SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

please help me answer

Transcribed Image Text:< >

Cengage Learning

Ch8 SMH/HW

1. MP.08.01.ALGO

eBook

v2.cengagenow.com

+

C CengageNOWv2 | Online teaching and learning resource...

G Abigail Trenkamp owns and operates the Trenkamp Colle...

b Answered: MASTERY PROBLEM Abigail Trenkamp owns...

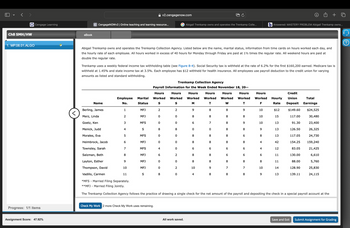

Abigail Trenkamp owns and operates the Trenkamp Collection Agency. Listed below are the name, marital status, information from time cards on hours worked each day, and

the hourly rate of each employee. All hours worked in excess of 40 hours for Monday through Friday are paid at 1½ times the regular rate. All weekend hours are paid at

double the regular rate.

Trenkamp uses a weekly federal income tax withholding table (see Figure 8-4). Social Security tax is withheld at the rate of 6.2% for the first $160,200 earned. Medicare tax is

withheld at 1.45% and state income tax at 3.5%. Each employee has $12 withheld for health insurance. All employees use payroll deduction to the credit union for varying

amounts as listed and standard withholding.

Trenkamp Collection Agency

Name

S

S

Payroll Information for the Week Ended November 18, 20--

Hours Hours Hours Hours Hours Hours

Employee Marital Worked Worked Worked Worked Worked Worked

No.

Status

T

Hours

M

W

T

Worked Hourly

F

Rate

Berling, James

1

MFJ

2

2

9

8

8

9

10

$12

Credit

Union

Total

Deposit Earnings

$149.60 $24,525

<

Merz, Linda

2

MFJ

0

0

8

8

00

8

8

10

15

117.00

30,480

Goetz, Ken

3

MFS

0

0

6

7

8

00

9

10

10

13

91.30

23,400

Menick, Judd

4

S

8

8

0

0

8

00

80

9

13

126.50

26,325

Morales, Eva

5

MFS

0

0

8

8

8

6

8

13

117.05

24,730

Heimbrock, Jacob

6

MFJ

0

0

00

8

8

Townsley, Sarah

7

MFS

4

0

6

60

6

00

10

8

4

42

154.25

159,240

6

4

12

83.05

21,425

Salzman, Beth

8

MFJ

6

2

8

8

6

10

6

6

11

130.00

6,610

Layton, Esther

9

MFJ

0

0

8

00

00

8

8

80

8

11

88.00

5,760

Thompson, David

10

MFJ

0

2

10

9

7

7

ས

10

14

128.90

25,830

Vadillo, Carmen

11

S

8

0

4

8

00

8

00

80

9

13

139.11

24,115

*MFS Married Filing Separately.

**MFJ Married Filing Jointly.

The Trenkamp Collection Agency follows the practice of drawing a single check for the net amount of the payroll and depositing the check in a special payroll account at the

Progress: 1/1 items

Check My Work 2 more Check My Work uses remaining.

Assignment Score: 47.92%

All work saved.

Save and Exit Submit Assignment for Grading

Transcribed Image Text:< >

Ch8 SMH/HW

1. MP.08.01.ALGO

Cengage Learning

eBook

v2.cengagenow.com

+

C CengageNOWv2 | Online teaching and learning resource...

G Abigail Trenkamp owns and operates the Trenkamp Colle...

b Answered: MASTERY PROBLEM Abigail Trenkamp owns...

Required:

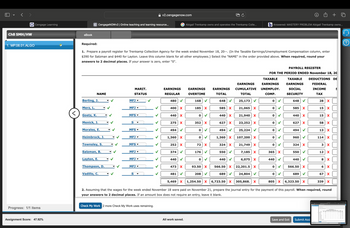

1. Prepare a payroll register for Trenkamp Collection Agency for the week ended November 18, 20--. (In the Taxable Earnings/Unemployment Compensation column, enter

$390 for Salzman and $440 for Layton. Leave this column blank for all other employees.) Select the "NAME" in the order provided above. When required, round your

answers to 2 decimal places. If your answer is zero, enter "0".

PAYROLL REGISTER

FOR THE PERIOD ENDED November 18, 20

NAME

MARIT.

