Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

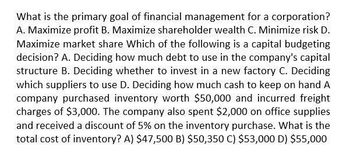

Transcribed Image Text:What is the primary goal of financial management for a corporation?

A. Maximize profit B. Maximize shareholder wealth C. Minimize risk D.

Maximize market share Which of the following is a capital budgeting

decision? A. Deciding how much debt to use in the company's capital

structure B. Deciding whether to invest in a new factory C. Deciding

which suppliers to use D. Deciding how much cash to keep on hand A

company purchased inventory worth $50,000 and incurred freight

charges of $3,000. The company also spent $2,000 on office supplies

and received a discount of 5% on the inventory purchase. What is the

total cost of inventory? A) $47,500 B) $50,350 C) $53,000 D) $55,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Help!!!arrow_forwardDon't Use Aiarrow_forwardBelow you have the three types of financial management decisions. Match each type of decision to a business transaction that would be relevant. Capital budgeting A. Deciding whether to issue new equity and use the proceeds to retire outstanding debt Capital structure B. Deciding whether to expand a manufacturing plant Working capital management C. Modifying the firm's credit collection policy with its customersarrow_forward

- Which of the following statements is true? a. Determining how day-to-day financial matters should be managed is not a function of financial managers. B. The goal of the firm is to maximize market share. C. Working capital management refers to identifying productive long-term assets the firm could acquire to maximize net benefits. D. Capital budgeting refers to identifying productive long-term assets the firm could acquire to maximize net benefits.arrow_forwardThe managers in a firm have decided to move the company's headquarters from a rented space to a new building that the company will purchase. This is an example of Multiple Choice a cash flow decision. a capital budgeting decision. a net working capital decision. a capital structure decision. a short-term financing decision.arrow_forwardWhy is understanding the relationship between the cash conversion cycle (CCC) and net working capital important to the contemporary business executive? Explain ways in which executive decisions regarding the CCC and net working capital can affect a company both adversely and beneficially. Support your response with a specific example from the business world.arrow_forward

- Having to decide on the purchase of a piece of machinery to improve productivity is part of the finance manager’s responsibility in ____________. Question 11 options: 1) short-term financial management 2) capital raising 3) capital budgeting 4) preparing the accountsarrow_forwardWhat is the primary purpose of computing the cost of capital? a. To determine the market value of the company's shares b. To assess the company's liquidity position c. To evaluate the profitability of investment projects d. To compare the company's performance with industry peersarrow_forwardWhat is the importance of quantifying plan? TRUE or FALSE 1. Long-term financial plans are goals that lay out the overall direction of the company.2. For corporations, the management must establish a mechanism which will allow plans to be monitored and change from time to time.arrow_forward

- Financial managers shouldconsider this when.improving thefinancials of the firm A. that the overall goal is the maximization of the market value of the equity through improved income and cashflows.B. that cost minimization is the primary concern of the firm.C. that exposing the firm to the most risk for the most return should be priority.D. that the personal goals of customer and employees are above the goals of the shareholders.arrow_forwardA firm's management wants to improve its cash flows with regard to working capital and wants to reflect this priority in its annual budget. What is an appropriate plan of action? O A. Stock up on inventory in order to never run out of stock B. Extend credit terms to customers in order to gain more sales O C. Pay all bills and payables when due D. Speeding up collection of accounts receivable from customersarrow_forwardEach of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? Check all that apply. Interest rates in the economy The performance of Index funds, such as the S&P 500 The firm's capital budgeting decision rules The impact of a firm's cost of capital on managerial decisions Consider the following case: Acme Manufacturing Corporation has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an Independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division L is considering a project with an expected return of 9.5%. Should Acme Manufacturing Corporation accept or reject the project?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education