EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

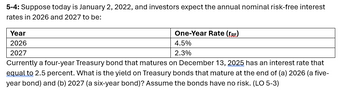

Transcribed Image Text:5-4: Suppose today is January 2, 2022, and investors expect the annual nominal risk-free interest

rates in 2026 and 2027 to be:

Year

2026

2027

One-Year Rate (IRE)

4.5%

2.3%

Currently a four-year Treasury bond that matures on December 13, 2025 has an interest rate that

equal to 2.5 percent. What is the yield on Treasury bonds that mature at the end of (a) 2026 (a five-

year bond) and (b) 2027 (a six-year bond)? Assume the bonds have no risk. (LO 5-3)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose today is January 2, 2022, and investors expect the annual nominal risk-free interest rates in 2026 and 2027 to be: Year One-Year Rate (rRF) 2026 4.5 % 2027 1.9 Currently, a four-year Treasury bond that matures on December 31, 2025 has an interest rate equal to 2.0 percent. Assume the bonds have no risk. What is the yield on Treasury bonds that mature at the end of 2026 (a five-year bond)? Round your answer to one decimal place. % What is the yield on Treasury bonds that mature at the end of 2027 (a six-year bond)? Round your answer to one decimal place. %arrow_forwardSuppose today is January 2, 2022, and investors expect the annual nominal risk-free interest rates in 2026 and 2027 to be: Year One-Year Rate (rRF) 2026 4.5 % 2027 2.1 Currently, a four-year Treasury bond that matures on December 31, 2025 has an interest rate equal to 3.0 percent. Assume the bonds have no risk. What is the yield on Treasury bonds that mature at the end of 2026 (a five-year bond)? Round your answer to one decimal place. _____ % What is the yield on Treasury bonds that mature at the end of 2027 (a six-year bond)? Round your answer to one decimal place. _____ %arrow_forwardToday is January 2, 2022, and investors expect the annual nominal risk-free interest rates in 2022 through 2024 to be: Year One-Year Rate (rRF) 2022 2.5 % 2023 2.3 2024 3.3 Assume the bonds have no risks. What is the yield to maturity for Treasury bonds that mature at the end of 2023 (a two-year bond)? Round your answer to one decimal place. % What is the yield to maturity for Treasury bonds that mature at the end of 2024 (a three-year bond)? Round your answer to one decimal place. %arrow_forward

- this is for intro to finance.arrow_forwardToday is January 2, 2022, and investors expect the annual nominal risk-free interest rates in 2022 through 2024 to be: Year One-Year Rate (rRF) 2022 2.7 % 2023 1.9 2024 3.8 Assume the bonds have no risks. What is the yield to maturity for Treasury bonds that mature at the end of 2023 (a two-year bond)? Round your answer to one decimal place. __________ % What is the yield to maturity for Treasury bonds that mature at the end of 2024 (a three-year bond)? Round your answer to one decimal place. __________ %arrow_forward5-3: Today is January 2, 2022, and investors expect the annual nomination risk-free interest rates in 2022 through 2024 to be: Year 2022 2023 2024 One-Year Rate (IRE) 2.2% 1.8% 2.9% What is the yield to maturity for Treasury bonds that mature at the end of (a) 2022 (a two-year bond) and (b) 2024 (a three-year bond)? Assume the bonds have no risks. (LO 5-3)|arrow_forward

- 25. Consider a bond with a settlement date of February 22, 2022, and a maturity date of March 15, 2030. The coupon rate is 5.5%. (LO 10-1) a. If the yield to maturity of the bond is 5.34% (bond equivalent yield, semiannual compounding), what is the list price of the bond on the settlement date? b. What is the accrued interest on the bond? c. What is the invoice price of the bond?arrow_forwardK Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): 0 2 5 Period $19.53 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? Cash Flows View an example Get more help. ★ a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) A 6 1 MacBook Pro & 7 $19.53 * 8 9 C 59 $19.53 60 $19.53+$1,000 Clear all BUB 0 {arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.252 6.163 Maturity Month/Year May 36 May 41 May 51 Bid 103.5462 104.4952 ?? Asked 103.6340 104.6409 ?? Change Ask Yield +.3015 2.329 +.4293 +.5405 ?? 4.031 In the above table, find the Treasury bond that matures in May 2036. What is the coupon rate for this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

- U1arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.202 6.158 Maturity Month/Year May 36 May 39 May 45 Bid 103.4599 104.4939 ?? Asked 103.5327 104.6396 ?? Change Ask Yield +.3287 5.979 +.4281 +.5392 ?? 4.011 In the above table, find the Treasury bond that matures in May 2039. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.674 6.208 Maturity Month/Year Bid May 31 103.4729 May 34 May 40 104.5069 ?? Asked 103.5457 104.6526 ?? Change Ask Yield +.3132 +.4401 +.5522 6.179 ?? 4.211 In the above table, find the Treasury bond that matures in May 2034. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning