Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

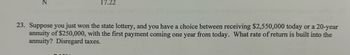

Transcribed Image Text:23. Suppose you just won the state lottery, and you have a choice between receiving $2,550,000 today or a 20-year

annuity of $250,000, with the first payment coming one year from today. What rate of return is built into the

annuity? Disregard taxes.

z

17.22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 6. You are comparing two annuities with equal present values. The applicable discount rate is8.75 percent. One annuity pays $5,000 on the first day of each year for 20 years. How much doesthe second annuity pay each year for 20 years if it pays at the end of each year?arrow_forward12. Which of these is an example of a single-payment fixed annuity? An annuity with a minimum APR of 3.4% into which you invest a lump sum of $12,500. An annuity with an APR of 3.4% into which you invest a lump sum of $12,500 An annuity with an APR of 3.4% into which you invest $2500 each year. An annuity with a minimum APR of 3.4% into which you invest $2500 each year.arrow_forward3. You won the lottery! You are considering whether or not to accept a lump sum amount or an annual annuity of $ 79,944 to be received at the end of every year for twelve years. Use 6% as the annual discount rate. How much is the stream of payments worth now? Round your answer to the nearest whole number.arrow_forward

- 8arrow_forward3. The average American has $91 lying about. Stick $91 in an ordinary annuity account each year for 12 years at 4% interest compounded annually and watch it grow. What is the cash value of this annuity at the end of year 12?arrow_forward118.) Your aunt Meg has given you perpetuity for your birthday. You will receive your first payment of $8000 one year from today. If the interest rate is 100%, what is the present value of your birthday gift? $4000 $6000 $7000 $8000arrow_forward

- Subject:- financearrow_forwardvear fromLIow. urn I, Wa. the payments occurred i orever? 5. Caiculating Annuity Cash Flows. If you put up $20,000 today in exchange for a 8.5 percent, 12-year annuity, what will the annual cash flow be?arrow_forward5. Present value of annuities and annuity payments The present value of an annuity is the sum of the discounted value of all future cash flows. You have the opportunity to invest in several annuities. Which of the following 10-year annuities has the greatest present value (PV)? Assume that all annuities earn the same positive interest rate. An annuity that pays $500 at the beginning of every six months An annuity that pays $1,000 at the end of each year An annuity that pays $500 at the end of every six months An annuity that pays $1,000 at the beginning of each year You bought an annuity selling at $2,867.74 today that promises to make equal payments at the beginning of each year for the next twelve years (N). If the annuity's appropriate interest rate (1) remains at 9.50% during this time, then the value of the annual annuity payment (PMT) is $375.00 You just won the lottery. Congratulations! The jackpot is $35,000,000, paid in twelve equal annual payments. The first payment on the…arrow_forward

- Use the following 8% interest factors to answer the question below: Future Value of Ordinary Annuity. 8.92280 10.63663 12.48756 What amount should be recorded as the cost of a machine purchased December 31, 2023, which is to be financed by making 8 annual payments of $10,000? Each payment is made at the end of the period. The applicable interest rate is 8%. Present Value of Ordinary Annuity. 5.2064 5.7466 6.2469 7 periods 8 periods 9 periods hsarrow_forwardSuppose you just won the state lottery, and you have a choice between receiving $2,515,000 today or a 20-year annuity of $220,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes. O a. 6.88% O b. 12.96% O c. 6.04% O d. 5.69% O e. 8.75%arrow_forwardAa.37.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education