Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

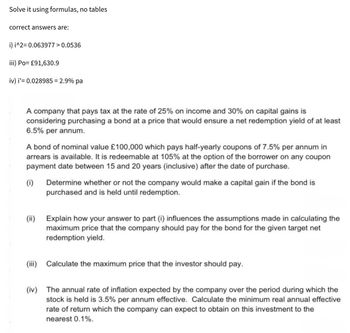

Transcribed Image Text:Solve it using formulas, no tables

correct answers are:

i) i^2=0.063977 > 0.0536

iii) Po= £91,630.9

iv) i' 0.028985 = 2.9% pa

A company that pays tax at the rate of 25% on income and 30% on capital gains is

considering purchasing a bond at a price that would ensure a net redemption yield of at least

6.5% per annum.

A bond of nominal value £100,000 which pays half-yearly coupons of 7.5% per annum in

arrears is available. It is redeemable at 105% at the option of the borrower on any coupon

payment date between 15 and 20 years (inclusive) after the date of purchase.

(i) Determine whether or not the company would make a capital gain if the bond is

purchased and is held until redemption.

(ii) Explain how your answer to part (i) influences the assumptions made in calculating the

maximum price that the company should pay for the bond for the given target net

redemption yield.

(iii) Calculate the maximum price that the investor should pay.

(iv) The annual rate of inflation expected by the company over the period during which the

stock is held is 3.5% per annum effective. Calculate the minimum real annual effective

rate of return which the company can expect to obtain on this investment to the

nearest 0.1%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 9 images

Knowledge Booster

Similar questions

- Use the following information about Red Rocks Inc. to answer the following question: Assume the following: Pays no taxes Return on net operating assets (RNOA) = 18% %3D Has $2,000 in net operating assets financed by equity At the beg. of the year borrows $1000 at 8%. Uses debt to buy additional operating assets. What is the return on equity (ROE) for Red Rocks? Edit View Insert Format Tools Table 12pt v Paragraph v B IU A e T?v I.arrow_forwardAssume the firm has a tax rate of 23 percent. c-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is Issued. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-3. Calculate the return on equity (ROE) under each of the three economic scenarios assuming the firm goes through with the recapitalization. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-4. Given the recapitalization, calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round…arrow_forwardK The outstanding debt of Berstin Corp. has eight years to maturity, a current yield of 9%, and a price of $80. What is the pretax cost of debt if the tax rate is 30%. A. 7.5% B. 10.8 % OC. 6.5 % OD. more information neededarrow_forward

- Wavering Plc is trying to decide on what discount rate to use when appraising future capital investment options. It is currently financed by a mixture of debt and equity, detailed as follows: Book value £000s 1 million £1 ordinary shares 1,000 Retained earnings 1,5007500 8% Pref. Share of £100 each 75012,500 £100 6.4% irredeemable debentures 1,250 Mortgage at 10% interest rate (secured on premises) 250 The market price of ordinary shares is £3.00, and the debentures have a market price of £80. The company pays corporation tax at a rate of 30%. The current return on government securities is 5%, the average stock market rate of return is 9% and the company has a beta value of 1.6. The management is considering taking…arrow_forwardConsider a simple firm that has the following market-value balance sheet: Assets Liabilities end equity $1 040 Debt Equity $400 640 Next year, there are two possible values for its assets, each equally likely: $1 180 and $960. Its debt will be due with 4.9% interest. Because all of the cash flows from the assets must go to either the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested 38% in the firm's debt and 62% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's pre-tax WACC is the same as the expected return on its assets. If the assets will be worth $1 180 in one year, the expected return on assets will be %. (Round to one decimal place.)arrow_forwardonly looking for parts c-1 and c-3arrow_forward

- which option is correctarrow_forwardPlease answer ASAParrow_forwardCalculate the aftertax cost of debt under each of the following conditions. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) raw C. Yield 8.0% 8.6 % 6.5 % Corporate Tax Rate 22 % 25 % Aftertax Cost of Debt % % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education