

Company was $6,800.

Total gross profit

Increases net income

Decreases net income

No impact on income

Increases net income

Decreases net income

No impact on income

No impact on income

Decreases net income

No impact on income

Increases net income

Decreases net income

Decreases net income

No impact on income

Decreases net income

Increases net income

Decreases net income

$

0

W

<Prev

1 of 1

MacBook Air

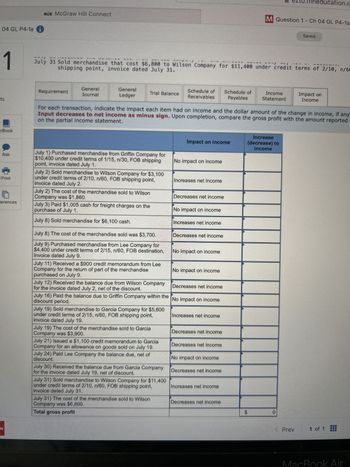

Transcribed Image Text:04 GL P4-1a

ts

1

eBook

MCC McGraw Hill Connect

218.mheducation.c

M Question 1- Ch 04 GL P4-1a

Saved

shipping point, invoice dated July 31.

July 31 Sold merchandise that cost $6,800 to Wilson Company for $11,400 under credit terms of 2/10, n/69

Requirement

General

Journal

General

Ledger

Trial Balance

Schedule of

Receivables

Schedule of

Payables

Income

Statement

Impact on

Income

For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any.

on the partial income statement.

Input decreases to net income as minus sign. Upon completion, compare the gross profit with the amount reported

Impact on income

Increase

(decrease) to

income

Ask

July 1) Purchased merchandise from Griffin Company for

$10,400 under credit terms of 1/15, n/30, FOB shipping

point, invoice dated July 1.

No impact on income

Print

erences

July 2) Sold merchandise to Wilson Company for $3,100

under credit terms of 2/10, n/60, FOB shipping point,

invoice dated July 2.

July 2) The cost of the merchandise sold to Wilson

Company was $1,860.

July 3) Paid $1,005 cash for freight charges on the

purchase of July 1.

July 8) Sold merchandise for $6,100 cash.

July 8) The cost of the merchandise sold was $3,700.

July 9) Purchased merchandise from Lee Company for

$4,400 under credit terms of 2/15, n/60, FOB destination,

invoice dated July 9.

July 11) Received a $900 credit memorandum from Lee

Company for the return of part of the merchandise

purchased on July 9.

July 12) Received the balance due from Wilson Company

for the invoice dated July 2, net of the discount.

July 16) Paid the balance due to Griffin Company within the

discount period.

July 19) Sold merchandise to Garcia Company for $5,600

under credit terms of 2/15, n/60, FOB shipping point,

invoice dated July 19.

July 19) The cost of the merchandise sold to Garcia

Company was $3,900.

July 21) Issued a $1,100 credit memorandum to Garcia

Company for an allowance on goods sold on July 19.

July 24) Paid Lee Company the balance due, net of

discount.

July 30) Received the balance due from Garcia Company

for the invoice dated July 19, net of discount.

July 31) Sold merchandise to Wilson Company for $11,400

under credit terms of 2/10, n/60, FOB shipping point,

invoice dated July 31.

July 31) The cost of the merchandise sold to Wilson

Company was $6,800.

Total gross profit

Increases net income

Decreases net income

No impact on income

Increases net income

Decreases net income

No impact on income

No impact on income

Decreases net income

No impact on income

Increases net income

Decreases net income

Decreases net income

No impact on income

Decreases net income

Increases net income

Decreases net income

$

0

W

<Prev

1 of 1

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Journalize the following transactions in general journal form. a. Bought merchandise on account from Brewer, Inc., invoice no. B2997, 914; terms net 30 days; FOB destination. b. Received credit memo no. 96 from Brewer, Inc., for merchandise returned, 238.arrow_forwardPurchase-related transactions The following selected transactions were completed by Epic Co. during August of the curr ent year: Aug. 3. Purchased merchandise on account for $33400, terms FOB destination. 2/10. n/30. 9. Issued debit memorandum for $2500 ($2450 net of 2% discount) for merchandise from the August 3 purchase that was damaged in shipment. 10. Purchased merchandise on account, $25,000, terms FOB shipping point, n/com. Paid $600 cash to the freight company for delivery of the merchandise. 13. Paid for invoice of August 3, less debit memorandum of August 9 31. Paid for invoice of August 10. Instructions Illustrate the effects of each of the preceding transactions on the accounts and financial statements of Epic Co. Identify each transaction by date.arrow_forwardRecord the following transactions in general journal form for Ford Education Outfitters and Romero Textbooks, Inc. a. Ford Educational Outfitters bought merchandise on account from Romero Textbooks, Inc., invoice no. 10594, 1,875.34; terms net 30 days; FOB destination. Romero Textbooks, Inc., paid 93.80 for shipping. b. Ford Education Outfitters received credit memo no. 513A from Romero Textbooks, Inc., for merchandise returned, 135.78.arrow_forward

- Purchase-related transactions Based on the data presented in Excrd.sc 6-14, journalize Ha I boa Co.s entries for (a) the purchase, (b) the return of the merchandise for credit, and (c) the payment of the invoice.arrow_forwardPlease answer Letters D, E, F, Garrow_forwardSales-Related Transactions Merchandise is sold on account to a customer for $16,500, terms FOB shipping point, 1/10, n/30. The seller paid the freight of $630. Determine the following: a. Amount of the sale $ b. Amount debited to Accounts Receivable $ c. Amount received within the discount period $arrow_forward

- Please provide Multi-step form of SCIarrow_forwardInstructions Journalize the following merchandise transactions. Refer to the chart of accounts for the exact wording of the account itles. CNOW journals do not use ines for jounal explanations. Every Nne on a journal page is used for debit or aredit ents. CNOW journals will automaticaly indent a credit entry when a credit amount s entered. 1 Sold merchandise on account, $94,800 with terms 2/10, n30. The sost.ot the merchandise nold was Mar. $56,900. Received payment les the discount. 13 Issued a $500 oredit memo for damaged merchandise. The customer agreed to keep the merchandisearrow_forwardSales-Related Transactions Merchandise is sold on account to a customer for $21,200, terms FOB shipping point, 2/10, n/30. The seller paid the freight of $360. Determine the following: a. Amount of the sale $fill in the blank 1 b. Amount debited to Accounts Receivable $fill in the blank 2 c. Amount received within the discount periodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,