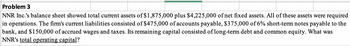

NNR Inc.'s

Operating capital refers to the amount of capital that a company needs to finance its day-to-day operations. It includes the funds needed to purchase inventory, pay for rent, utilities, and salaries, and cover other operating expenses. Operating capital is a crucial measure of a company's financial health, as it provides an indication of the amount of capital that the company requires to keep its operations running smoothly. Companies must manage their operating capital effectively to ensure that they have enough cash on hand to meet their daily operational expenses.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Muffin's Masonry, Inc.'s balance sheet lists net fixed assets as $33 million. The fixed assets could currently be sold for $57 million. Muffin's current balance sheet shows current liabilities of $15.0 million and net working capital of $14.0 million. If all the current accounts were liquidated today, the company would receive $8.20 million cash after paying the $15.0 million in current liabilities.What is the book value of Muffin's Masonry's assets today and the market value of these assets?arrow_forwardNovak Corporation's net income for the current year was $622000, Depreciation recorded on plant assets was $58000 and amortization expense was $93000. Accounts receivable and inventories increased by $49000 and $20000, respectively. Supplies and accounts payable decreased by $2000 and $39000, respectively. The equipment account balance increased by $55,000 and a $500,000 convertible bond was retired through the issuance of common stock. How much cash was provided by operating activities? O $565000 $667000 O $585000 $879000arrow_forwardMansukharrow_forward

- tyson Company's working capital accounts at December 31, 2018, are given below: Current Assets: Cash $100,000 Marketable Securities 50,000 Accounts Receivable $250,000 Less Allowance for Doubtful Accounts (20,000) 230,000 Inventory, Lifo 300,000 Prepaid 8,000 Total Current Assets $688,000 Current Liabilities: Accounts Payable $200,000 Notes Payable 50,000 Taxes Payable 10,000 Accrued Liabilities 30,000 Total Current Liabilities $290,000 During 2019, DeCort Company completed the following transactions: a. Purchased fixed assets for cash, $20,000. b. Exchanged DeCort Company common stock for land. Estimated value of transaction, $80,000. c. Payment of $40,000 on short-term notes payable. d. Sold marketable securities costing $20,000 for $25,000 cash. e.…arrow_forwardYou are evaluating the balance sheet for SophieLex's Corporation. From the balance sheet you find the following balances: cash and marketable securities = $450,000; accounts receivable = $1,100,000; inventory = $2,000,000; accrued wages and taxes = $450,000; accounts payable = $750,000; and notes payable = $500,000. Calculate SophieLex's current ratio.arrow_forwardIndustrial Incorporated has current liabilities of $2,500, long-term debt of $4,000, and shareholders' equity of 14,250. If Fixed assets total $18,250, current assets must bearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education