STATUS

EARNINGS

REGULAR

EARNINGS

OVERTIME

EARNINGS

TOTAL

TAXABLE

EARNINGS EARNINGS

CUMULATIVE UNEMPLOY.

TOTAL

COMP.

TAXABLE

EARNINGS

SOCIAL

SECURITY

DEDUCTIONS DE

FEDERAL

INCOME

TAX

Berling, J.

MFJ ▼

480

168

648

25,173

0

648

28 X

Merz, L.

MFJ ▼

<

Goetz, K.

MFS ▾

Menick, J.

S ▾

Morales, E.

MFS ▾

Heimbrock, J.

MFJ ▼

Townsley, S.

MFS ▾

Salzman, B.

Layton, E.

MFJ ▾

MFJ ▼

Thompson, D.

MFJ ▼▾

p p p p p p p p p

400 X

185 X

585 X

21,065 X

585 X

15 X

440 X

0

440

21,940 X

440

15 X

275

352

X

627

X

23,252 X

627

X

58 X

494

>

0

494

25,224

0

494

13 x

1,360 X

0

1,360 X

107,200 X

0

960

114 X

252 x

72

X

324 X

374

176

550

21,749 X

7,185 X

0

324 X

3 X

365 X

550

12 X

440

0

440

6,075 X

440

440

8

x

473

93.50

X

566.50 X

22,201.5 X

0

566.50 X

6 X

Vadillo, C.

S

481

208

689

24,804

0

689

67 x

5,469 X

1,254.50 X 6,723.50 X

305,868. X

805 X 6,323.50 x

339 X

2. Assuming that the wages for the week ended November 18 were paid on November 21, prepare the journal entry for the payment of this payroll. When required, round

your answers to 2 decimal places. If an amount box does not require an entry, leave it blank.

Progress: 1/1 items

Check My Work 2 more Check My Work uses remaining.

Assignment Score: 47.92%

All work saved.

Save and Exit

Submit Assi

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- NSPIRON متوقف مؤقتا elearn.squ.edu.om/mod/quiz/review.php?attempt=D16687 G... Obs -Jblicyl .lyI all zihll Go SQU E-LEARNING SYSTEM (ACADEMIC) E-LEARNING SERVICES SQU LIBRARIES SQU PORTALATTENDANCE The correct answer is: OMR 35,200 Question 10 Company XYZ is currently producing AND selling 10,000 units of product A. At this level, the total product cost was $60,000. This included $10,000 direct materials, $20,000 direct labor and $30,000 manufacturing overhead cost, which included 20% variable manufacturing overhead cost. The selling and administrative expenses were $100,000, which included $60,000 variable selling and administrative costs. Assume that the selling price per unit $20, how much was the total contribution margin? Theorrect Mark0.00 out of 2.00 Flag question a. $134,000 b. None of the given answers C. $40,000 d. $104,000 e. $194,000 The correct answer is: $104,000 Windows Finish review ENG II ...arrow_forwardPlease help solve stepsarrow_forwardD2L. 7-1 Problem Set: Module Sev X CengageNOWv2| Online tea X * Cengage Learning -2 Project: Company Accour X + | x ow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3D&takeAssignmentSessionLocator%3D&inprogress%3Dfalse | 电 eBook Show Me How Vertical Analysis Income statement information for Einsworth Corporation follows: 000 101,400 Sales Cost of goods sold Gross profit Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales 0008 Cost of goods sold 101,400 Gross profit $236,600 Feedback Check My WNork Divide each element by sales to determine the vertical analysis percentage. Check My Work Previous Next 3:07 PM 回(ゆ、 4/11/2022 AD dyarrow_forward

- Could you help me find the blanksarrow_forward- Fi X * MindTap - Cengage Learning O ) (4) lofi hip hop radio - beats x ng.cengage.com/static/nb/ui/evo/index.html?deploymentld=590512258542108435051542&elSBN=9780357114582&id=1062959402.. * CENGAGE MINDTAP Q Search this course HW 6 Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following table: A-Z Stock Percentage of Portfolio Expected Return Standard Deviation Artemis Inc. 20% 6.00% 30.00% Office Babish & Co. 30% 14.00% 34.00% Cornell Industries 35% 13.00% 37.00% Danforth Motors 15% 5.00% 39.00% What is the expected return on Andre's stock portfolio? O 16.05% O 8.03% O 14.45% O 10.70% Suppose each stock in Andre's portfolio has a correlation coefficient of 0.4 (p = 0.4) with each of the other stocks. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified four-stock portfolio is 35%, the portfolio's…arrow_forwardngageNOWv2 | Online teachin x = Ch. 12 Key Terms - Principles of A X takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Cancel Your... F Startup Opportuniti. V How brands are co.. Assignment Practic... COVID-19 Student.. C20-128PR01-2016... O Final Exam Review Eli Inc. issued $110,000 of 10% annual, 4-year bonds for $112,800. What is the total amount of interest expense over the life of the bonds?arrow_forward

- Please see question in picture attached to fill in table. Thank youarrow_forwardengageNOWv2 | Online teachin x = Ch. 12 Key Terms - Principles of A X /takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false p Cancel Your. F Startup Opportuniti.. V How brands are co... Assignment Practic.. A COVID-19 Student. Нос С20-13 Bhakti Games is a chain of board game stores. Record entries for the following transactions related to Bhakti's purchase of inventory, A. On October 5, Bhakti purchases and receives inventory from XYZ Entertainment for $5,500 with credit terms of 2/10 net 30, B. On October 7, Bhakti returns $1,600 worth of the inventory purchased from XYZ. C. Bhakti makes payment in full on its purchase from XYZ on October 14. If an amount box does not require an entry, leave it blank. А. В. 78°F Cloudyarrow_forwardDA. 7-2 Project: Company Accour x D2L 7-1 Problem Set: Module Sev X CengageNOWv2 |Online tea X Cengage Learning + x ngagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker3D&takeAssignmentSessionLocator=&inprogress%3Dfalse 电 手 eBook Show Me How Long-Term Solvency Analysis The following information was taken from Celebrate Company's balance sheet: Fixed assets (net) 006'86$ 000 1,471,050 Long-term liabilities Total liabilities Total stockholders' equity 1,634,500 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. If required, round your answers to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders equity (Previous Check My Work 330 PM hp 144 114arrow_forward

- A CSUF Portal E MyLab and Mastering P Do Homework - Chapter 8 Hon x -> -> a mathxl.com/Student/PlayerHomework.aspx?homeworkld=606850034&questionld=1&flushed%3false&cld%3D6647439&back=https://www.mathxl.com/Student/DOAS.. Update Financial Management I Shaheen Behbehani a 10/25/21 8:33 PM Question 2, P 8-8 (similar... HW Score: 0%, 0 of 10 points E Homework: Chapter 8 Homework O Points: 0 of 1 Save Part 1 of 3 Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year. Your upfront setup costs to be ready to produce the part would be $7.91 million. Your discount rate for this contract is 7.6%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.) Clear All Check Answer Help Me Solve…arrow_forward* MindTap - Cengage Learning O ) (4) lofi hip hop radio - beats g.cengage.com/static/nb/ui/evo/index.html?deploymentld=590512258542108435051542&EISBN=9780357114582&id=1062959402... 5 CENGAGE MINDTAP Q Search this HW 6 Back to Assignment Attempts Keep the Highest / 2 4. The beta coefficient A stock's contribution to the market risk of a well-diversified portfolio is called risk. It can be measured by a metric called the beta coefficient, which calculates the degree to which a stock moves with the movements in the market. Based on your understanding of the beta coefficient, indicate whether each statement in the following table is true or false: Statement True False Beta coefficients are generally calculated using historical data. Higher-beta stocks are expected to have higher required returns. Stock A's beta is 1.0; this means that the stock has a negative correlation with the market.arrow_forwardMindTap - Cengage Learning CengageNOWv2 | Online teachin x 9 Cengage Learning b Answered: CengageNOWv2| Onli x i v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Ch 13-2 Practice Exercises E Calculator eBook Show Me How Print Item Reporting Stockholders' Equity Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 50,000 shares of common stock authorized, and 2,000 shares have been reacquired. Common Stock, $80 par $3,200,000 Paid-In Capital from Sale of Treasury Stock 64,000 Paid-In Capital in Excess of Par-Common Stock 440,000 Retained Earnings 1,728,000 Treasury Stock 42,000 Stockholders' Equity Paid-In Capital: Common Stock, $80 Par 3,200,000 Excess over par 440,000 Treasury Stock From Sale of Treasury Stock 64,000 Total Paid-in Capital $ 3,704,000 Retained Earnings Total Treasury Stock Total Stockholders' Equity Check My Work 2 more…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you